Chainlink whales make waves: Is a surge on the way?

- Chainlink whales held over 8% of the Supply on Exchanges.

- LINK maintained a bull trend as of press time.

Chainlink [LINK] whales executed strategic maneuvers before a notable price surge. Have there been any significant actions from these whales lately, and what is the current status of their transactions?

Chainlink whales go in big

As per a recent Santiment report, Chainlink whales engaged in substantial accumulation activities before witnessing a surge in the token’s price. The chart indicated that these whales initiated the accumulation process around the 17th of October when the price was approximately $7.

During this period, whales amassed over 40 million LINK tokens. With the accumulation, the total tokens held by the leading addresses increased from around 693 million to over 736 million.

Also, at the time of this update, the cumulative volume held by these addresses stood at around 741 million. According to CoinMarketCap, the total supply of LINK at press time stood at 1 billion.

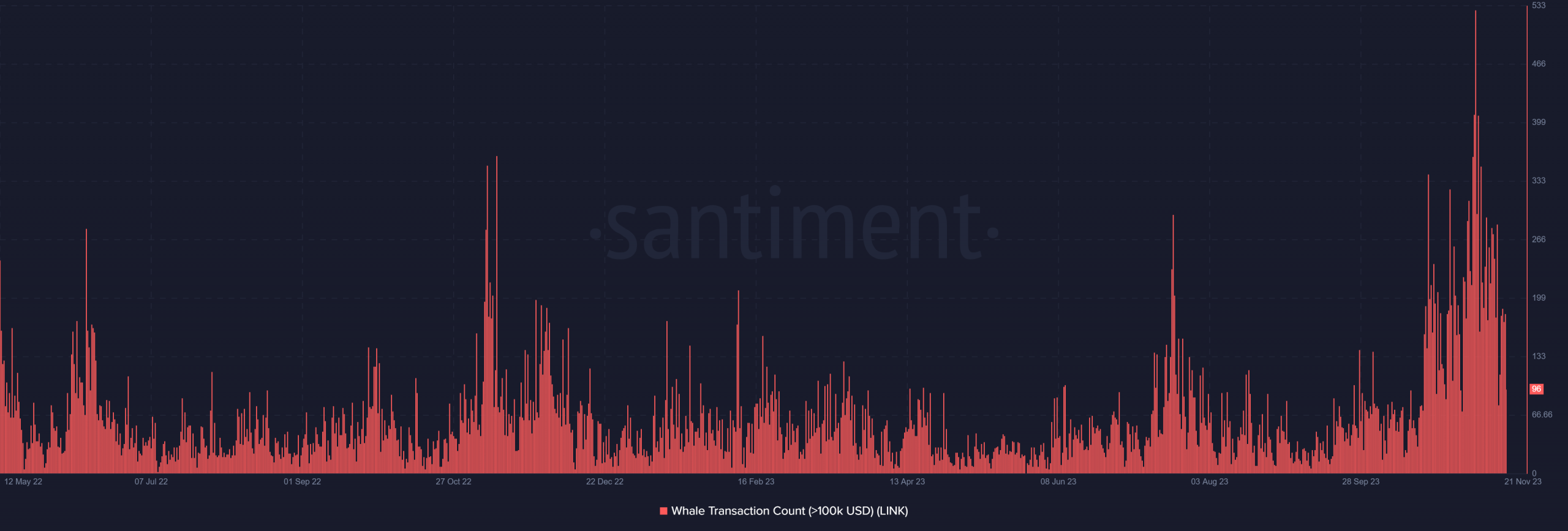

Chainlink whale transactions pick up steam

An examination of Chainlink’s whale transactions, involving $100,000 and above, revealed an uptick in activity towards the end of October. Before this period, transaction numbers remained below 100, with only occasional spikes.

However, starting around the 23rd of October, there was a notable increase in the number of transactions. By the 9th of November, the transaction count exceeded 500, marking the highest observed in over a year.

As of press time, the number of transactions stood at around 96.

Although it may have decreased, this figure remains elevated compared to most of the year. The significance of these indicators lies in the fact that LINK experienced a surge in high-volume transactions during this period.

LINK maintains a $14 price range

At the time of this update, LINK‘s price was being corrected. A review of the daily timeframe chart revealed an initial surge of over 8%, suggesting a parabolic movement.

Subsequently, there was a 2.9% decrease, bringing the price to around $14.4. The decline continued, with a further reduction of over 1%, resulting in a press time trading price of about $14.2.

Read Chainlink’s [LINK] Price Prediction 2022-23

Despite this decline, the asset remained bullish, supported by indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD).

As of the latest data, the RSI was above 50, and the MACD was above one. However, it was notable that the bull trend exhibited signs of weakening in response to the ongoing price decline.