Everything seems to be on the up and up. Vegeta memes are back, Bitcoin is giving gold a run for its money, and Twitter has added a Bitcoin hashflag. It’s only a matter of time that the five-figure fold is revisited, institutional investors certainly seem to think so.

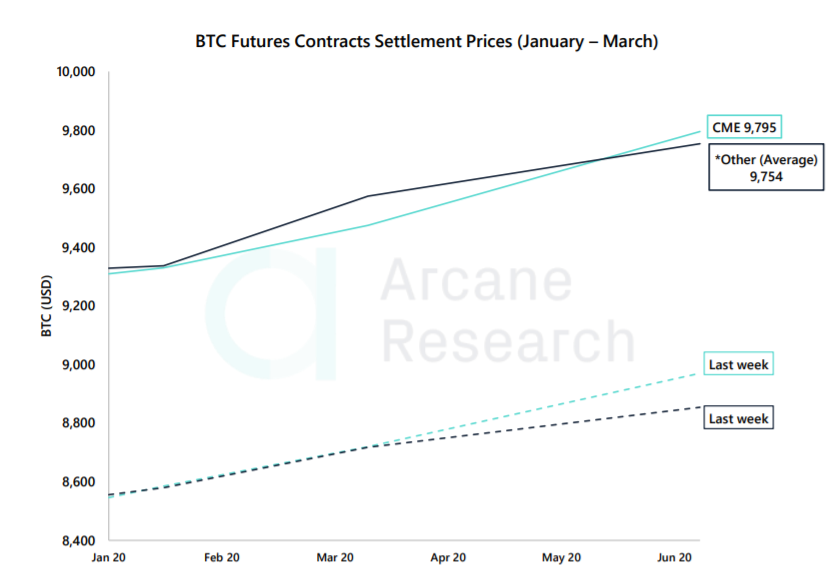

According to a recent report by Arcane Research, the premium on Bitcoin Futures contracts traded on the Chicago Mercantile Exchange [CME] has been on a rise, now at over 5 percent. Even as the premium on other unregulated exchanges [Kraken, BitMEX, Deribit, and FTX] are still locked in the 4.5 percent range.

It’s important to note here that these premiums pertain to the contracts expiring in June 2019, after the much-anticipated Bitcoin halving.

Source: BTC Futures Premium, Arcane Research

The industry is divided on whether the effect of the halving is priced in or not. With the reduction of block rewards down to 6.25 BTC per block, the price is pegged to rise to balance out the decrease in mining incentives. The question of – has this effect already been incorporated into the current price of Bitcoin or not – is the crux of the debate.

While Bitcoin, in the long-run, is slated to rise, even in the eyes of the institutions, thanks, in good measure to the halving effect, the short-run price action is less bullish.

The report also highlighted the increase in BTC premiums for contracts expiring in March has dropped. As recorded during the last week of January, the premium was 1.77 for trades on the CME, while on the other unregulated exchanges, the premiums were still over 2.5 percent.

In contrast to the previous week the bearish signs mount. In the previous report, the premiums on the March contracts on CME’s coffers were over 2 percent, while unregulated exchanges saw lower premiums. A switch has unfolded in the ensuing week.

On the other hand, premiums on contracts expiring in June show consistent incline on a week-on-week basis for both categories.

Source: BTC/USD, TradingView

A major reason for the increase in premiums on the longer-term is the consolidation of the price of Bitcoin. Last week’s breakage of $9,000 [the third coming of Vegeta] in a month, saw Bitcoin break out of a bearish channel persisting since Bitcoin reached its 2019 high of $13,800 in June and overcome its 200-day MA.

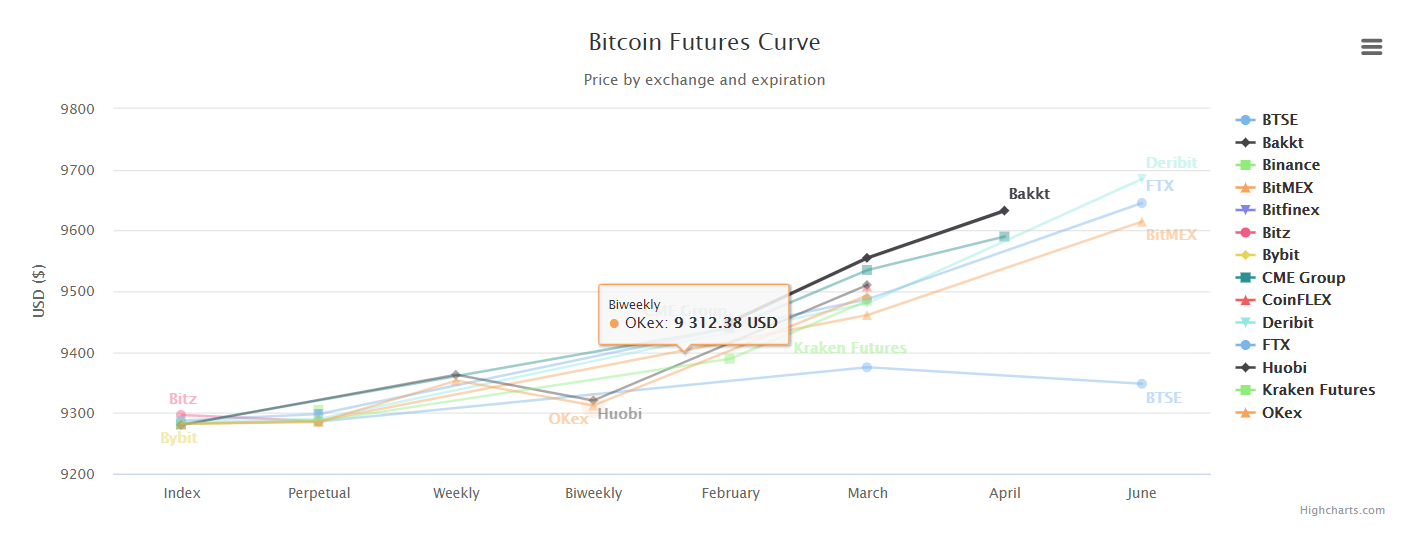

Looking at the picture for a wider perspective more insights can be drawn. Most exchanges move in cohesion on the weekly and biweekly contracts front but diverge soon after.

Source: Bitcoin Futures Premium, Austerity Sucks

In March, for instance, CME and Bakkt, the two top regulated exchanges [with starkly varying volumes], have the highest premiums by far, with the contracts priced around $9,500. Going forward, Deribit, FTX, and BitMEX overtake the regulated-duo, with the price closing in on $9,700.

Other notable movements were seen in the premiums for OKEx and Huobi, both catering to the Chinese markets. For the two exchanges premiums drop from weekly to bi-weekly and pick up as the expiry period increases.