Bitcoin halving and a 37% hash rate drop: Will the price pull through?

With less than 17 days remaining for third Bitcoin halving, it is time to take another look at the state of miners, especially after the recent price plunge. The hash rate has changed, the difficulty has been adjusted and hence, the pre-existing narratives around halvings have also changed. And from the looks of it, the halving did favor the bears. But, since fundamentals have faced a radical shift, examining how the miners’ health would shed light on how the halving will proceed.

Half of a half (of a half)

Bitcoin, the first cryptocurrency, introduced the concept of ‘halving’ wherein the rewards for miners are effectively cut down by 50%; this is to ensure the coin issuance is on track and the inflation is controlled. However, halving is much more than that; there are economic aspects to halving that make it much more eventful, especially with respect to what follows after a halving.

A 50% reduction in block rewards induces a negative supply shock and this will push the price higher, provided the demand doesn’t fall. The first two halvings observed price surges due to halving anticipation. However, after halving, the price would dip a little but would continue to surge and usually head into a bull run hitting new highs.

The third halving, however, is different, simply due to the fact that the adoption of Bitcoin has surged, especially since the 2017 peak; adoption, not just in terms of mainstream media for speculative purposes, but also in terms of institutional investors and the technical aspects of the Bitcoin ecosystem.

Superposition

Additionally, Bitcoin’s third halving has caused a heated debate on whether the halving is priced in or not. Let’s assume it has and it hasn’t, a state of superposition where it is true and not at the same time. The half that argues that halving is priced in refers to the June 2019 surge, a time when Bitcoin hit $13,800, whereas the other half refers to Bitcoin’s downfall since June 2019.

Speaking to AMBCrypto, Poolin’s VP, Alejandro De La Torre said,

“The halvening is a significant event in mining. Most mining farms have been upgrading their mining rigs since the new generation of miners came out. In other words miners have been working on the halving situation for more than a year now. Miners have also been moving their operations to other areas of the world where electricity is cheap… But this has been happening precisely because of the coming up 50% reduction of the bitcoin block reward”

