Bitcoin’s 13 March crash could just be the beginning; more volatility in April?

The 13 March drop for Bitcoin had implications wider than previously anticipated. Plenty of records were set that day. Previously uncorrelated, Bitcoin became widely correlated with the S&P 500. The so-called “safe haven” title, a title that was already in doubt, was confirmed; Bitcoin was not a safe haven asset. However, despite everything that transpired, hodlers didn’t seem to be affected by Bitcoin’s massive volatility.

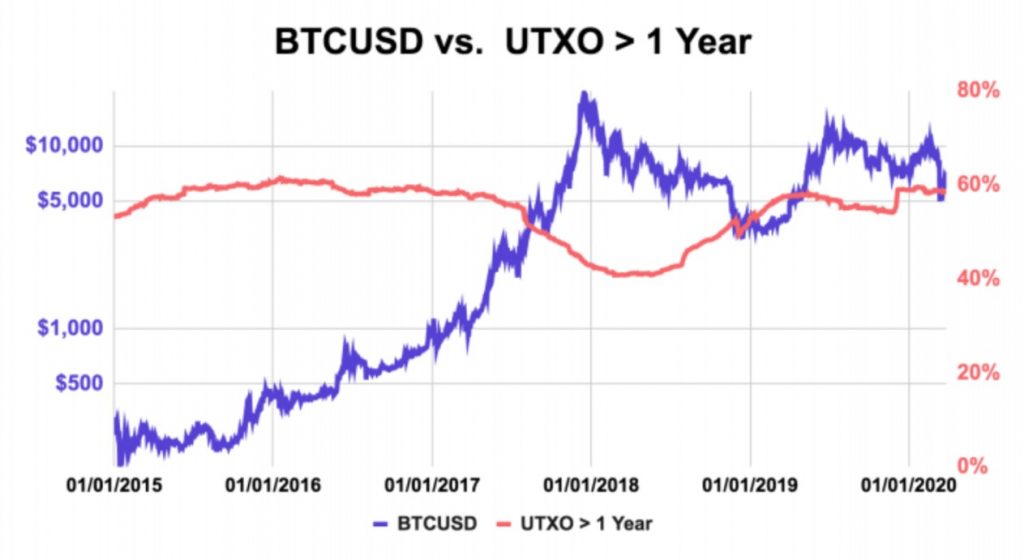

The holders of last resort are a category of holders that provide liquidity by buying the dips and crashes and basically, not panic when the entire market is. Similarly, UTXOs are unmoved, unspent BTC transactions, and a capitulation of the same represents a truly scary picture for the Bitcoin ecosystem; especially if it comes at times panic selling.

Usually, UTXOs see a reduction at cycle peaks, representing the holders taking profits. However, any sell-off from UTXOs before cycle peaks, as mentioned, represents a dire scenario. According to Kraken’s latest report, the UTXOs which were greater than 1 year stood still during the recent crash.

As seen in the attached chart, the UTXO>1 Year [red line] stayed, more or less, at the same level, ie., at 60%, even with Bitcoin’s price falling by 50% in a single day. Since this drop, the price had recovered almost 90% of its value, at press time.

“However, long-term holders (1+ year) were largely unphased by bitcoin’s plunge and have yet to be shaken out of the market. 58.4% of bitcoin supply is accounted in unspent transaction outputs (UTXOs) that haven’t moved in more than a year as of Mar 31. Should this change, one might expect bitcoin to fall and volatility to surge; a drop in UTXOs older than 1 year would suggest that holders have lost confidence in bitcoin and have exited the market.”

This is an interesting observation since the ongoing month, the month of April, has historically been one of the most volatile months. For example, in April 2013, BTC saw a 321% annualized volatility. As for March 2020, the volatility was 178%. Additionally, the volatility average for April is 102% and the median volatility is 74%. Hence, big moves from BTC can be expected in April; especially since April 2019 was when Bitcoin surged from $4,000 to $13,800 in 3 months.