Bakkt’s Bitcoin Futures volume drops by 65% on the back of latest expiry

Growing institutional interest has been a driver for Bitcoin’s price since July 2020. However, in what is being termed as the bull run of the season, other drivers of growth such as increasing liquidity, demand by new buyers, and Bitcoin’s volatility on spot exchanges, are also rearing their heads.

For Bakkt, institutional interest has contributed to a surge in Bitcoin Futures volume. As a regulated crypto-derivatives exchange that offers physical settlement in a speculative cryptocurrency market, Bakkt’s market share has steadily risen on the charts.

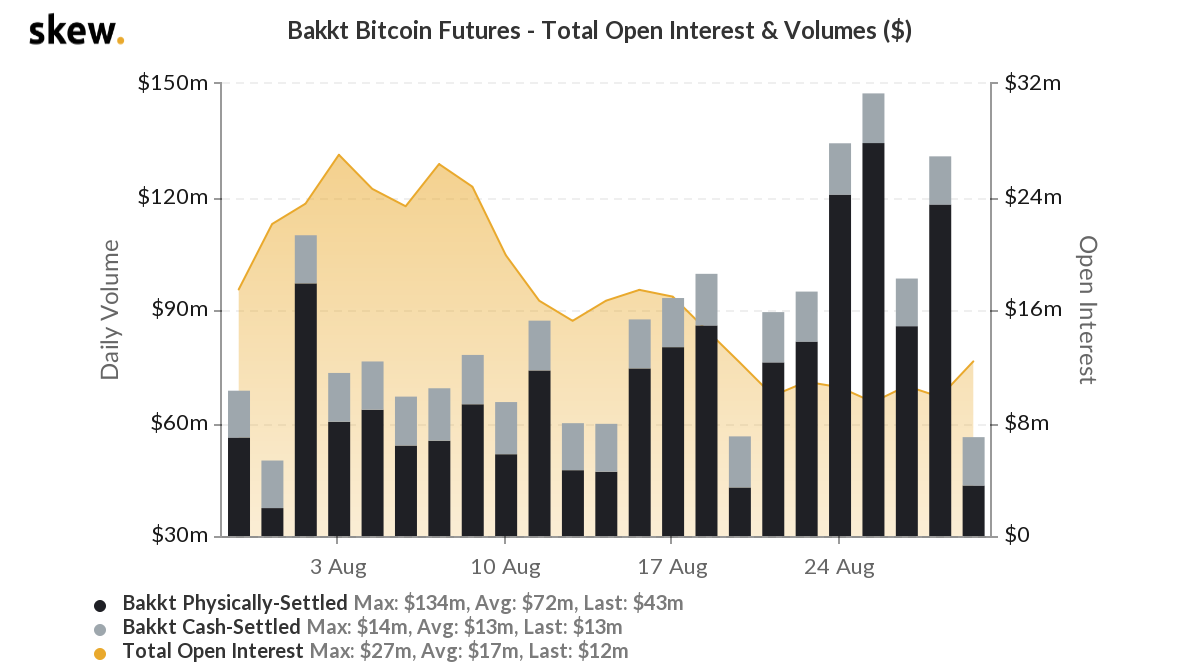

In August 2020, Bakkt’s daily Bitcoin Futures volume was consistently above $50M, with the figure even hitting $100M quite a few times. However, the recent expiry of $150M worth of Bitcoin contracts contributed to a drop of over 50% in the total volume of Bitcoin Futures on the platform.

Source: Skew

A drop in the volume of Bitcoin Futures points to bearish sentiment for traders on derivatives exchanges. However, compare this to BTC/USD for more insights.

Here, it must be noted that Bakkt Bitcoin Futures expire on the last Friday of the contract month.

Key Insights,

- In June 2020, Bakkt Bitcoin Futures contracts expired on 26 June 2020. There was a price drop of 10.7% from the start of the month to the last Friday, while there was a drop of 7% in the week preceding the expiry.

- In July 2020, Bakkt Bitcoin Futures contracts expired on 31 July 2020. However, there was no noticeable price drop on spot exchanges. This can be attributed to the rally in Bitcoin prices that started on 27 July 2020.

- In August 2020, Bakkt Bitcoin Futures contracts expired on 28 August 2020, and there was a drop of 7% from the highest point in the month and a 3% drop within a week, preceding the expiry in question.

Source: TradingView

From the listed insights, the trend that emerges is that the expiry of Bitcoin Contracts may lead to a price drop of 3-7% on spot exchanges. However, increasing volume and new demand may influence prices, following which, the drop in question may not emerge to be as significant.

In September 2020, Bakkt Bitcoin Futures Contracts are expiring on 28 September 2020. If the volatility in Bitcoin’s price drops, the price may be directly influenced by expiring contracts. There may be a drop of 3-7% in Bitcoin’s price on spot exchanges, in the week preceding the expiry of these contracts.