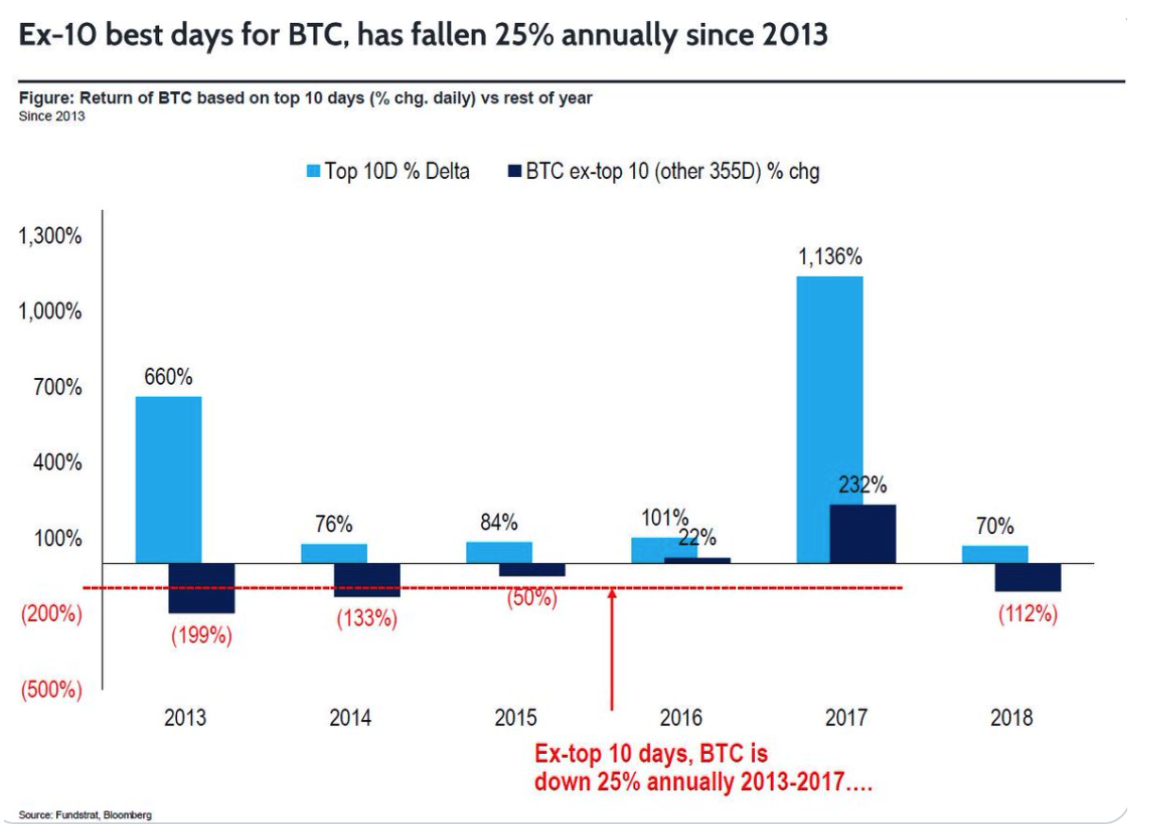

It really doesn’t matter if halving is priced in or not because Bitcoin’s “magic” needs only 10 days or so. According to Fundstrat’s Thomas Lee, a meager 10 trading days each year have historically accounted for substantially all of Bitcoin’s returns. Additionally, the deduction of Bitcoin’s 10 best days from each of the past five years would cause BTC to be down by 25% per year, instead of being up by 2,000%.

Additionally, the price drop from 8 March to 14 March came as a shock due to two reasons; the first because the drop was very close to halving, the second was the timing of the drop, which took place while the equity markets plunged as well.

Source: BTCUSD TradingView

The second reason makes a world of difference since Bitcoin’s outlook for investment was that it was an uncorrelated asset with the equities market. Hence, this changed everyone’s perspective on the ‘uncorrelated narrative’ of Bitcoin.

Adding more to the changed narrative, Thomas Heller, Global Business Director of F2Pool, commented,

“Compared to the halvings of 2012 and 2016, there is much more awareness from the wider bitcoin community about the May 2020 halving, so it’s possible that we won’t experience such a strong bull run as before.”

Heller continued that the “bitcoin price is very unpredictable” and he believed that there would be “a general bullish trend between now and December 2020”.

Furthermore, owing to the positive correlation with the stock market, in addition to the aforementioned points, the narrative around Bitcoin has definitely changed. Hence, the narrative around halving has also changed.

To understand more about the nature of the third Bitcoin halving, it is necessary to take a look at the miners who are the lifeline of the Bitcoin community.

State of Miners

Since the rewards that Bitcoin miners earn are denominated in BTC and their expenses are denominated in USD, the miners are a constant source of selling pressure. Each day, a total of 1800 BTCs are produced by miners and hence sold, and at the current price, it would easily create a ~$12 million selling pressure.

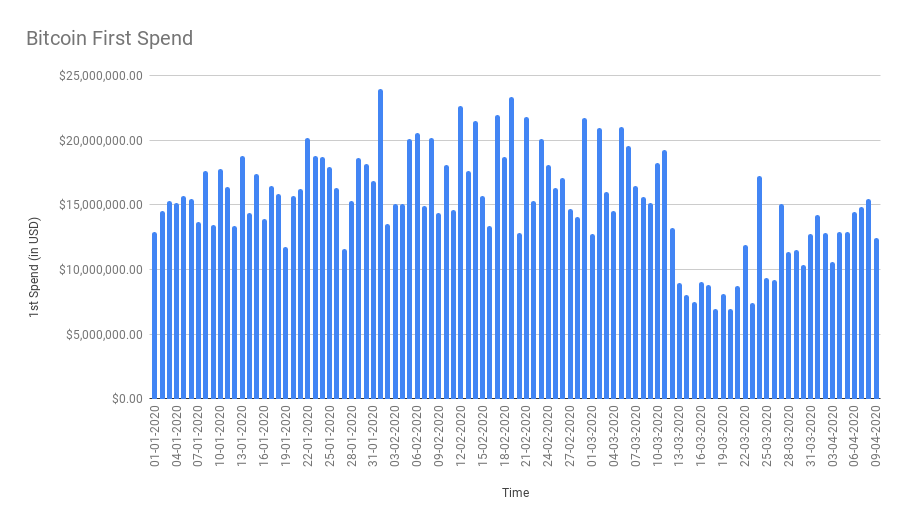

First of all, spend is a metric that measures the outflow of BTC from miner wallets and when there is a huge outflow of BTCs, it represents miner panic sell-off.

