BitMEX quanto futures for YFI, BNB, and DOT live now

BitMEX has been paying special attention to its clients’ needs as it added more coins to its list of derivatives products. It started expanded its list of Quanto Futures in 2020 with the addition of ETHUSD Quanto Futures back in April, and ever since, other altcoins like Chainlink [LINK] and Tezos [XTZ] have managed to acquire a place in this list. In order to keep up with changing sentiment in the market, BitMEX delved into decentralized finance [DeFi] by adding Yearn.finance [YFI] to its Quanto Futures contract.

The YFI Quanto futures went live today, along with Binance Coin [BNB] and Polkadot [DOT]. The BitMEX exchange has been reserved in listing tokens, but this year has proved that it needs to buckle up and make some tough decisions in order to keep its position as one of the prominent derivatives exchange intact. This was evident in the choice of tokens picked by BitMEX and its demand among the crypto users.

YFI is currently the eighth-largest DeFi protocol, with $375.9 million locked up in liquidity, according to DeFi Pulse. The protocol paves gateways to a range of yield-generating products. Whereas, DOT is the native token of Polkadot, a protocol that connects decentralized applications and services. Binance’s BNB token has been powering its exchange and has been among the major tokens for a long time now. It ranks seventh on the CoinMarketCap list, with DOT on the ninth position in terms of their market caps.

Given BitMEX’s recent altercation with the US regulators, the exchange has also introduced changes in its leadership, with CEO Arthur Hayes and CTO, Samuel Reed stepping down. This definitely impacted the exchange’s standing in the market as Skew noted BitMEX slipping to the fourth position in terms of BTC 24-hour futures volume. It was also fourth in terms of open interest.

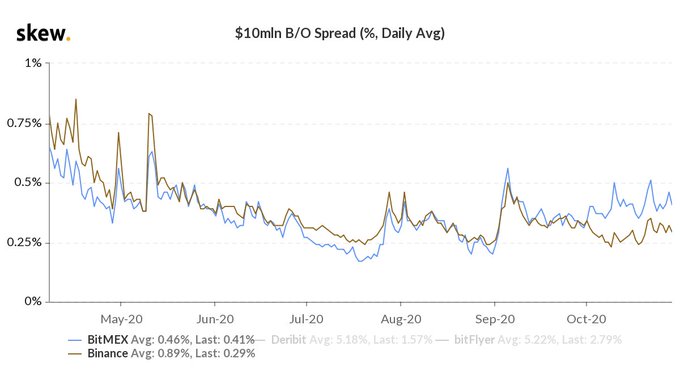

Data provider Skew noted that Binance overtook BitMEX in October as Bitcoin’s most liquid perpetual swap.

Source: Skew

BitMEX has been trying to move with the changing tides, but these obstacles have not thrown it out of the race yet. BitMEX still leads many other exchanges in the retail arena and still holds the lowest spread on BTC futures. It may not be as liquid as Binance at this point, but as it stabilizes could compete in the coming days.