Bitcoin, Ethereum Options suggest surge in price soon; halving effect in play?

Both Bitcoin and Ethereum Options have seen their realized volatility [RV] decline, while their implied volatility [IV] is on the rise as well. Combining these metrics with others, it can be noted that the price of Bitcoin and Ethereum might be due for a surge in the near-term.

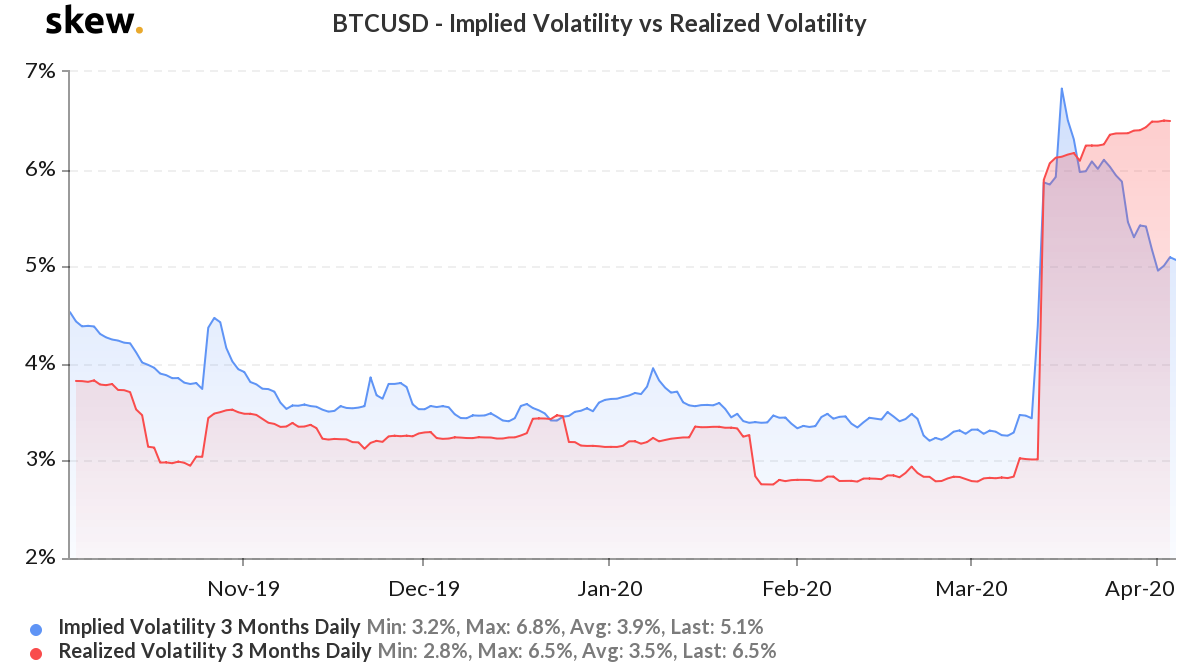

Implied volatility v. Realized volatility

Source: Skew

Implied volatility is a measure of the volatility of the markets in the near future ie., it is the forecast of a likely movement in a security’s price. As seen above, the 3 month IV was on a decline after the 50% fall of BTC from 9,000 to $4,500. While the IV was on a decline, the RV was on the rise, indicating more volatility than implied. The same was the case with Ethereum as its IV was on the decline, while the RV was rising.

This rise in RV was directly related to the price rise that was happening with Bitcoin as it was trying to successfully breach the $7,000 level. Furthermore, the approaching halving might also be forcing the age-old narrative of the price rising before the halving.