Source: Bytetree

However, an interesting observation is that the BTC outflow during the March sell-off was minimum. In fact, the first spend reduced and created a record low for 2020. This indicated that the miners did not panic during the recent sell-off and that many actually bought the dip.

Source: BTCUSD TradingView

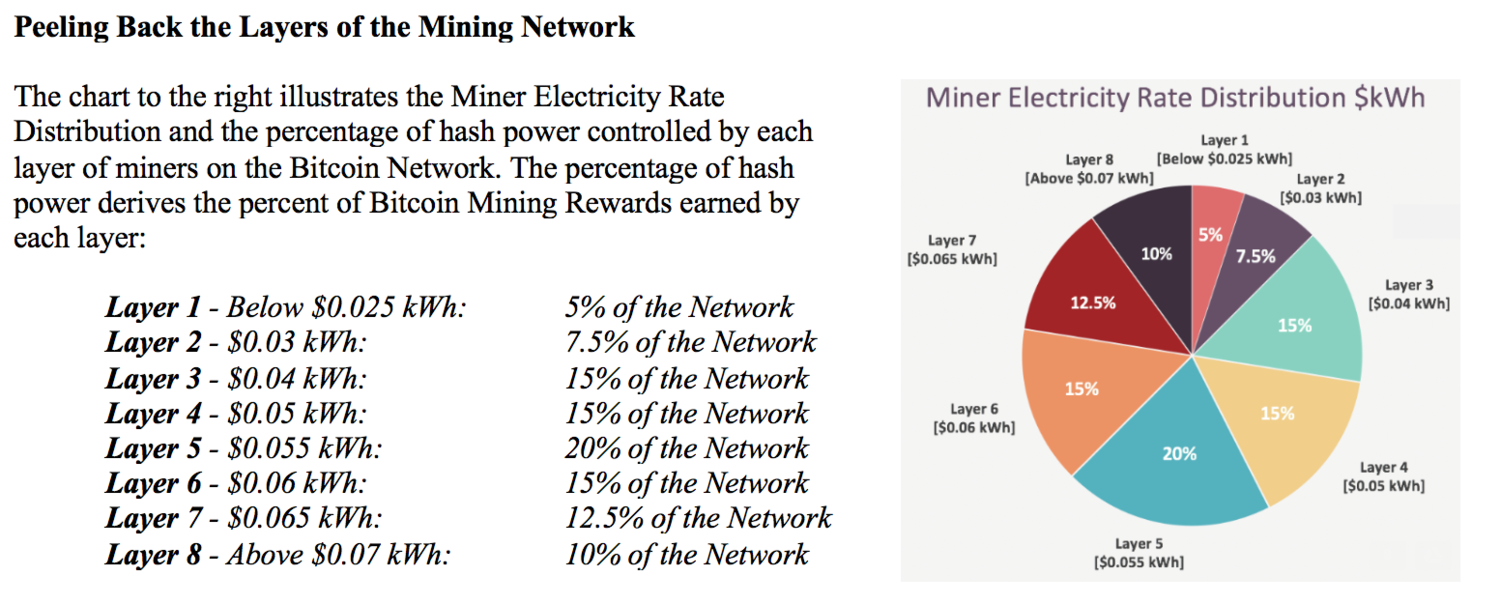

In the attached chart, it can be seen that the hash ribbons are below the zero-line, indicating that not all miners are profitable. The only miners who are profitable are the ones with cheap electricity costs since electricity constitutes about 95% of the operational expenses for a miner. Based on this, Blockware solutions classified miners into 8 divisions.

Source: Blockware Solutions

To make things interesting, miners with low electricity costs and updated mining rigs would not only be the most profitable, but also have a lower break-even price.

According to the same, a miner with electricity costs below $0.025 and an S9 mining rig would have a break-even price of $2,568. However, a miner using the same rig with electricity cost above $0.07 would have a break-even price of $9,631. Hence, the recent drop not only let the hash rate drop but also had a major difficulty readjustment and this could have hurt the miners with older mining rigs and higher electricity cost.

Hence, if the price of Bitcoin continues to stay at the current level [$6,800 to $7,300], then these miners would probably have to throw in the towel, while miners who can withstand losses until the price rises would be okay.

What do the miners need?

1 BTC = $10,000

For the next halving, for miners of every layer to be profitable, the price of Bitcoin would need to be above $10,000. For this range, however, the miners in layer 8 would need to sell 96.3% of their BTC to cover the costs. Overall, the miners must sell 39.12% of BTC mined [$211 million] and hence, the hodlers and buyers need to match this $211 million selling pressure to keep the price from falling.

