This key market sentiment indicates this about Bitcoin’s trajectory

If one were to choose one word to define Bitcoin and its price movement over the past few weeks, it would be Persistence.

With the cryptocurrency’s valuation showing no signs of stopping since October, Bitcoin hinted at a price reversal after it dropped down to $15,800 on 14 November. While the crypto’s price was back up to $16,390 at press time, BTC should be expecting more corrections going forward. In fact, according to Skew, bearish sentiment has already started to take shape on the charts over a week of Futures trading.

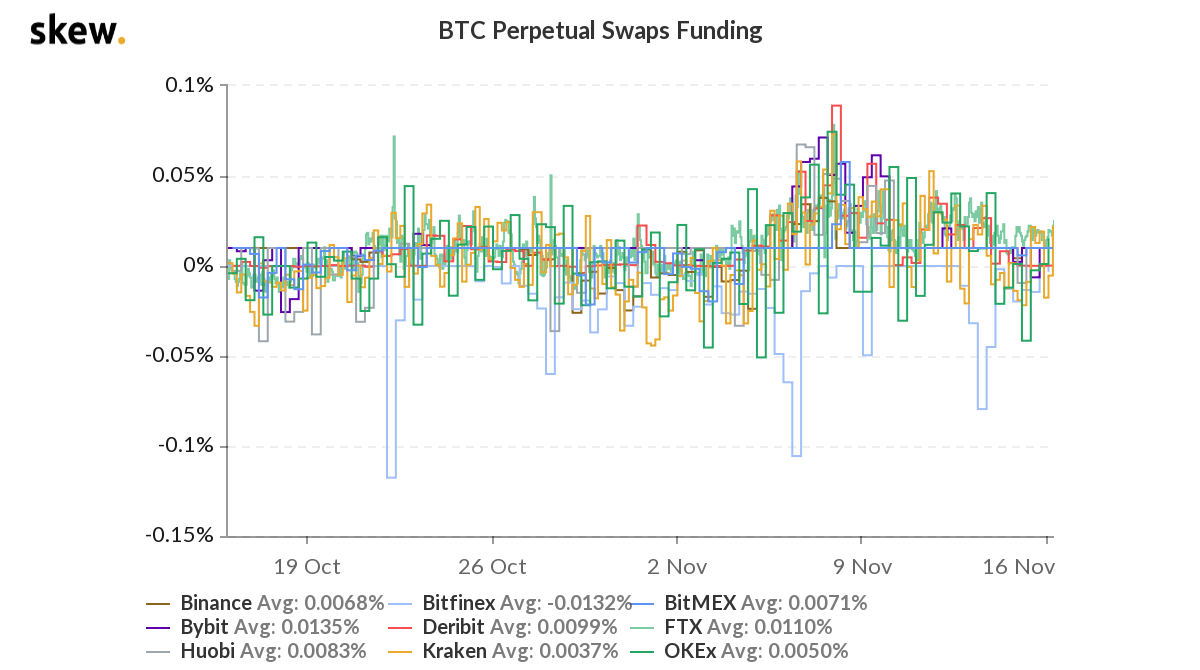

Bitcoin Funding Rate has dropped

As can be observed from the chart attached herein, the Bitcoin Perpetual Swap funding rate on collective exchanges took a massive slump after Bitcoin clocked in at $16,480. A funding rate is determined by the number of people expecting the market to rise and fall. When the funding rate goes down, it means more people are shorting the market, in comparison to longing. While such a shift in momentum can be considered regular, it is essential to note that it was exhibited right after the price hit a new high for 2020.

What this means is that the market is slowly starting to account for the long-awaited recovery period. Traders are getting a little nervous about Bitcoin’s rise since the crypto-asset hasn’t seen such an extended bullish turnaround since 2019.

While it is certainly possible that Bitcoin might hit a new high before registering a drop, the signs clearly point towards an inevitable drop.

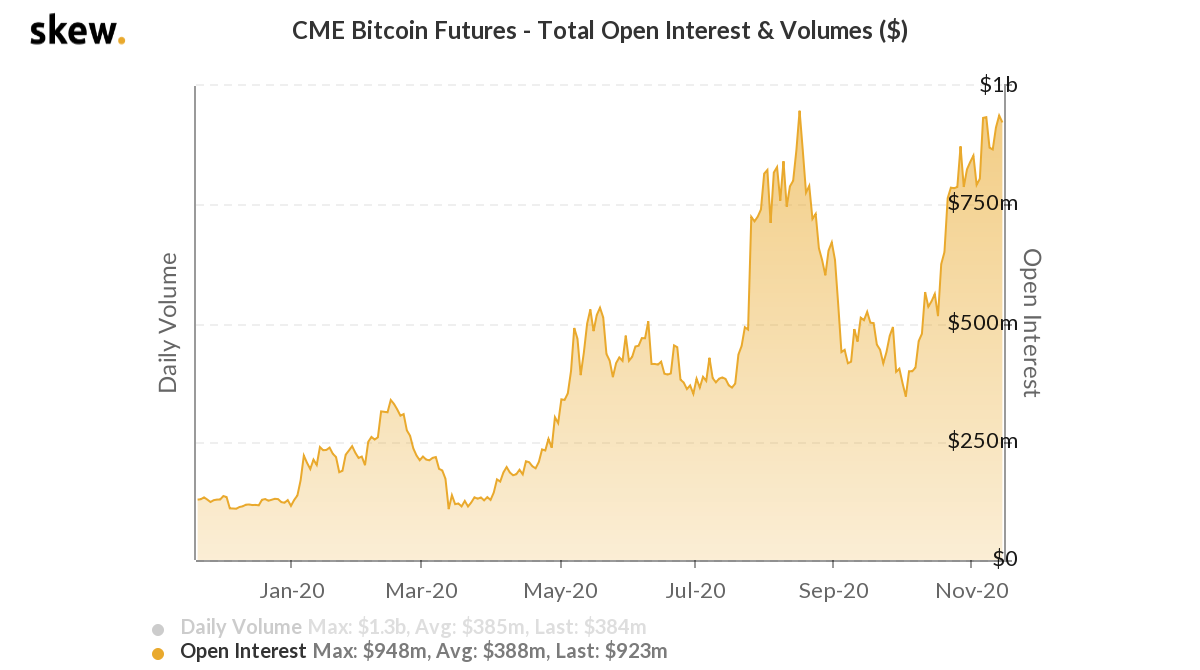

CME’s Open Interest return to ATH range

With Futures trading on retail exchanges taking a minor dip, CME’s Bitcoin OI noted a return to an all-time-high range. The Open Interest climbed to a high of $928 million, right towards the end of the trading week on 13 November. Institutions and high net worth individuals have been active in the space over the course of the price hike. It will be interesting to see if the OI continues to rise over the week.

While institutions have been one of the positive factors for Bitcoin in 2020, its impact hasn’t carried the price forward during a recovery. The current price movement might be proving that statement wrong at the moment. Bitcoin’s institutional end might get used to absorbing liquidity when the retail side is facing a sell-off.