Bitcoin

Bitcoin’s blockchain activity spikes; value transfers, miner fee note growth

Bitcoin’s value plunged by nearly 5% over an hour on 19 January and at press time, was valued at $8,650. While this is the second time the king coin’s price plummeted after crossing the $9,000-mark this year, it is still going strong in terms of on-chain network activity and usage.

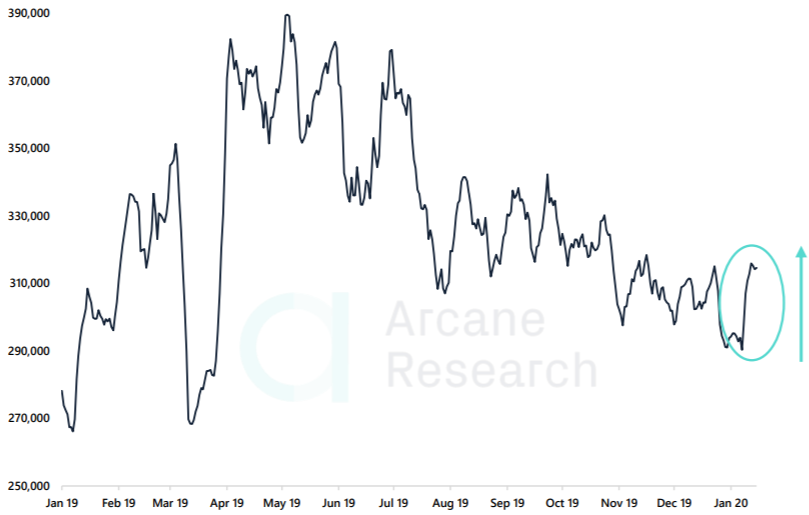

Reportedly, Bitcoin’s blockchain activity continued its uptrend this week too; interestingly, to levels that were not seen in the last two months. According to Arcane Research’s latest weekly report, Bitcoin’s blockchain activity is back to November levels.

Bitcoin’s blockchain recorded a whopping surge of 90% in 2020, a development that effectively pushed the 7-day average of the value of transfers to $6 billion.

Source: Arcane Research | Confirmed Transactions Per Day: 7 Day Average

Additionally, miner fees also witnessed an uptrend. Arcane Research stated,

“Miner Fees are seeing the same increase, up 89% so far in 2020. Although there is a feedback loop on blockchain activity from price action in the market, it is a healthy sign to see that the blockchain activity seems to be turning around as well.”

Source: Arcane Research | On-chain Bitcoin activity [7-day average]

It was previously reported that activity on the Bitcoin blockchain made a comeback in the first week of January after sustaining a slump in December 2019. Arcane Research, in its previous report, had said,

“The activity on the Bitcoin blockchains starts the year with a long-awaited bounce.”

Besides, Bitcoin’s hash rate hit an ATH recently, recording 126.13 exahash per second prior to the coin’s third halving event scheduled for May this year. Meanwhile, its difficulty, which was in a decline, picked up pace and approached the 15T-level.