How Binance looks well-set to navigate post-CZ era

- Despite outflows, liquidity on the exchange wasn’t significantly impacted.

- Binance’s troubles allowed entities like Bybit and Coinbase to expand their market.

One of the largest Web3 ecosystems, Binance [BNB], settled its legal disputes with the U.S government last week by agreeing to pay a $4 billion penalty and undertaking measures that improve its compliance with the local laws.

The event also resulted in the exit of former CEO and one of the most popular faces in the industry – Changpeng Zhao (CZ).

While these events did create panic, there was no evidence of a damaging impact on the market’s near-term prospects at the time of publishing.

In fact, market bellwether Bitcoin [BTC] scaled the $38,000-level since these developments went public, AMBCrypto observed using CoinMarketCap’s data.

The continuation of bullish momentum implied that the most anticipated event in the market – the approval of spot Bitcoin ETF applications by the U.S. Securities and Exchange Commission (SEC) – wasn’t in danger. This was illustrated in a recent report by crypto market data provider Kaiko.

Binance seems OK

As far as Binance’s own empire was concerned, the crypto behemoth did witness an exodus of funds as the news went public.

As per AMBCrypto’s scrutiny of DeFiLlama’s data, $2.74 billion in net outflows were recorded since 20th November. This was the day when news of the resolution was first reported by Bloomberg.

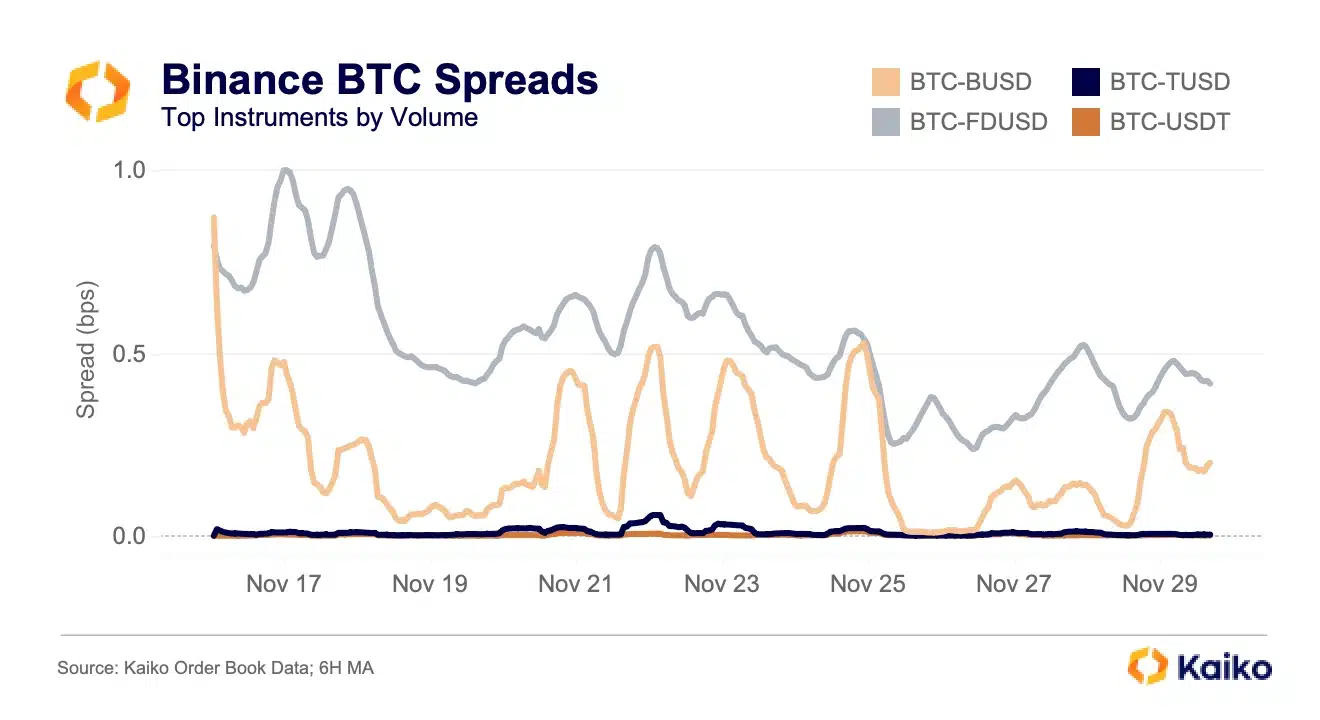

However, by no means did this result in an acute liquidity shortage on Binance, evidences put forward by Kaiko showed. Spreads for top BTC pairs on the exchange have dropped significantly after spiking in the initial days of the episode.

As one would expect, an exchange spread is the difference between the price the seller is asking, and what the buyer is willing to pay. Typically, an asset with high liquidity has a lower spread and vice versa.

