Bitcoin Options show cupid price effect, come Valentine’s Day

Bitcoin could find the perfect match in the Options market.

It has been over four months since Bitcoin was over $10,000 and an unlikely suitor could take it back to the five-figure paradise. Bitcoin Options, an important metric of market sentiment, is providing a favorable outlook of the larger spot market, with Valentine’s day around the corner.

According to Su Zhu, CEO of Three Arrows Capital, there is an “aggressive skew” for Bitcoin Options expiring on Friday, dated 14 February 2020.

The skew, given the general market conditions, is inclined to swing in a bullish manner, considering Bitcoin is, at press time, trading at just over $9,800, testing the $10,000 level.

Aggressive skew for next Fri 14feb (Valentine's day) expiry, the options mkt is expecting big moves up the next 7days https://t.co/iK1IOBfoeG

— Su Zhu (@zhusu) February 7, 2020

“The Options mkt [market] is expecting big moves up the next 7 days,” he suggested, referencing the data from Deribit tweeted by @btc_status. The charts suggest that contracts “BTC – 14FEB20” are considerably more bullish than the ones expiring on 21 February, 28 February or those expiring a month later on 27 March.

Implied Volatility [IV] for ‘Valentine’s day’ contracts was as high as 80 percent, compared to other contracts whose IV’s were hovering close to the 70 percent mark.

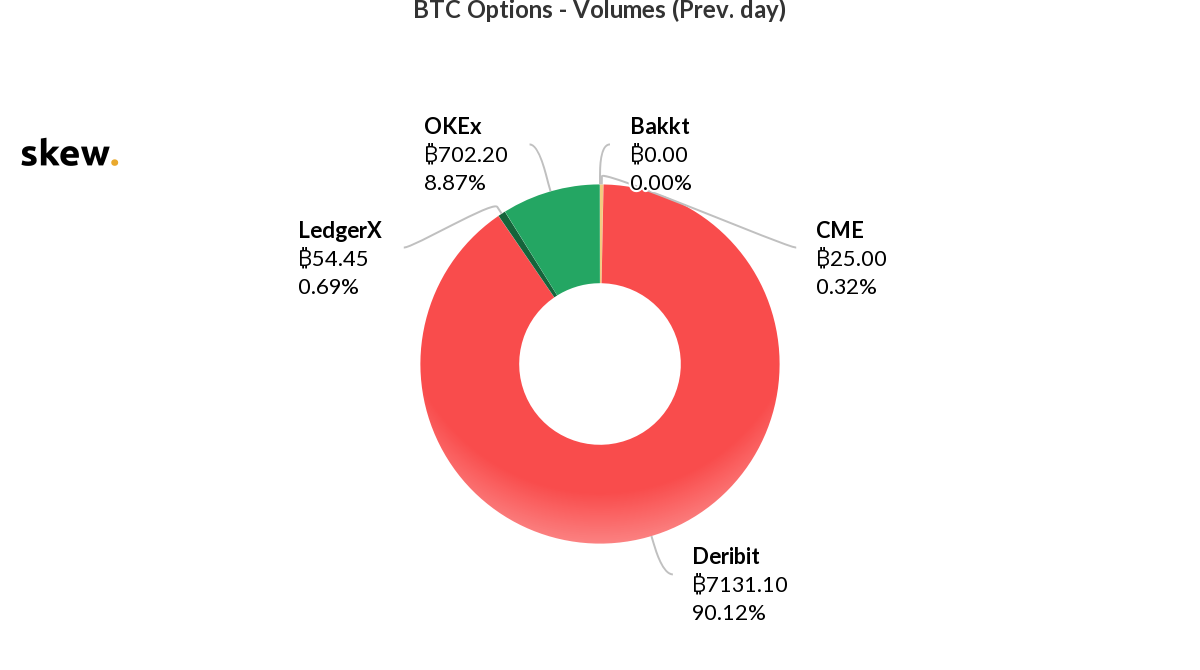

The importance of Bitcoin Options on Deribit cannot be overstated considering the dominance of the exchange in the derivatives market. According to data from skew, Deribit accounted for over 90 percent of the volume on Bitcoin Options, based on volume from the previous trading day [6 February 2020].

Over 7,130 BTC equivalent volume was traded on the exchange, accumulating a volume of almost $70 million.

