Bitcoin: Are prediction models stuck in an echo chamber?

Bitcoin could potentially be the biggest success story of our generation. In the past decade alone, it has enabled the rise of an entire industry, one that rivals modern civilization’s greatest institutions. No longer is crypto considered mere ‘Internet money,’ one that only has relevance among tech enthusiasts and likes of the cypherpunks. Today, it’s seeing growing interest from Wall Street and the powerful corridors of institutional and traditional finance.

Do price models help Bitcoin’s identity crisis?

Interestingly, over the past few years, Bitcoin has slowly but surely cemented itself as one of the most robust forms of long-term investments. In fact, one of the key drivers of investor confidence in Bitcoin has been the growing clarity in crypto-regulations to suit the digital age of finance. However, a shift from being primarily a means of exchange to a store of value has had serious implications for the cryptocurrency, the most notable being the growing popularity of prediction models.

Bitcoin prediction models have gained renewed interest lately. While seemingly headline grabbers, among them, the Stock to Flow model seems to dominate user interest the most.

As a store of value, Bitcoin has had to compete with monetary metals like gold. While opinions are often very polarising for gold-bugs and crypto-enthusiasts regarding which asset the future belongs to, the S2F model has shown that both Bitcoin and gold share common strands of DNA as both propagate scarcity as a driver of value.

S2F and Bitcoin – Gold rivalry

While gold is a natural resource that exists in limited quantity, Bitcoin has emulated the same principle via its code. Its 21 million hard cap ensures that its stock to flow ratio will compete with that of gold and may even be well-positioned to overtake that of gold in the coming years.

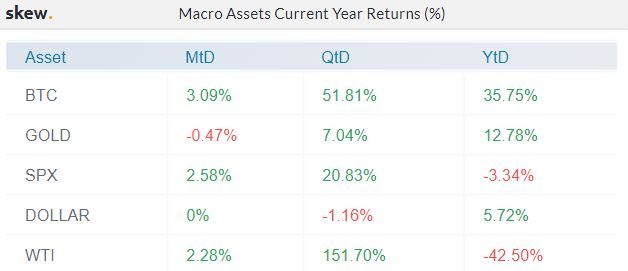

Source: skew

Taking 2020 as an example, despite its shortcomings, in terms of returns, Bitcoin seems to have trumped gold and interestingly, Bitcoin’s higher volatility may have actually helped out here.

For new users who are looking at Bitcoin as a store of value, models like the S2F provide scenarios that are extremely lucrative.

Models like S2F have become very crucial agents that drive the longer bullish narrative for Bitcoin. The very fact that the price has stayed true to the model’s predicted pattern shows that historical precedents are on the side of Bitcoin as it journeys to the $100k mark.

Source: Digitalik

However, over the past few weeks, conversations around Bitcoin have been mostly around whether or not the king coin will breach the $10k resistance. While S2F parades Bitcoin as the asset that will be valued at $100k in a year or two, the coin is currently struggling to realize 10 percent of that projected value.

This creates dissonance. Critics argue that S2F proponents need to go beyond historical precedents and take into account the different variables that may have an effect on Bitcoin’s price, and not be limited to just the scarcity narrative. In fact, a recent report by Messari had highlighted that,

“S2F proponents need to provide underlying reasons for why such a causal relationship would exist. Pointing out historical correlation between bitcoin’s price and its S2F is not enough.”

Source: BitPremier

For example, if one were to take a look at Bitcoin’s volatility, in the past year alone, it is fairly evident that Bitcoin can rock the boat quite furiously.

Are prediction models caught up in an echo chamber?

While financial models do get things wrong, what is interesting to note is that with the S2F, the fact that previous price actions have abided to its rules makes many Bitcoin maximalist and investors extremely hopeful of the model’s success. In fact, in the months since PlanB revealed the dynamics of the model, the $100k target seems more like a promise than a prediction, at times, like when the $10k mark poses significant resistance.

Introducing the (FF) Whale Model! ?

This quantum analysis model uses dozens of statistical modeling, measurement, and research to predict #Bitcoin's future price.

It forecasts the bottom in 2021, then the start of a bull run in 2022.

RETWEET AND LIKE! ?? – #WhaleModel pic.twitter.com/apArMSCGYQ

— Whale ? (@CryptoWhale) June 2, 2020

Interestingly, a new quantum model for Bitcoin’s price was in the limelight at the start of the month, one that painted a totally different narrative for the king coin. Unlike the S2F, the Fermisions Flows (FF) Whale model supposedly uses quantum analysis to predict the future price of Bitcoin. It noted that for Bitcoin, a near-term price slump is plausible before it bounces back to ATHs in the coming years.

The dissonance between this model and other models like the S2F once again highlights how various price models take different aspects and base their predictions on those aspects alone. Generally, they don’t account for other factors and aspects that might come into play, making them very skewed and very faulty.

Any model, whether it is the S2F or a lesser-known one, if it must offer insight into Bitcoin’s price performance in the years to come, must be beyond the sum of these individual parts and should be a product of a myriad of variables such regulations, macro-economic catalysts, scarcity, correlation with traditional markets, etc.