Smaller players emerge but Binance still the king in the market

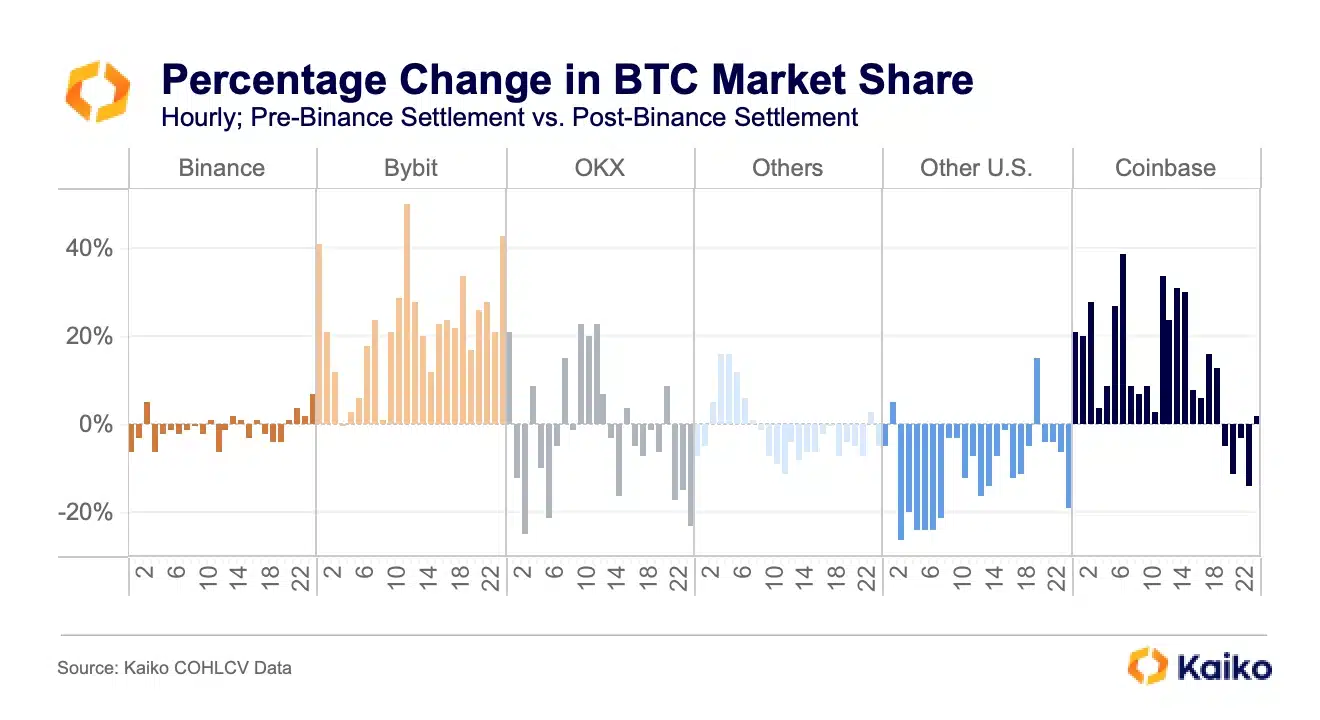

Being the world’s largest crypto trading platform, even a normal dip in Binance’s market share could create big opportunities for some of the smaller players. This is exactly what happened.

What seemed like a small change of 4% for Binance, resulted in a massive 50% increase in Bybit’s share, and 34% for Coinbase.

As shown below, Bybit recorded market share gains in all the UTC hours, emerging as the biggest beneficiary of Binance’s troubles. Ironically, the largest crypto exchange in the U.S., Coinbase, recorded higher market share during non-U.S. trading hours.

“All told, Binance has ceded some market share to Coinbase in non-U.S. hours and Bybit across the board,” Kaiko noted in the report.

It was reasonable to conclude that the events of the previous week strengthened competitiveness in the centralized crypto trading market. However, not nearly enough to challenge Binance’s dominance.

BNB gets timid response from traders

The ecosystem’s native crypto coin BNB suffered a major dent due to the episode. As of this writing, the fourth-largest crypto asset was trading at $228.94, still down more than 12% from its pre-settlement levels.

AMBCrypto analyzed BNB’s price chart using CoinMarketCap and found a considerable drop in trading volumes over the last 10 days. The slowdown in trading activity indicated investors’ continued skepticism.

The developments also impacted BNB’s derivatives market. Open Interest (OI) in BNB futures trended lower after an initial spike, as per data fetched by AMBCrypto from Coinglass.

The initial surge was more short positions getting opened. In fact, for most of the last few days, the number of bullish-leveraged positions have trailed the bearish ones.

However, as BNB’s price started to plateau, traders betting on further declines abandoned their plans. If BNB starts to consolidate around the current levels, a further drop in OI could be on the cards.

Binance marches on

Meanwhile, putting the past behind, Binance announced a major deal that could bridge traditional finance with the crypto market.

How much are 1,10,100 BNBs worth today?

Dubbed as the world’s first cryptocurrency triparty arrangement, Binance’s institutional clients would be able to hold collateral with a third-party bank in the form of fiat equivalents such as Treasury Bills.

The collateral would provide an additional yield-generating revenue for institutional investors.