Bitcoin primed to drop further as Put/Call ratio spikes

There has been a stark sentiment shift in the Bitcoin market.

On 9 March, the price of the world’s largest cryptocurrency fell to its lowest point in over two months, losing over 20 percent from its 2020 high. While initial estimates posited this as yet another regular downturn for the Bitcoin markets, the extension of this bearish run paints a dreary story.

The maturation of cryptocurrency derivatives helps predict the sentiment of the market and with top exchanges regularly churning out more than $1 billion in volume, the contractual crypto-market is an effective barometer of future sentiment.

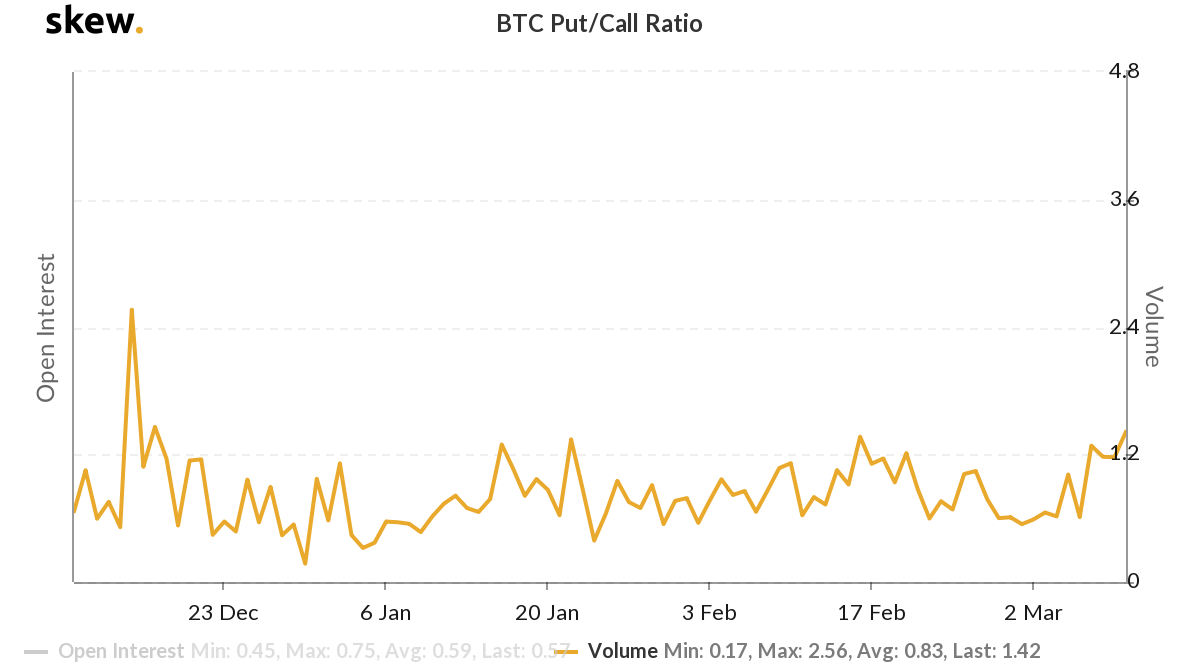

According to data from Skew markets, the Put/Call ratio of Bitcoin Options contracts has reached 1.42, its highest point since mid-December, a time when the price was at $7,200, 8 percent lower than the price at press time. Not only has the Put/Call ratio reached an almost three-month high, but it has crossed over 1, indicating that the Put Options contracts now outnumber the call Options contract.

BTC Options Put/Call ratio | Source: skew

Options contracts provide a unique layer of risk sensitivity in the derivatives market as it allows traders to opt-out of positions based on evolving market trends. This ‘opt-out’ can be both on the buy side [call] or the sell side [put].

A put option gives the holder a right to sell; conversely, a call option gives the holder the right to buy. Hence the Put/Call ratio indicates the right to sell options traded in the market to the right to buy options, which portrays how the asset’s imminent price change is perceived by Options traders.

Since Bitcoin’s Put/Call ratio is over 1, there are more traders who are opting for contracts with a right to sell, rather than a right to buy. Interpreting it differently, the number of traders opting for a right to buy has fallen, when compared to the traders with a right to sell.

This metric increased significantly, from 0.62 on 6 March, to 1.28 a day later, when the price dropped by 2.78 percent over the day. The decline in price over the next few days was a testament to the declining sentiment among Options traders. Since 7 March, the price has tanked by over 12 percent, with the decline continuing at press time.

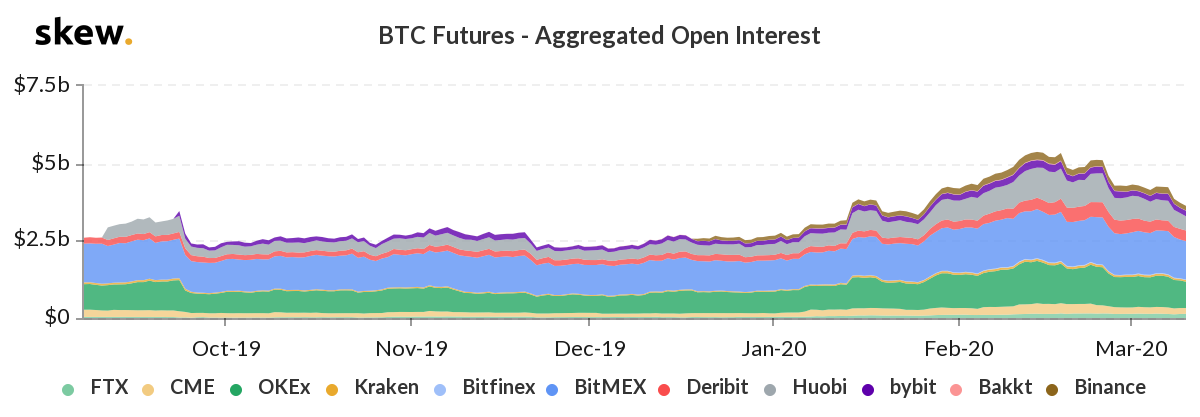

BTC Futures Open Interest | Source: skew

Options are not the only leading indicator of onrushing bearish sentiment, based on the derivatives market. Since 6 March, the Open Interest on Bitcoin Futures has also seen a significant fall, with the 9 March drop accelerating trading. The OI for the collective Futures market dropped by over $400 million, as traders closed off positions and fast.