Bitcoin use for illicit activities is only 2%, while 21% transactions are lawful and 77% are unclassified

Cryptocurrency adoption around the globe has been on the rise as regulators and governments realized that it cannot be banned completely. However, one of the major roadblocks toward widespread adoption has been the views of a few naysayers who have often claimed that the nature and technology behind cryptocurrencies made it easier for money laundering and other illicit activities.

Like many other myths surrounding the crypto space, even the accusations of it being a potential tool for miscreants and criminals had been debunked lately.

Elliptic, a blockchain and crypto-focused analytical firm, often hired by law-enforcing authorities, conducted a study on the use of Bitcoin in illicit activities for more than 200,000 bitcoin transactions. The study found out that only 2 percent of the total transactions taken into consideration were found to be used for illicit activities. Some of the interesting conclusions from the study have been listed below,

- Only 2 percent of the 200,000 bitcoin transactions in the data set were deemed illicit.

- 21 percent of the total transactions were identified as lawful.

- roughly 77 percent, remained unclassified.

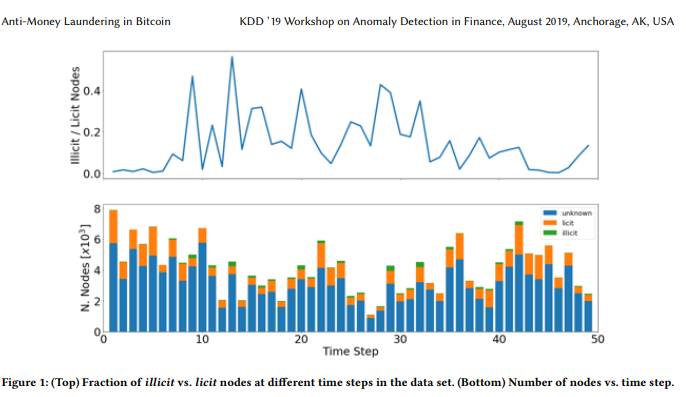

This was later confirmed by the MIT-IBM Watson AI Lab which analyzed 203,769 bitcoin transactions worth $6 billion with the help of machine learning. The aim of the study was to see if machine learning can aid the process of detecting money laundering patterns. The AI study used various methodologies and data sets to arrive at the conclusion that the data put forward by Elliptic was correct.

The following graph represents the timestamp of Bitcoin confirmation on each node and the green bar at the top of each node signifies illicit transactions.

Another study by Chainalysis suggested that the use of Bitcoin for illicit activities in 2019 has been only 1% which was presented in the form of a webinar.

Banks don’t like people having their way with their money

Bitcoin transactions on its network can be validated and verified from the public ledger available to everyone. Even though certain privacy-centered crypto tokens like Monero and Dash promise a certain level of anonymity on transactions, their impact and use for illicit activities have been quite low.

Coin mixing tools are often been seen as a way for criminals to help them in hiding their transactions; however, these pools remain under a constant watch, making it quite a risk to launder large sums of money. Higher volume transactions have been caught by market monitoring tools more easily, and even small amounts of hacked or stolen digital currency are considered highly difficult to launder.

