After Bitcoin’s halving, is the supply shock going to rescue price yet again?

Bitcoin is to undergo its third block reward halving in 3 weeks’ time and speculation is rife with regard to the halving’s impact on various stakeholders. At the start of 2020 – the halving year, most investors expected strong bullish sentiment, however, the past few weeks demonstrated that Bitcoin cannot be confined to pre-determined narratives.

In the latest episode of the Funky Crypto podcast, John Kim of the Litecoin Foundation discussed the upcoming halving event, its implications and the significance of such an event for the king coin’s future. At Bitcoin’s current price point, the block reward halving may come as a difficult change to get used to among the miner pool, Kim noted that,

“After the halving a lot of the miners turn off their machines because they’re not profitable anymore. And then the difficulty adjustment happens and it becomes profitable again and people turn the machine back on and start mining again.”

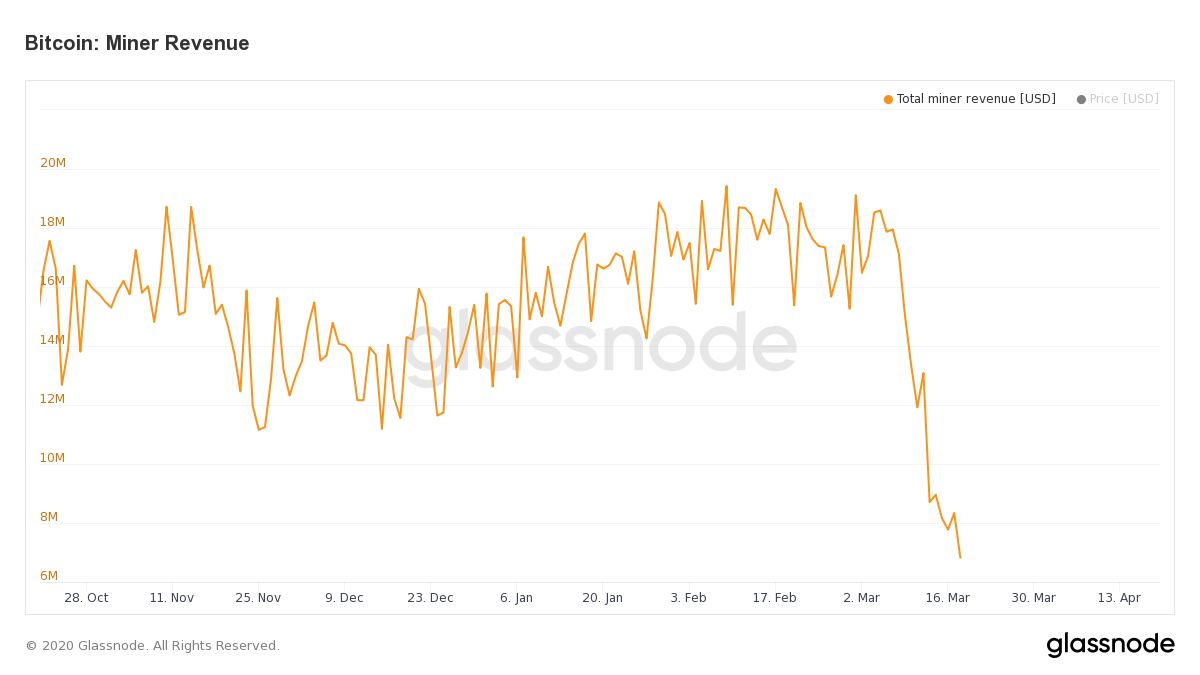

Source: Glassnode

Such a scenario is extremely likely as Bitcoin miner revenue in the past 6 months has dropped significantly according to network data from Glassnode.

