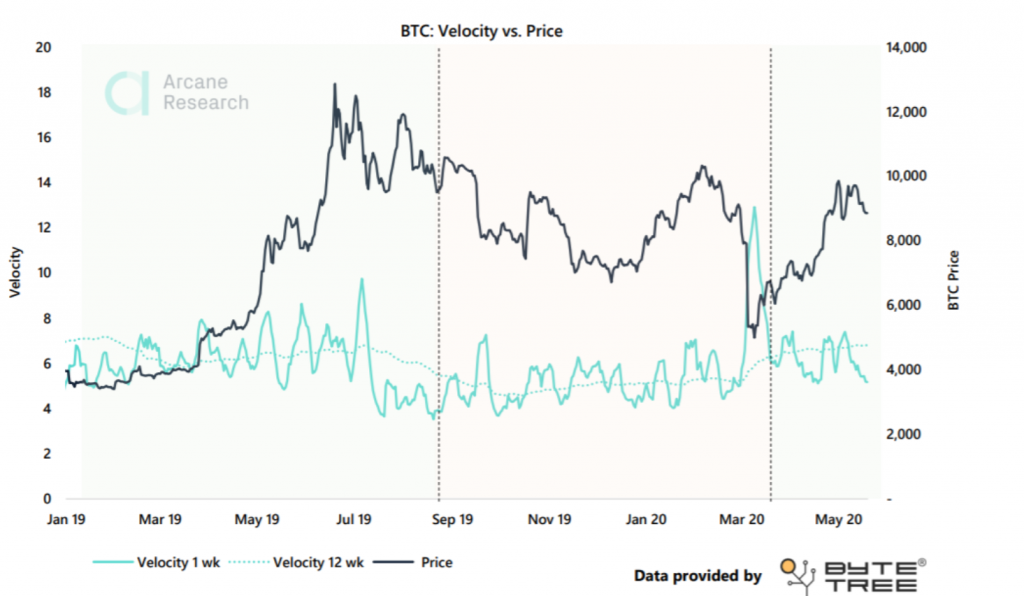

Bitcoin’s short-term velocity drops post-halving

Bitcoin‘s 50% price drop in March raised quite a few concerns about the coin’s potential. However, as its much-anticipated halving drew closer, Bitcoin performed quite well and managed to regain the trust of many in the month of April. But now that the halving’s done, the top coin seemed to be going back to square one. This was evidenced by the fact that Bitcoin’s velocity, which was on a steady incline in April, registered a significant fall post-halving, as revealed by the latest Arcane research report.

Source: Bitcoin velocity, Arcane research

The short-term velocity drop implied a temporary slowdown in transaction activity. This is surprising because the community usually sees new users come into the network, post-halving. Ordinarily, this would result in an increase in buying pressure, resulting in Bitcoin’s price rising. Does the latest drop hint at a bearish run in the near future?

When observed, it can be seen that the previous halvings’ historic patterns reveal that Bitcoin’s price could be in for temporary pullback, before reaching new highs. So, this drop in BTC’s short-term velocity could be suggesting the same.

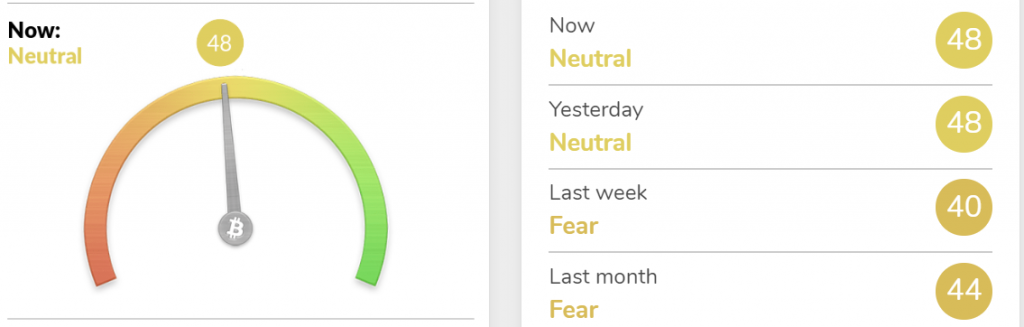

On the contrary, Bitcoin‘s Crypto Fear and Greed Index painted a very different picture. The FG index which was in extreme fear in March, had started to surge towards the end of April, signaling a shift in the market from extremely bearish to slightly bullish. Bitcoin’s Fear and Greed Index was at 48, as of press time, indicating the recovery of trading interest, as well as the improving market sentiment.

Source: Crypto Fear & Greed Over Time, alternative.me

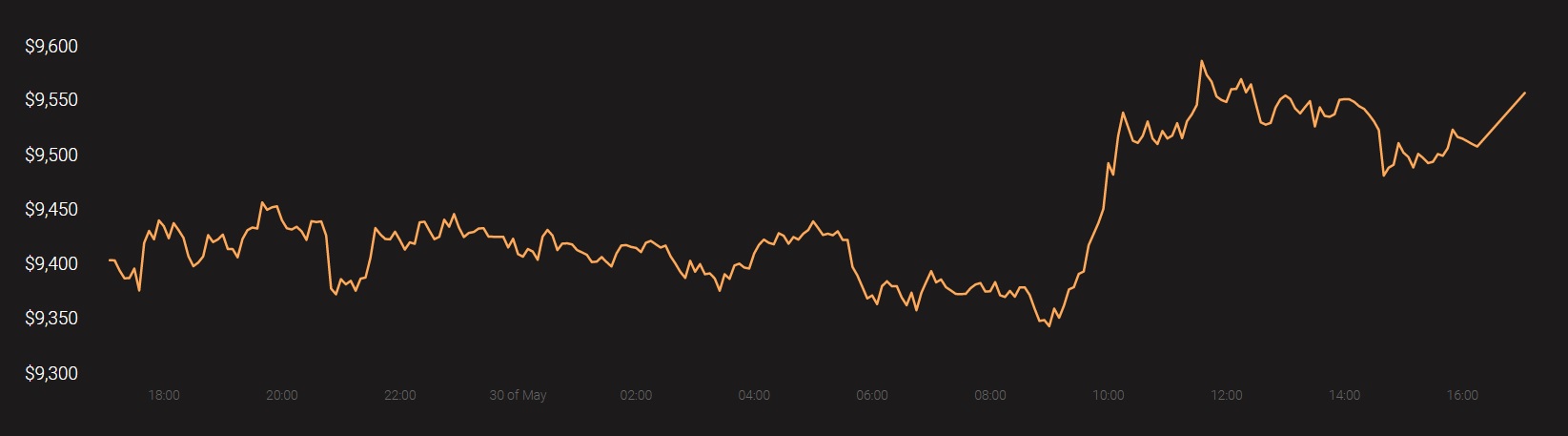

Therefore, in the larger scheme of things, this drop in Bitcoin’s short-term velocity might just be a temporary pullback. Bitcoin might be taking a step back to reach new highs and the fact that the king coin has been continuously trying to reach its key resistance level of $10,000 is proof of this statement. At the time of writing, Bitcoin was trading at $9,564.80, with a 24-hour trading volume of $32 billion.

Source: Coinstats