Bitcoin

Bitcoin: To hodl or not, is the question

Bitcoin, known popularly as digital gold, is a store of value. It is also hard money and has limited supply. However, unlike gold, BTC is digital and doesn’t face the problems that gold does. Regardless, BTC is becoming scarcer each day, especially with halving completed, the asset’s inflation has also reduced.

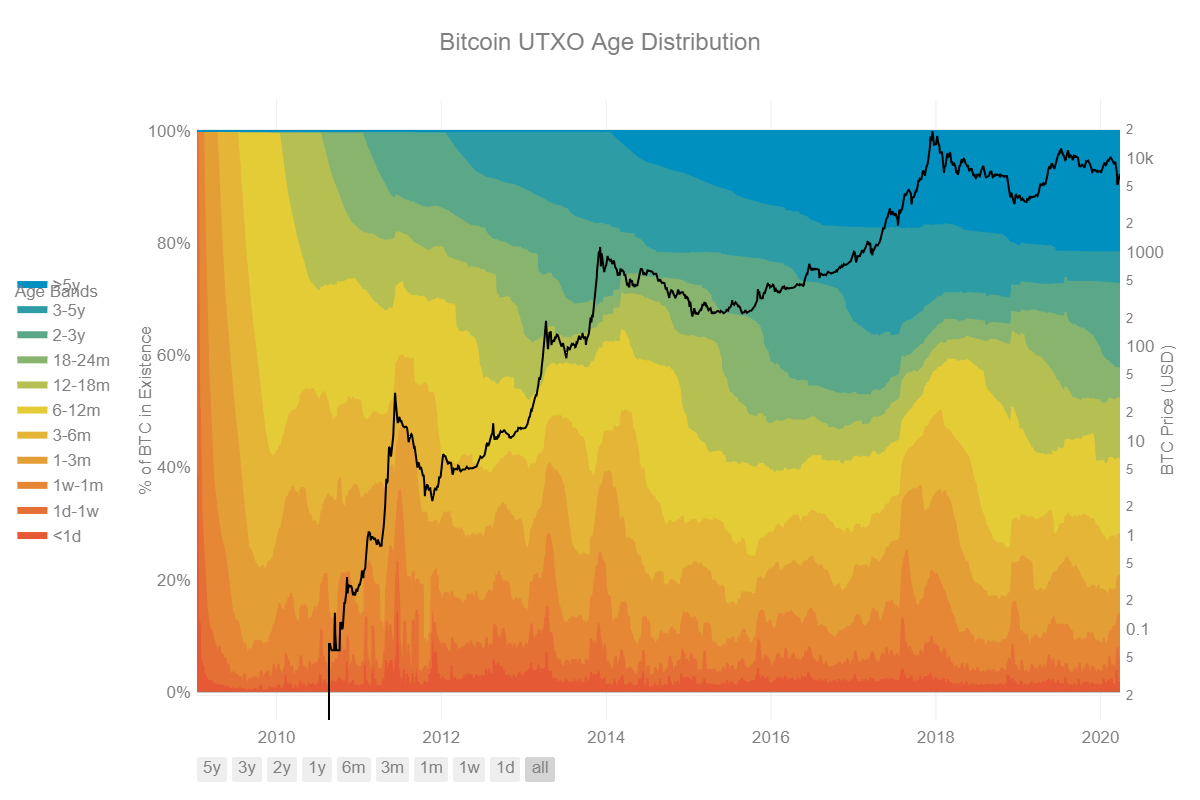

In addition to this, the behavior of hodlers shows what investors think about Bitcoin and its macro view. HODL waves from Unchained Capital showed, until March 2020, a total of 21% of all the BTC were aged 5 years or older; meaning, they hadn’t moved in over 5 years. Since 2017, this has increased from 16% to 21%. As of today, the BTC that is in continuous circulation [of 1 day to 1 week] constitutes 1% or less. This shows that people are long term bullish on Bitcoin and would prefer hodling.

Source: Unchained Capital

An even interesting way to look at this is using the price to determine the amount of BTC moved. Data from Glass node suggests that 10.9% of the BTC was last moved when the price was $10,000. 17% last moved when BTC was below $100 and most of which is assumed to be lost [considering the age and 4.4 million BTCs lost]. With the price being extremely volatile in March and April, and dropping from $8,000 to $3,8000, a large portion of BTC [46.6%] moved in the current price range, ie., $5,000 to $10,000.

Source: Twitter

Also seen above is that 1.7% of the BTC was last moved when BTC was between $15,000 to $20,000, this could be the investors that FOMO’d into the bull rally of 2017.

With 3rd halving behind us, the S2F ratio for Bitcoin ranges from 50-60, depending on how accurate the values are. Either way, the point is that the S2F ratio is approaching closer to Gold’s and soon, it is likely to overtake gold, the best store of value, and safe-haven asset. All of the above indicate to one thing, Bitcoin is increasingly becoming a safe haven asset and a store of value, soon it is likely to be the go-to asset.