1 BTC = $7,500

For this level, layers 6, 7, and 8 would operate below break-even price of $7,704, $8,346, and $9,631, respectively. This would mean that 53.8% of all the Bitcoin mined need to be sold to cover the operational expenses. Here, the selling pressure remains at $211 million due to a fall in BTC price.

1 BTC = $5,000

For this level, layers 4 through 8 are all operating at a loss and these layers in total account for 14.25% of the total hash rate. The selling pressure of miners increases from 52.15% to 69.60% at this level and is at $187 million.

Hence, the lower the price dips, the more miners operate at a loss and are forced to shut off the rigs. As for the hash rate, the 50% plunge in price caused the hash rate to reduce by 31%; however, since the drop, the hash rate has recuperated from 85 EH/s to 116 EH/s.

Talking about more miners needing to shut off their mining rigs due to lower prices, Heller added that if the hashrate and difficulty remained the same without an increase in BTC’s price then, “it’s very possible we would then see a decrease of around 20% of the network hashrate” as inefficient miners would have to turn their older machines off.

“These machines and hashrate would eventually (over the course of the following months) find it’s way to other regions around the globe with significantly cheaper electricity.”

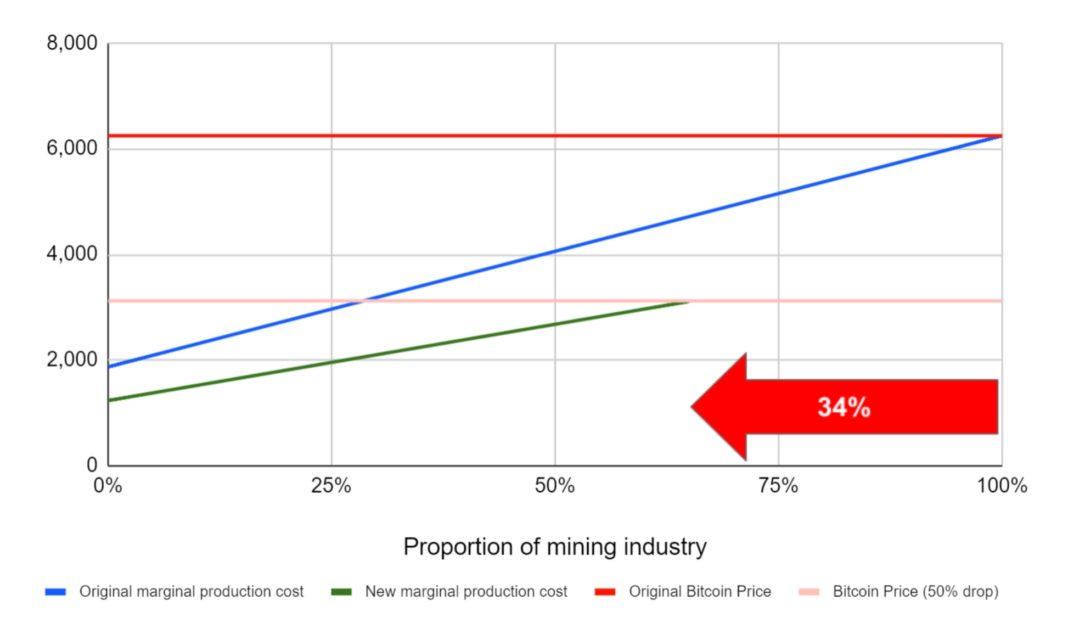

For the approaching halving, since the rewards are going to be reduced by half, BitMEX research estimated the hash rate to drop by 34%, almost equivalent to the level seen during the recent crash. Accordingly, the price based on this cost curve would put a new marginal cost of production for Bitcoin in the vicinity of $3,100.

Source: BitMEX Research

All of the above assumes that when the hash rate drop occurs, the miners will be rational and will keep mining until the difficulty adjustment, and that the price of Bitcoin doesn’t change.

Combining the number of miners that would be operating at a loss and the hash rate decline after halving, it would be safe to assume that 3rd halving would take a huge toll on the miners, especially those with higher electricity costs and older mining rigs. However, as mentioned above, if those 10 magic days of Bitcoin push the price drastically, as it did in April 2019, it would be a win-win situation for both miners and retail.