Source: Bitcoin Options Volume, skew

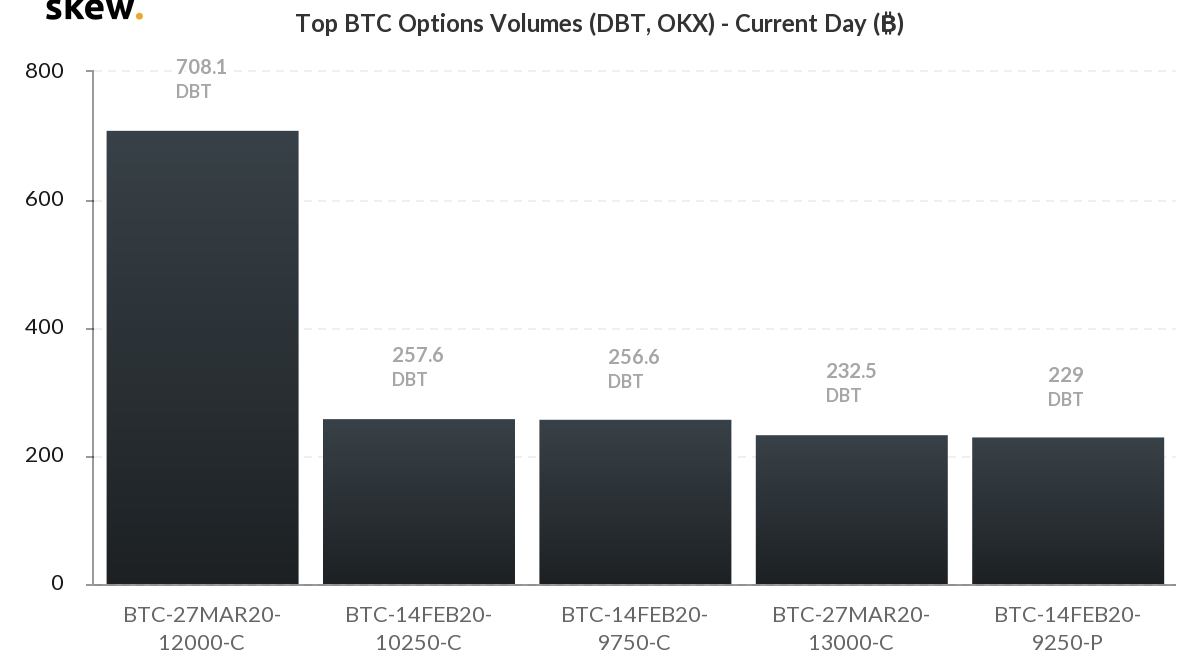

To further break down the volume on Deribit, the figures show the exact nature of the bullish tendency. In terms of a volume of 700 Bitcoins, according to expiry and price, the 27 March contracts are bullish at a price of $12,000. The Valentine’s Day contracts take the next two spots at $10,250 and $9,750, respectively, with 257.6 and 256.6 Bitcoins in volume.

A bittersweet pullback is also present with 229 Bitcoin Options expecting a drop to $9,250.

Source: Bitcoin Options Volume – Deribit, OKX, skew

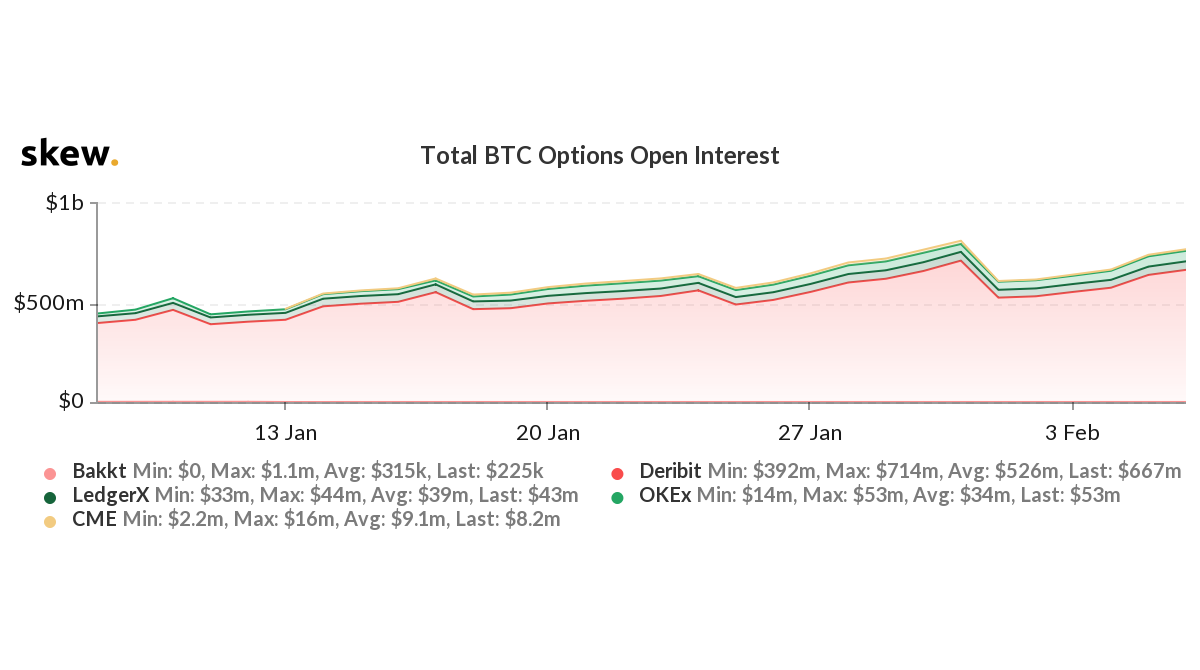

In terms of Bitcoin Options’ open positions on the derivatives exchange, it is far ahead of both regulated and unregulated competitors.

On 6 February, Deribit’s OI was over $650 million, with OKEx in second with a paltry $53 million in volume. Bakkt, the Intercontinental Exchange’s digital assets platform, saw positions worth around $225,000 created, barely visible on the chart.

Source: Bitcoin Options OI skew