Kim noted that previous halvings have led to an initial drop but after around 150-180 days Bitcoin has seen its value surge and gain momentum in the market. He added,

“Because the supply shock happens and the price starts shooting up because supply is cut in half and demand continues to rise the price must catch up. So that’s what happens. ”

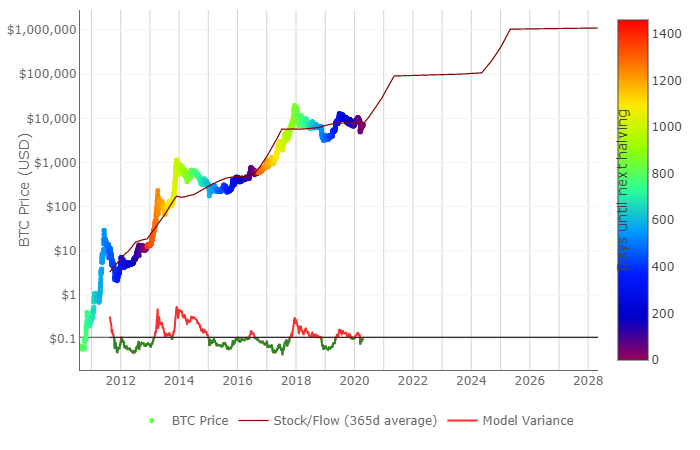

The Stock to Flow model projects that Bitcoin’s value is likely to reach the $100k mark in over a year’s time and this has become a key argument used to reassure many in the ecosystem who are worried about’s recent price action and the upcoming halving. Kim argued that the $100k projection is more on the ‘conservative side’.

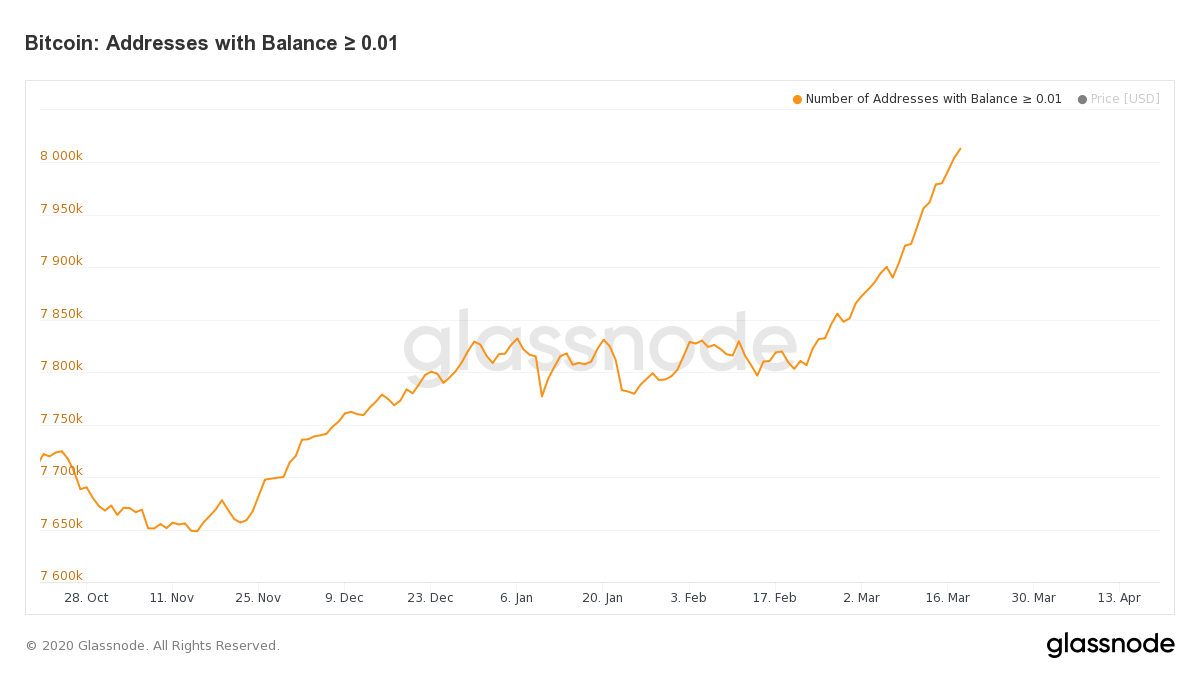

Source: Glassnode

Interestingly as the market prepares for the halving, Bitcoin has seen a surge in active addresses holding 0.01 to 0.1 BTC. This could be a positive sign for the king coin and may also give a glimpse of the predominant sentiment in the market.