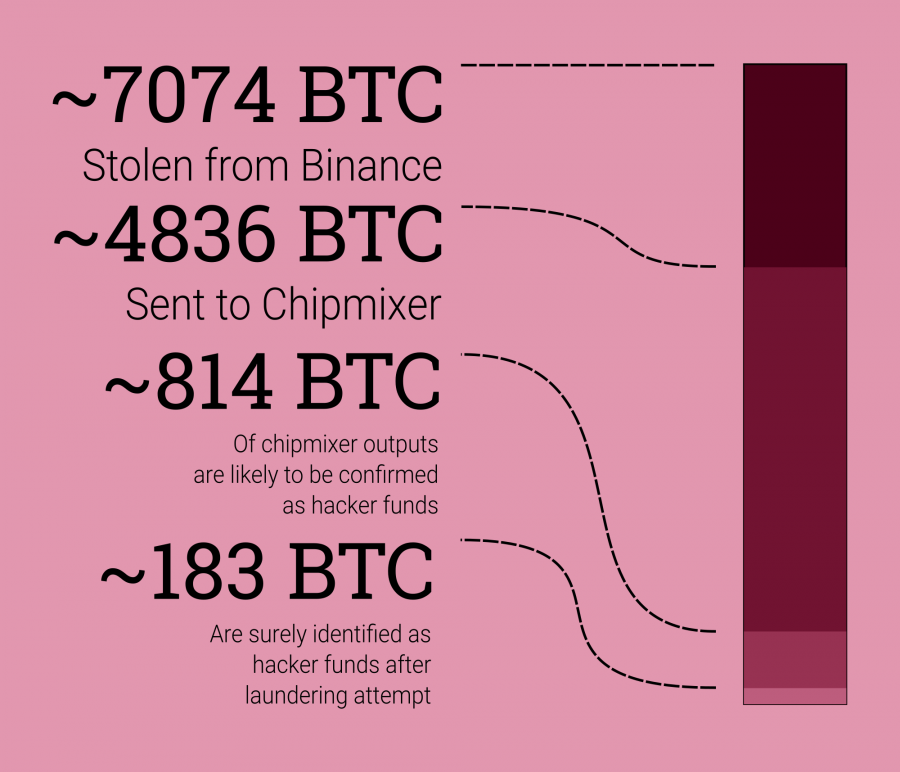

This was clear in case of Bitcoin hacked from Binance exchange, where the scammers are still trying to launder small amounts of the total 7074 stolen BTC. According to the report, scammers have managed to launder 4836 BTC through a coin mixing service called Chipmixer. However, the interesting thing to note here is that even though the scammer took all precautions and clustered the robbed BTC in just 10 coins a batch, analysts have been able to detect that the coins were coming from the scammer.

Clain’s analysis detected abnormal transaction activities in Chipmaker’s mixing pools and traced back at least 183 BTC to the scammer and it was estimated that the number could

go up to 814 BTC.

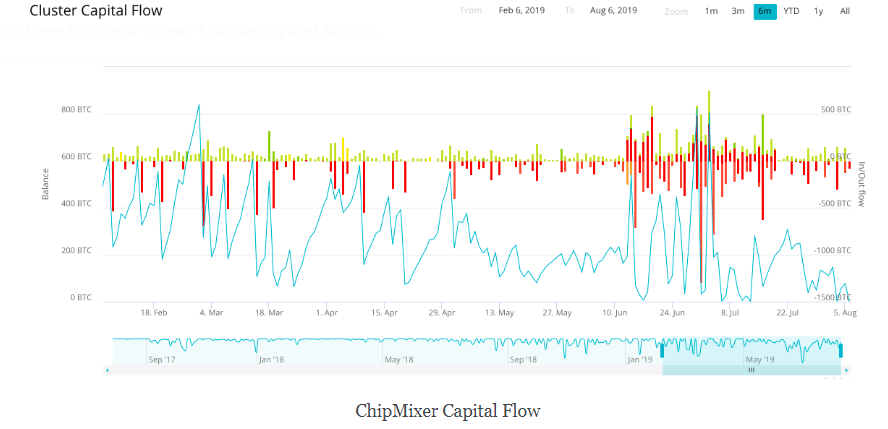

The following chart recorded increased activity on Chipmixer that led to the suspicion of money laundering. The case has a great significance as it highlighted the superiority of crypto and the technology backing it over centralized banks and Fiats issued by them.

It has been evident from numerous independent studies in recent times that the use of cryptocurrencies for money-laundering and other illicit activities were nowhere near what the naysayers have been propagating. Even the coin mixing services which can aid in hiding crypto transactions can not be used for laundering large sums of money.

Banks don’t follow what they preach

Major banks and financial institutions around the globe who have been fueling negative narratives around crypto are known to be the biggest defaulters on each scale, be it money laundering, inflation, debts or the recessions. Many high-profile banks around the globe have been caught laundering money for drug cartels, sex traffickers and many high-profile criminals. However, most of the time they got away with fines and without any prosecution or lawsuit.

While on one hand, these banks wanted to discard a technology that has been challenging their position and role in society, on the other, they continue to do the same what they accused Bitcoin and crypto could be used for. Since 2012 major banks around the globe have paid $200 billion in fines for their involvement in money laundering

Governments around the globe have been pouring in billions towards anti-money laundering laws and regulations, still, major banks have found a way around it to help anyone who paid them enough. Although the restrictions and Anti-money laundering laws have led to banks being more watchful in recent times as evident from the HSBC’s recent sex trafficking involvement scare. After the news about US authorities shutting a sex-ad website surfaced, HSBC sprung into action to check if they were serving anyone related to the case.

The bank authorities narrowed down the accounts of people whom they believed were involved and handed it over to the concerned authorities.

A look back at the stained history of major banks around the globe

source: Bloomberg

Cryptocurrency can be categorized relatively as a relatively new asset class and the concerns of regulators around the globe are understandable. Arin Ray, a senior analyst at Celent whose expertise lies in the domain of Anti-Money Laundering and Investment management told AMBCrypto that according to his experience, crypto is an evolving tech and currently its Anti-Money laundering compliance has not been widely proven. He explained,

“Crypto is still an emerging field and it is not yet clear if the crypto technology would be fundamentally safer than fiat from AML perspective. We do see most crypto market players and exchanges ramping up their KYC-AML processes and regulators are becoming increasingly interested, so this sector will face more scrutiny as it further develops.”

Cryptocurrency is backed by tech which can be evolved to meet regulatory scrutiny

Cryptoverse is relatively a new class of assets and frictions with the regulatory bodies have been a part of any evolving technology. The underlying technology of blockchain can be evolved further along with the cooperation from stakeholders to make it more compliant to the regulatory requirements. This is evident from the fact that this year alone countries like Russia, France, Germany, and Portugal have regulated crypto use in one way or another.