Consider this before you take Bitcoin’s market sentiment at face value

Ever wondered what the classic bottleneck is? In the crypto-market, when Bitcoin’s price crosses a long-known resistance and the price rallies, CT is filled with bullish sentiment, bullish tweets, and bullish rants even. However, where is the entire picture? A trader’s perspective is a 360-degree one. That, alas, is often lost around the noise that accompanies such a rally.

Interestingly, there are several charts that can give you a complete picture, and the noise can be accounted for by averaging over 60d or 90d!

Consider this – One popular example of noise is, “This is good for Bitcoin.” Since the price crossed $13.5k, almost every conversation about any event or development in the space has ended on the following note – “This is good for Bitcoin.” Maybe yes, but mostly no. Not everything is good for Bitcoin. At the very least, expecting these developments to be definitely good for Bitcoin is very unwise.

Plan B’s Tweet || Source: Twitter

Here’s an example – The Presidential debates, the looming Election Day, and its outcome, cannot all be entirely bullish for Bitcoin. At least, not at first glance. The issue here is that many take the opinions of analysts like Plan B at face value, without digging any deeper. After all, a bullish tweet serves everyone well, right?

However, that shouldn’t be the case. If you dig deeper, you’ll find that President Trump’s win back in 2016 was bullish for Bitcoin. The reason being, the store of value narrative got a boost as investors rushed to safeguard their dollars and hedge against the risk to the stock markets.

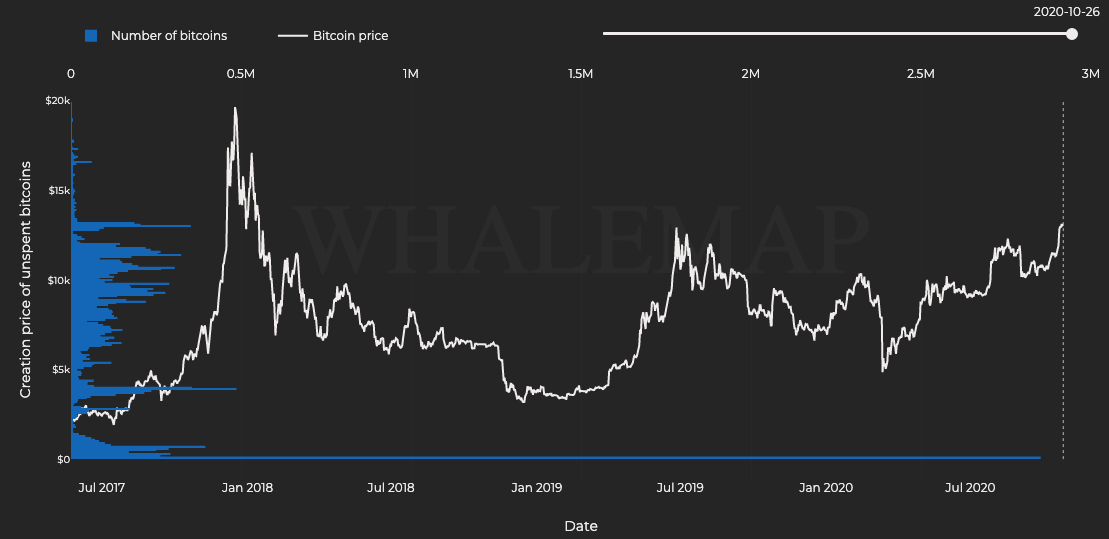

Further, while there’s no Bitcoin correlation chart with U.S presidential elections, the picture is clearer with one look at the volume profile.

Bitcoin Volume Profile || Source: Whalemap

Massive Bitcoin accumulation transpired around the price range of $10,000 to $13,000. The present-day market is bullish for Bitcoin and the volume profile signals that most traders/HODLers might possibly HODL for the price to cross $15k, before flooding exchanges with their Bitcoin and before increasing selling pressure.

Another message making noise lately is Bitcoin surging to $15k or $18k over the weekend! This one is on @MaxKeiser.

Max Keiser’s Tweet || Source: Twitter

Max Keiser is known for making such claims. In fact, $28,000 still in play is another one of his popular price references. This time around, however, Bitcoin’s price depends more on its trade volume on spot exchanges and exchange reserves, and not CT entirely. Sentiment is useful, yes, but at the end of the day, it’s just noise. Fundamental metrics are what should be accounted for the most.

This can be evidenced by the fact that Bitcoin exchange reserves are still at their lowest, but trade volume on spot exchanges hasn’t even crossed the 60day average.

Bitcoin Reserves || Source: Cryptoquant

In fact, reserves haven’t gone up, despite recent developments like PayPal’s announcement, the influx of smart money, and the news of the launch of CBDCs. Further, based on CoinMarketCap’s on-chain analysis, 97% of Bitcoin HODLers are currently profitable, despite the fact that exchange reserves have continued to drop.

Ergo, it’s important that one looks through the noise as charts, not sentiment or tweets, share a complete perspective. This is the case because entering a trade with half the info is as risky as gambling away your investment.