Bitcoin Options contracts traded on Deribit crossed 319K amidst ‘Black Thursday’ woes

After ‘Black Thursday’ transpired on 12-13th March, along with Bitcoin’s valuation, its derivatives market also took a major hit. The Open Interest and daily volume dropped across major Futures platforms, with significant panic-induced sell-offs damaging the market sentiment of Bitcoin.

However, according to Deribit’s recent newsletter for March 2020, a different outlook was noted by one of the world’s top derivatives platforms.

According to the newsletter shared with AMBCrypto, after the collapse of 13 March, the implied volatility of Bitcoin surged by over 300 percent for the daily Options of Deribit, and it cost the exchange quite a lot. In order to combat the situation, the exchange decided to strengthen the insurance fund with multiple injections.

Source: Deribit

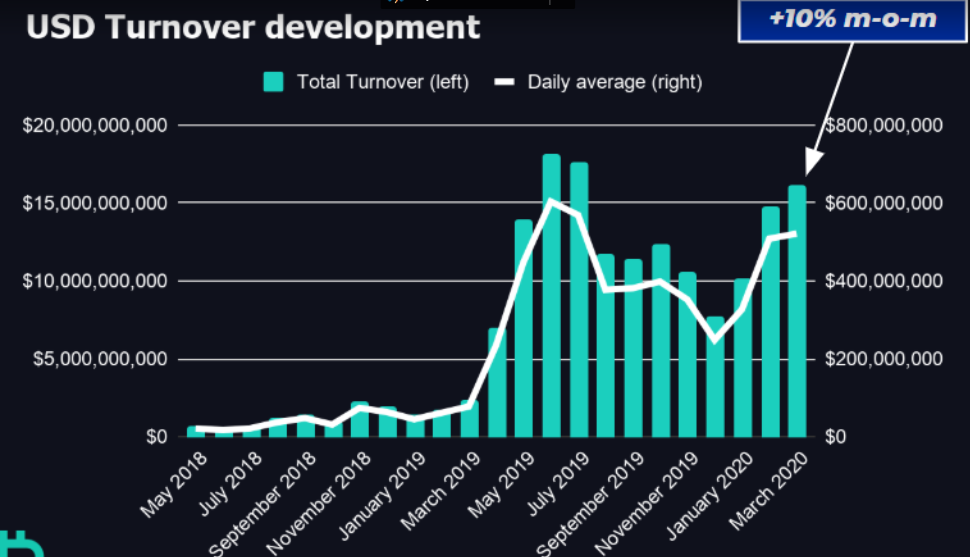

On the bright side, with the rise in implied volatility, volumes on Deribit went on to set a record for Options contracts traded on the exchange. According to the report, the total turnover in terms of USD was estimated to be over $16.1 billion, a figure that outperformed the performance of February 2020 by 10 percent. The record turnover in March 2020 was also Deribit’s third-best month in terms of USD turnover since May 2018.

Bitcoin Options contracts traded also reached a new high of 319,392, marking the highest number across all the exchanges in the space. In comparison, 613,163 ETH Options were also traded over the same duration.

Source: Deribit

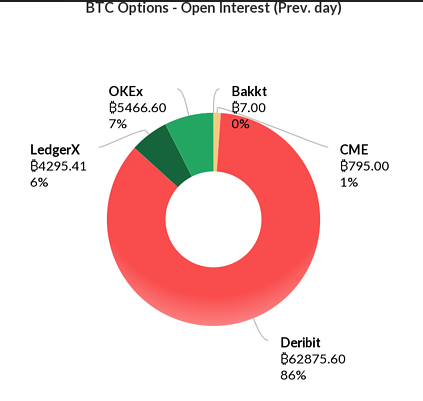

Data also indicated that a whopping 86 percent of Bitcoin Options OI was held on Deribit on 31 March, outperforming the likes of Bakkt, CME, and OKEx.

However, even though the Options volumes registered significant activity, the USD Options turnover dipped by 22 percent in March due to Bitcoin’s price collapse in the second week of March.

Previously, it had been reported that the total number of Bitcoin sent to Deribit registered the highest amount of losses as a SOPR index of 0.93 was observed. In fact, during the month of March, price volatility attached to Bitcoin saw a cautious approach from several investors; however, the aforementioned data would suggest that many moved huge amounts of Bitcoin to account for their losses.