Binance Futures records 85% month-on-month across perpetual contract markets

2019 recorded a slew of developments in the derivatives market. The size and accessibility of crypto-derivatives have prompted this space to post some staggering figures.

According to the latest edition of Binance Research for the month of January, the volume on Binance Futures recorded an increase of 85% month-on-month, with $56 billion traded across its perpetual contract markets.

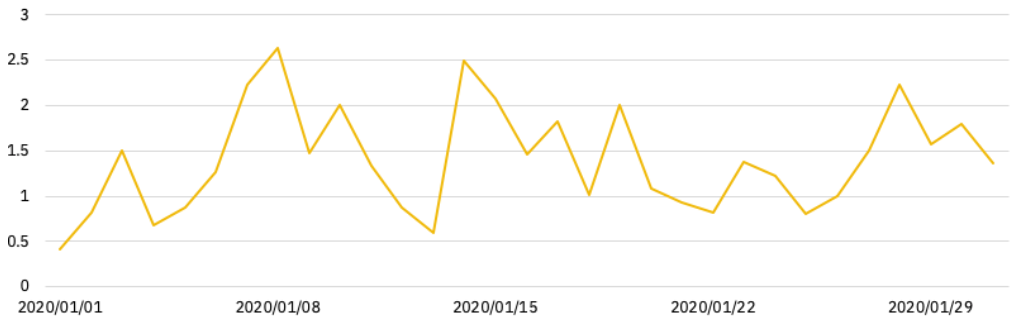

Source: Binance Research | Daily volume traded on BTC/USDT’s perpetual contract [in USD billion]

The research report further said,

“During the month, Binance Futures displayed a daily average of $1.7 billion worth of contracts traded.”

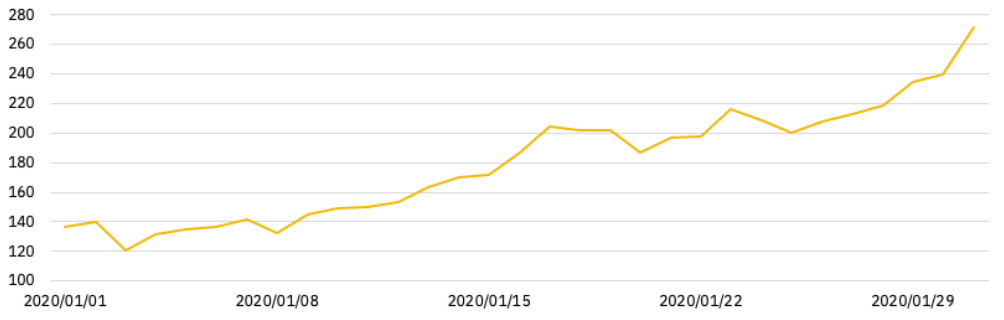

Additionally, Binance Futures saw its Open Interest spiking as well. Open interest reached the $200 million mark, a level that it has successfully retained since.

Since the start of the year, Open Interest on Binance Futures increased from $137 million to $271 million as of 31 January, i.e an overall increase of 98% was recorded.

Source: Binance Research | Total open interest in perpetual markets in January [in USDT million]

Besides, Open Interest across altcoin perpetual markets on Binance’s platform have collectively appreciated from under USDT 20 million on 1 January to USDT 75 million. This implied an expansion of more than 250% in a single month.