Bitcoin’s implied volatility drops, but Options still project restricted trades

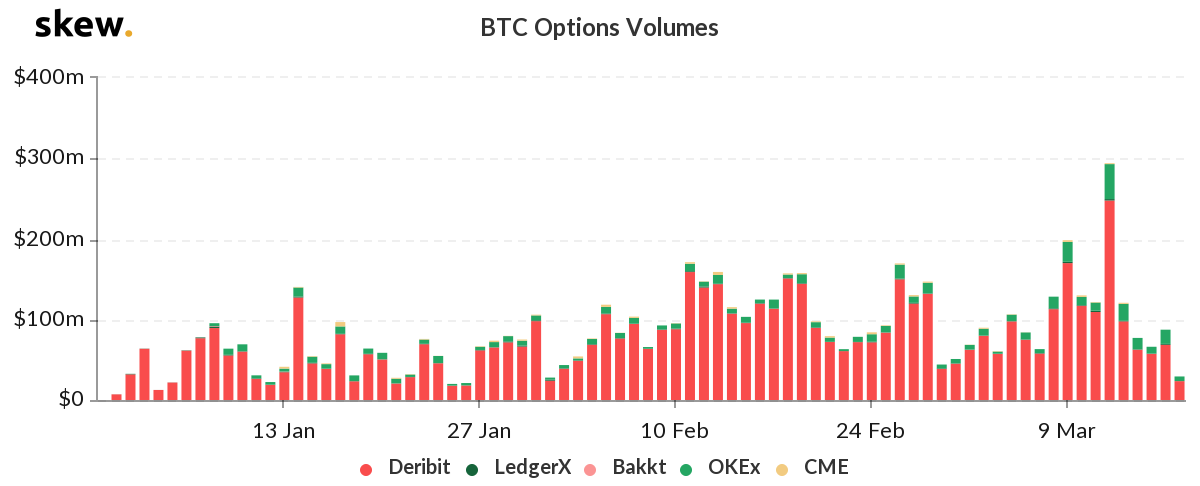

Bitcoin Options volumes marked new highs recently. On 12 March, as Bitcoin’s price fell from $7k levels to $4k levels, the Options market noted heightened volume, with Options contracts of about $294 million. However, as the market became more volatile, this volume shrunk and fell close to $28.8 million, at press time.

Source: Skew

The Options market has been dominated by Deribit exchange for a long time. On 9 March, Deribit’s Bitcoin Options volume reached an all-time high mark of $248 million, while other Options platforms like OKEx recorded $43 million in volume. Bakkt and CME reflected restricted trades. However, on 17 March, the volume on Deribit exchange was $24 million, whereas OKEx was the only other exchange reporting Options volume, at press time.

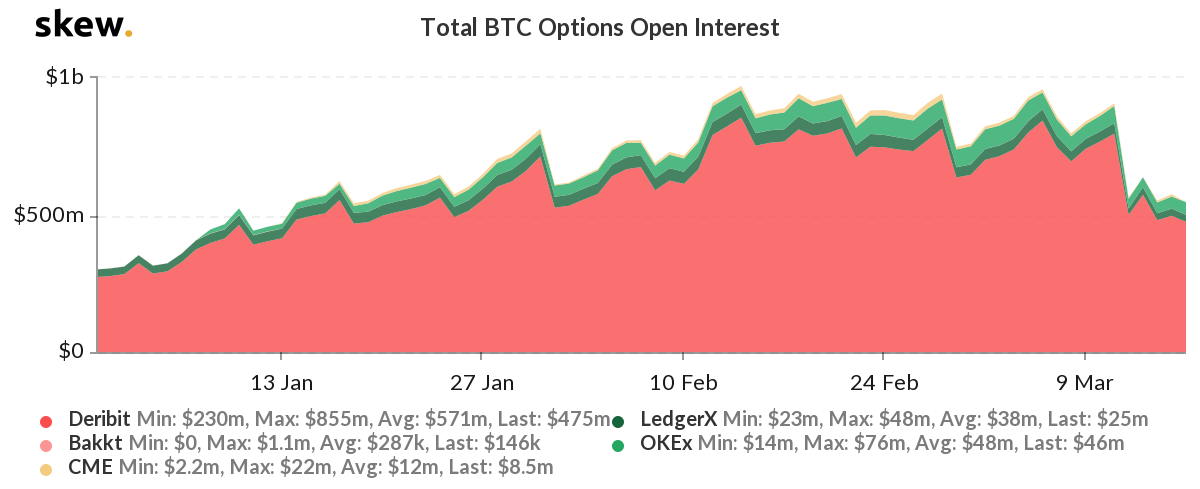

Meanwhile, the Open Interest [OI] has also taken a nosedive. The OI had reported a peak on 14 February in the wake of the rise and fall of Bitcoin in the $10k range. The top was noted at $970.30 million, after which, the interest kept falling. On 16 March, the Bitcoin Options Open Interest stood at $546.14 million.

Source: Skew

The reduced interest could be a sign of caution practiced by most traders as the volatility of Bitcoin spikes. According to data aggregated by Skew, the realized volatility over the past 10 days spiked to 313% on 16 March, while the 1-month volatility surged to 187%. However, as the price of BTC was rising by 23% in the past 21-hours, the realized volatility fell to 316%.

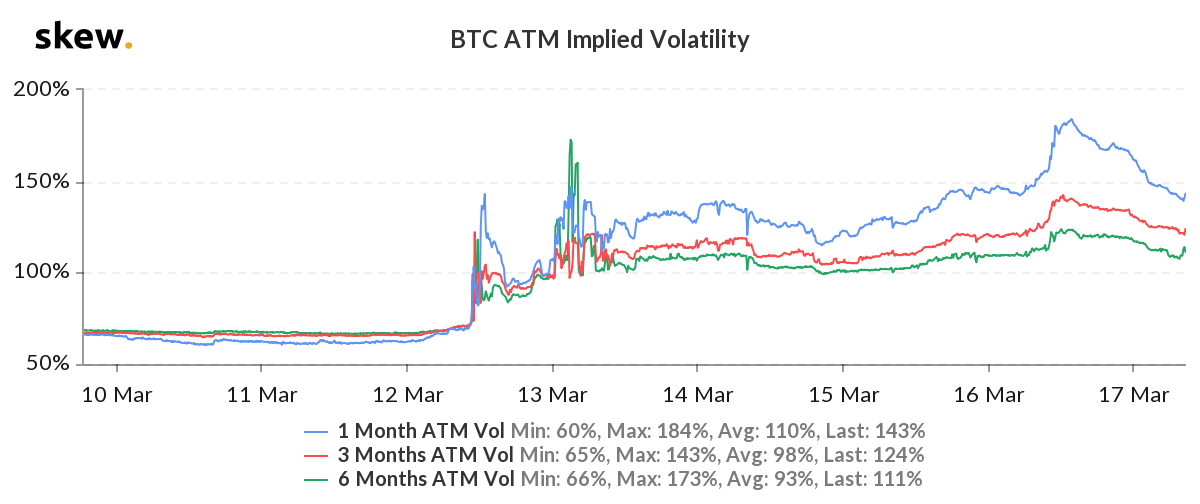

Implied Volatility, a metric that refers to the market’s assessment of future volatility, was falling, at press time. On 16 March, the 1-month ATM volatility stood at 184%, whereas the 3-month ATM volatility was recorded to be 140%.

Source: Skew

However, on 17 March, the market predicted lower volatility in the Bitcoin market as the 1-month ATM volatility fell to 141% and 3-month volatility shifted to 124%.