Binance Coin, VeChain, Monero Price Analysis: 25 August

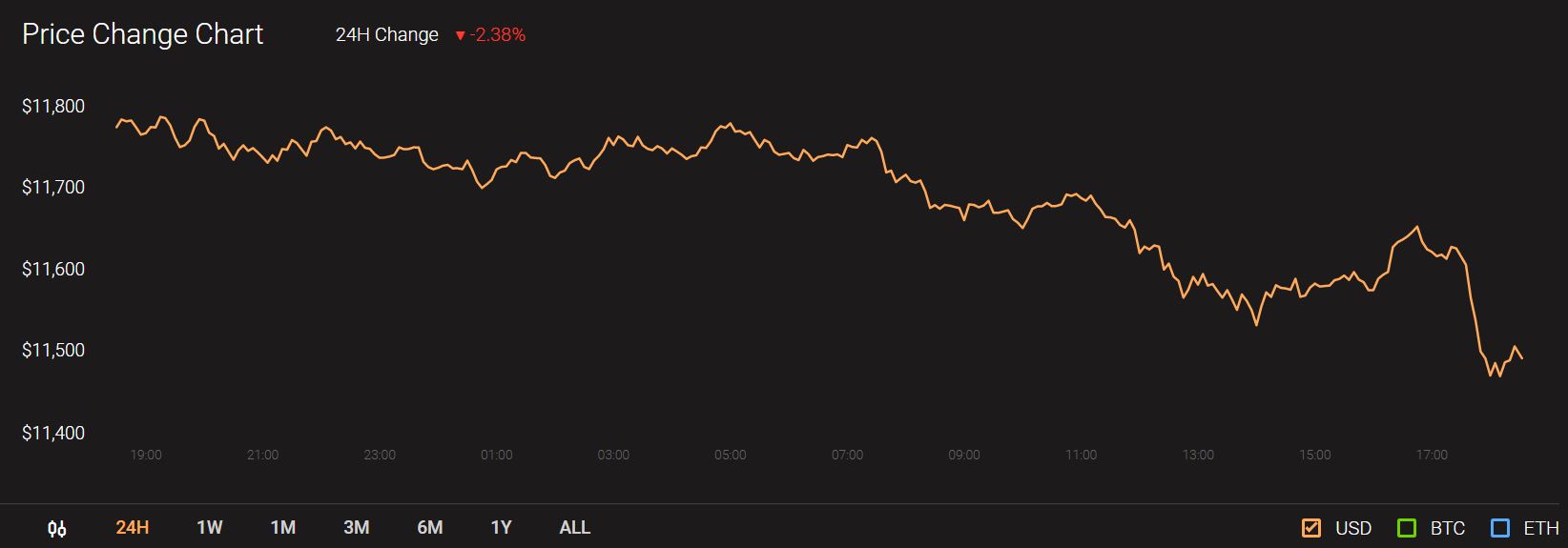

In the long-term, multiple metrics seem to suggest Bitcoin will command a price in the 6 figures. However, short-term analysis saw Bitcoin fail to break past $11,800 and could be set to drop back to $11,300.

Source: CoinStats

The major altcoins also show some indecision and bearishness. Binance Coin indicated a possible drop of almost 10% over the next few days, and Monero could be set to register a similar loss in value. VeChain did not exhibit a strong trend but indicators pointed toward a downside.

Binance Coin [BNB]

Source: BNB/USDT on TradingView

Binance Coin dipped briefly beneath support at $22, before surfacing above it. It was trading at $22.45 at press time. MACD indicated a buy signal.

However, BNB has been bouncing off support region $22, each bounce having a lower high than the last. Unless BNB forms a higher high, it could indicate the coin is primed for another slide in value to find support at $20.

Binance Coin had a market cap of $3.24, placing it in the top 10. For a couple of days, BNB had below-average 24h trading volumes, suggesting many traders and investors are waiting for the market to decide on a direction.

VeChain [VET]

Source: VET/USDT on TradingView

VeChain was ranked 23rd with a market cap of $988 million. Recently, VeChain officially launched an initiative to empower green businesses, called “Blockchain-enabled Sustainability Solution.”

VET was another coin forming lower highs and set in a short-term downtrend. It has support at $0.0178 region. Directional Movement Index showed a lack of a strong trend. While -DMI (pink) rose, APX (yellow) did not rise above 20, which is a value APX usually stays above during a strong trend.

Even a weak bearish outlook can push VET downward, with the next important level at $0.0159.

Monero [XMR]

Source: XMR/USDT on TradingView

Monero exhibited choppy action over the past few days. It failed to hold on to $105, instead cratering to find support at $90. Subsequent attempts to move upward were met with strong selling pressure.

20 SMA (white) crossed below 50 SMA (yellow), indicating short-term bearishness. Parabolic SAR also gave a sell signal. On the low time-frame, a candle has to close above the past couple of days’ highs at around $94, before the short-term bearish outlook for XMR can be questioned.

If price closes beneath $90 support, we can expect a drop of 10-15% in the coming days.