Are Chain-LINK marines betting on a big move?

Chainlink’s tale in 2020 is quite a story. From being valued at $1.35 on 13th March 2020, the asset witnessed an unprecedented rally to $20. Recently, the coin dipped below $13 for a brief period but since then, the asset has bounced back to $15.60 at press time.

Swarmed by its newfound popularity in the market, it rose through the rankings; many analysts were widely skeptical about the coin’s future prospects.

Fair to say, not everyone was completely sold on Link’s development and its astounding rally. However, Santiment had some positive indicators lately.

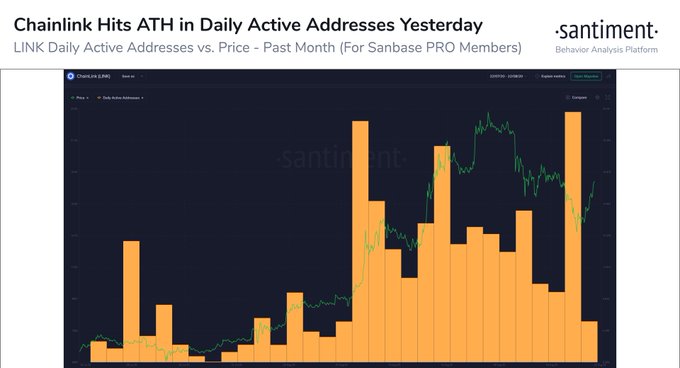

The data analytics platform suggested Link had surpassed an all-time high in terms of daily active addresses on 23rd August, and its price recovery indicated the formation of a ‘classic bullish divergence’.

However, in spite of the bullish signs, the recent recovery was perceived as a ‘dead-cat bounce’ pattern, which is suggestive of a temporary hike that is caused by speculators buying in order to cover their market positions.

Is there credit due, or does it not deserve it yet?

A tricky dilemma scenario considering the collective market conditions, Link’s major criticism at the moment is coming from its alliance with DeFi. Many suspected that Link’s price is currently running wild in the markets due to DeFi’s influence and factually, the assessment is not far off.

Other than that, Zeus Capital had recently revealed that 70% of the total LINK supply is currently held by only 9 whales, which is also indicative of the kind of monopoly that might be ongoing behind the scenes.

However, the mentality of the LINK Marines could be considered as another major factor for LINK’s current price performance.

Regardless of whether LINK is going to dump in the future or not, present hodlers are of the idea that they have been profitable while holding onto their LINK. This creates a psychological edge in their minds; ‘LINK Marines’ have a proven record of registering a profit and their optimism might be making them cling to their holdings at the moment.

The dead-cat bounce explained above is a classic example. Investors believed that rather than selling for profits, LINK’s decline presented them with another opportunity to buy in, and accumulate more, hence the price entertained a minor recovery.

These investors might be hoping for another re-test at $20 since the market has been overall bullish since March even though there were bouts of recovery and stagnation.

The jury’s out on LINK’s future

It is difficult to point towards one narrative at the moment because against all odds LINK is surviving at the moment. Over time, it could easily become another case of pump and dump. For now, it is still engaging in high trading activity, hoping to realize another bullish pump in the charts.