Bitcoin’s Q1 performance lent a boost by 57% hike in active addresses

Bitcoin has been noting spurts of growth, followed by a lot of correction in the market. The world’s largest cryptocurrency was pushed down to the levels of $6.1k on 1 April, before it pumped by 8.71% later that evening. Even just a few hours ago, Bitcoin pumped and crossed the $7,200 mark, before falling again, in yet another sign of the continuing tussle between buyers and sellers in the market.

At press time, Bitcoin was being traded at $6792.

Source: Coinstats

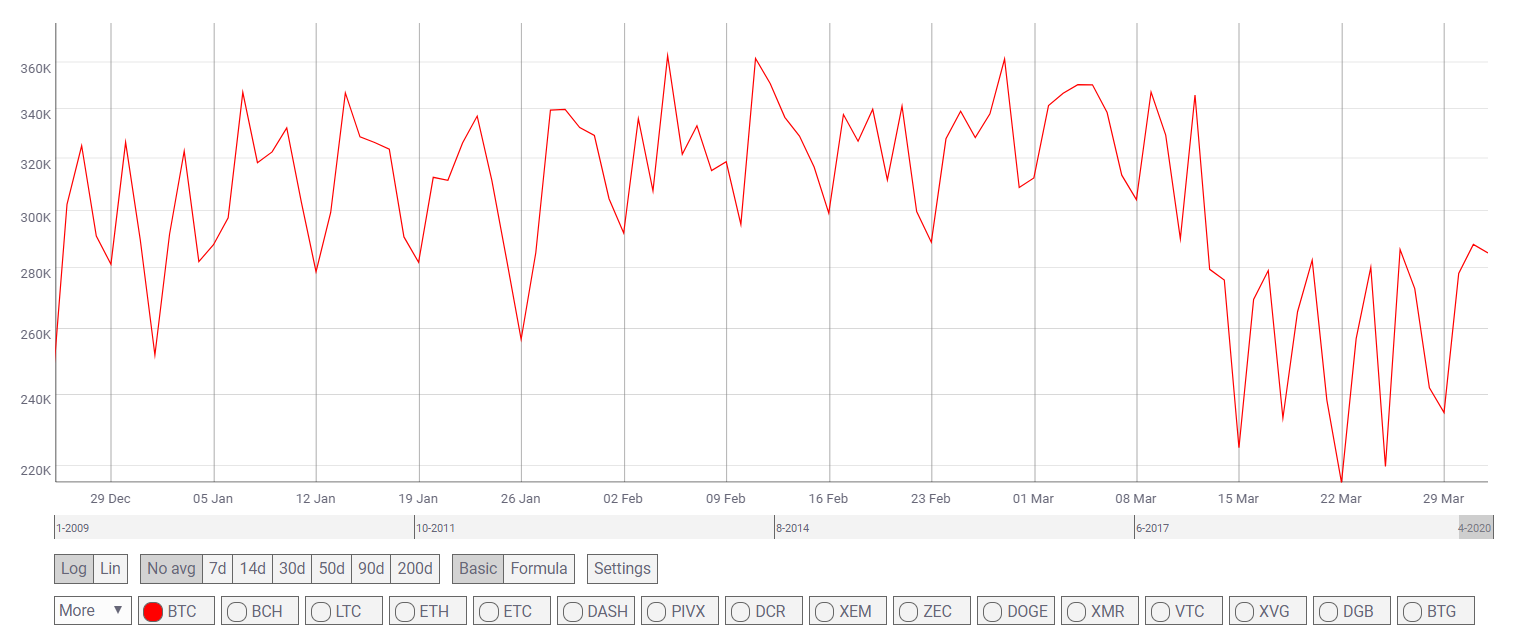

Bitcoin’s performance over the last few days is emblematic of the king coin’s performance over the first quarter of 2020 as it was overshadowed by the pandemic that engulfed the financial markets, as a whole. Bitcoin’s gains were wiped out due to its fall and its YTD returns stood at -7.28%.

However, the active addresses on the network climbed from 524.36k to 816.889k towards the end of the quarter. This was a 55.78% jump in the total number of active Bitcoin addresses.

Source: Coin Metrics

However, on the contrary, the transaction count did not see such whopping growth. According to data collected by Coin Metrics, the total number of transactions that took place on 1 January was 251.867k; this figure moved up by 13.28% by the end of the quarter to report a total transaction count of 285.331k.

Source: Coin Metrics

Even though the transaction count took a hit due to the fall on 12 March, according to the CEO of a leading exchange in the U.K, 92% of the transactions on the exchange platform were for buying Bitcoin. The CEO of CoinCorner, Danny Scott, shared some insights and said,

“Looking at Q1 as a whole, we’ve seen just as much confidence as in March, with 92% of CoinCorner’s transactions being people buying Bitcoin.”

He added,

“Registrations were up 22% from February to March and volume up by a massive 87.5% from February to March (remembering that 93% of this is from buyers). The volume we’ve seen in March was our biggest month for the last 2 years.”

However, despite such rising on-chain metrics, the hashrate of Bitcoin had fallen, along with the difficulty readjustment. Many expect the approaching halving to give these metrics a required boost over the next few months.