Bitcoin’s options trading hits $1 million volume 2 hours after FTX’s launch

Update:

Sam Bankman-Fried, the CEO of FTX Exchange told AMBCrypto that its RFQ [Request For Quote] options system was simpler and more powerful. He added:

“We also think that the range of products we offer will draw users to the platform.”

With respect to the largescale launch of options trading by different players in the crypto industry, Sam Bankman-Fried said that there was a growing interest in options. Capitalizing on this interest, FTX has built an innovative system that allows users to design their own options and to quote for other users’ requests as well.

__________________________________________________________________________________________________

The participation of new entrants in the industry has kept the space interesting for speculative trading. FTX has been making headway for a while; especially with the launch of Bitcoin Option tradings.

The move to launch Options trading was announced by the CEO of the exchange, Sam Bankman-Fried on January 12, via Twitter.

Options launching on FTX in 2 hours!https://t.co/B85lrLVDQO

— SBF (@SBF_Alameda) January 11, 2020

Hours into the announcement, Bitcoin options trading feature went live on FTX exchange and hit $1 million in trading volume. With the addition of exciting features for the cryptocurrency space, FTX is gaining momentum with traders and steadily climbing the ranks of popular exchanges.

Source: FTX

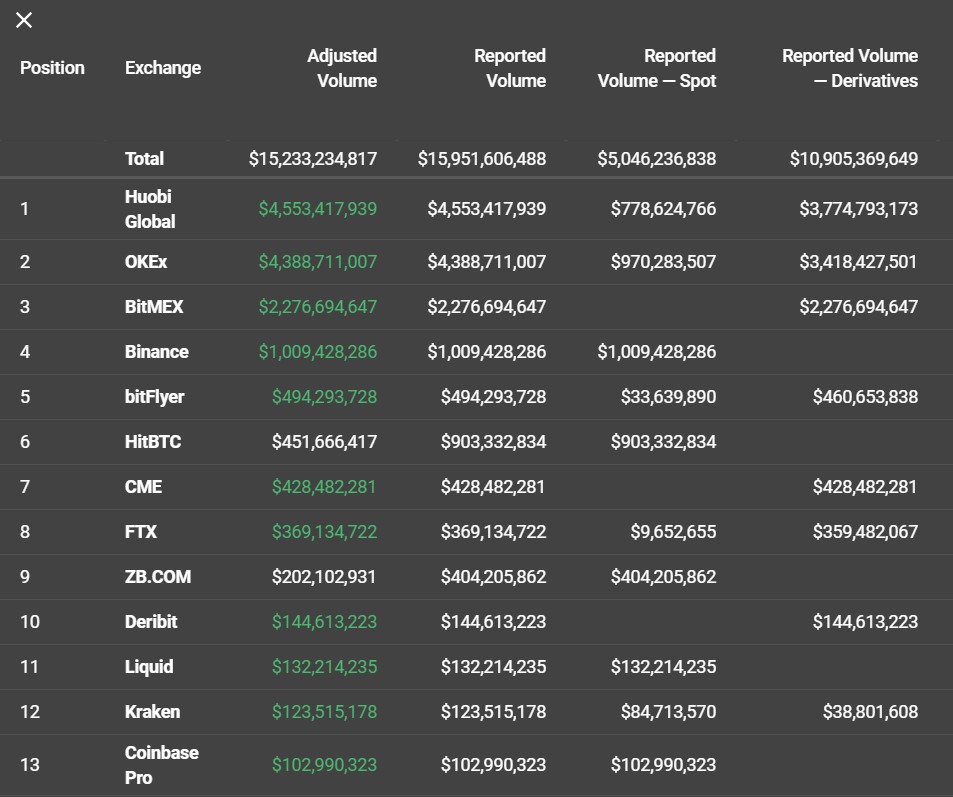

As seen on FTX’s volume monitor, the exchange stands at the 8th spot, just above CME, based on trading volume [adjusted]

In addition, the exchange also received support from one of the giants in crypto space, Binance. Binance reportedly invested tens of millions in crypto derivatives platform FTX back in December 2019.

Options Trading

Options trading is the new hype in the crypto space as many exchanges are pushing forward to enable the feature. CME, the hub of institutional crypto trading, was among the first to launch Bitcoin Futures contracts back in 2017. Many exchanges have followed suit since CME. Another important update is the addition of the Options trading feature for Bitcoin on CME. The launch by CME, which is scheduled on January 13, was noted by J. P. Morgan Chase’s executives as ‘highly anticipated’ due to an ‘unusually strong activity’ prior to the launch.