Bitcoin advocate: Halving tests miners’ potential but ‘does not result in centralization’

Bitcoin’s third halving is seven days away and halvings usually create a Darwinian pressure of ‘survival of the fittest’ among miners. Many speculate that large miners who can bear the heavy electricity expenses will knock the small miners out of business during this event.

Interestingly, in a recent podcast, Bitcoin advocate Andreas Antonopoulos echoed a different opinion. He believed that halving tests the potential of miners adapting to the environment, it certainly does result in centralization. He stated,

“Darwinian evolution is the survival of the species that has best adapted to its environment. So, the most adaptable miners will survive but I don’t think it centralizes things.”

Antonopoulos noted that the environment during the halving event is not the only factor that decides who’s better, as per the natural selection process. If looked at it this way, oil prices saw a massive drop recently and this has indeed affected miners in the countries where oil is the primary source of electricity. Noting that the major competition lies in getting the cheapest form of energy than procuring better ASICs, Antonopoulos stated,

“Now most of the pressure is on source price of electricity and operating efficiency. And that means infact that the having could together with a low oil price decentralize mining by giving an advantage to miners outside of China.”

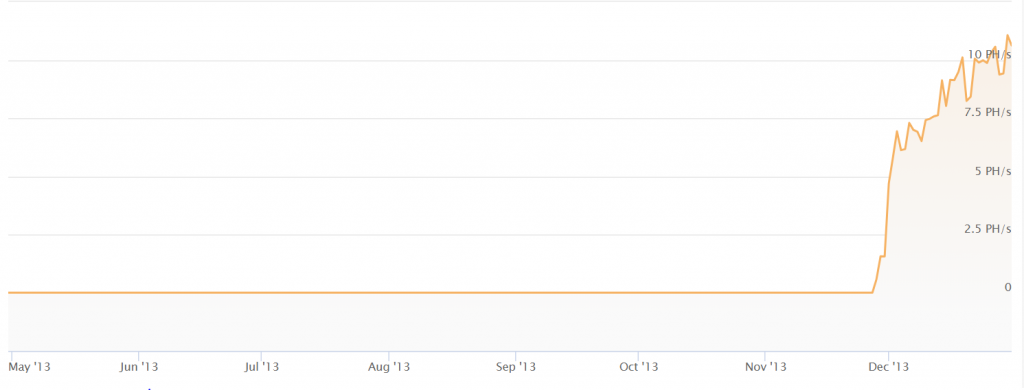

Will the halving change the economics of mining so that it’s no longer profitable, except for ASIC machines or customer hardware? In 2013 when ASICs were first introduced to Bitcoin mining, hashrate had increased in such a rate that GPUs became pretty much obsolete.

Source: BTC Hashrate Chart 2013, coinwarz

New and more efficient ASICs produce more hashes per watt and this increases the difficulty rate. Thus when hashrate goes up after a period of 2016 blocks and the difficulty readjusts, it gets more difficult to mine Bitcoin as small miners can’t bear the electricity expenses with GPUs and FPGAs and previous generations of ASICs. Commenting on the same Antonopoulos stated,

“As your competitors install the newer, denser, more efficient ASIC equipment, you find your equipment is no longer profitable to run because it costs more in electricity than the Bitcoin you were producing and you turn it off. This has been the case since the very beginning. Mining profitability is thus determined by the mining equipments your competitors have.”