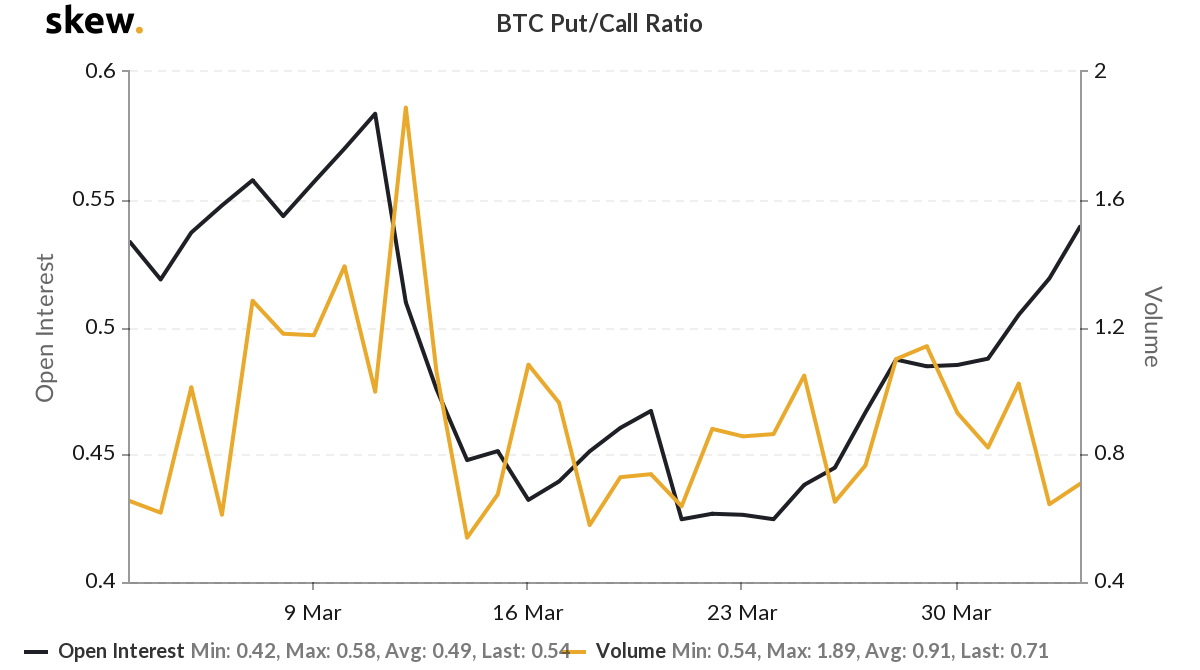

Additionally, for Bitcoin, the Put/Call ratio was on a decline, highlighting that the Puts [sell] were reducing while the Calls [buy] were on the rise. This was also a sign of institutional sentiment on the buy-side.

Source: Skew

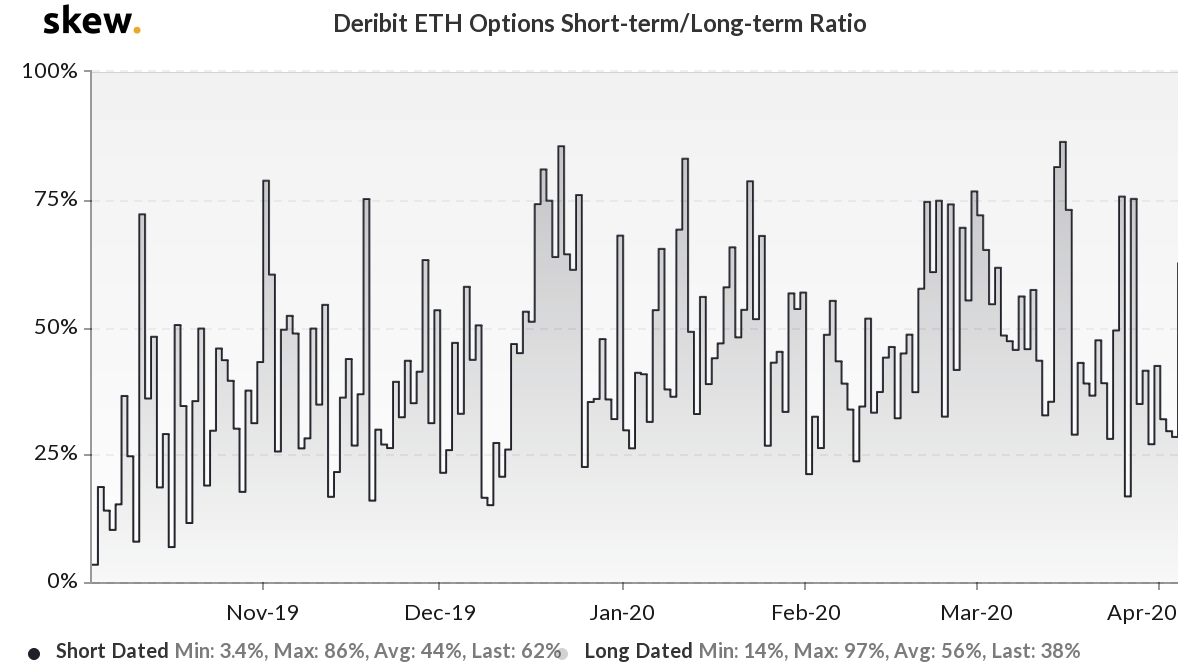

For Ethereum, however, the percentage of short-dated Options [SDOs] has been on the rise, while long-dated options [LDOs] were declining.

Source: Skew

The previous article explained how SDOs’ rise could predict a rise in Bitcoin’s price.

“This correlation is due to the investors wanting to profit on the king coin’s short-term price movements; hence, they opt for short-dated Options instead of long-dated Options which have a higher risk-to-return ratio.”

Hence, for Ethereum too, the IV’s decline and RV’s rise is in line with the SDOs’ rise, thus implying that the price might rise in the near future. Furthermore, the fast-approaching Bitcoin halving does have an associated narrative wherein its price is expected to rise right before the halving. Hence, even the halving narrative fits perfectly with the surge in RV, implying a surge in both the price of Bitcoin and Ethereum.