Bitcoin in for more despair than delight

Even with Bitcoin trading in a tight range for the past two months, expectations of a Bitcoin push over $10,000 are bleak in comparison to the drop from this point forward. Going by the pricing of futures and options contracts from now till the end of 2020, the cryptocurrency is not seen in the best of light.

According to a recent report from Ecoinometrics, the next phase of Bitcoin’s 2020 outlook is two-fold. Firstly, the optimistic expectation is the accumulation of positions between the $8,700 to $9,000 range, as traders foresee more “sideways price action.” Secondly, and on the pessimistic side, Bitcoin “breaks out to the downside.”

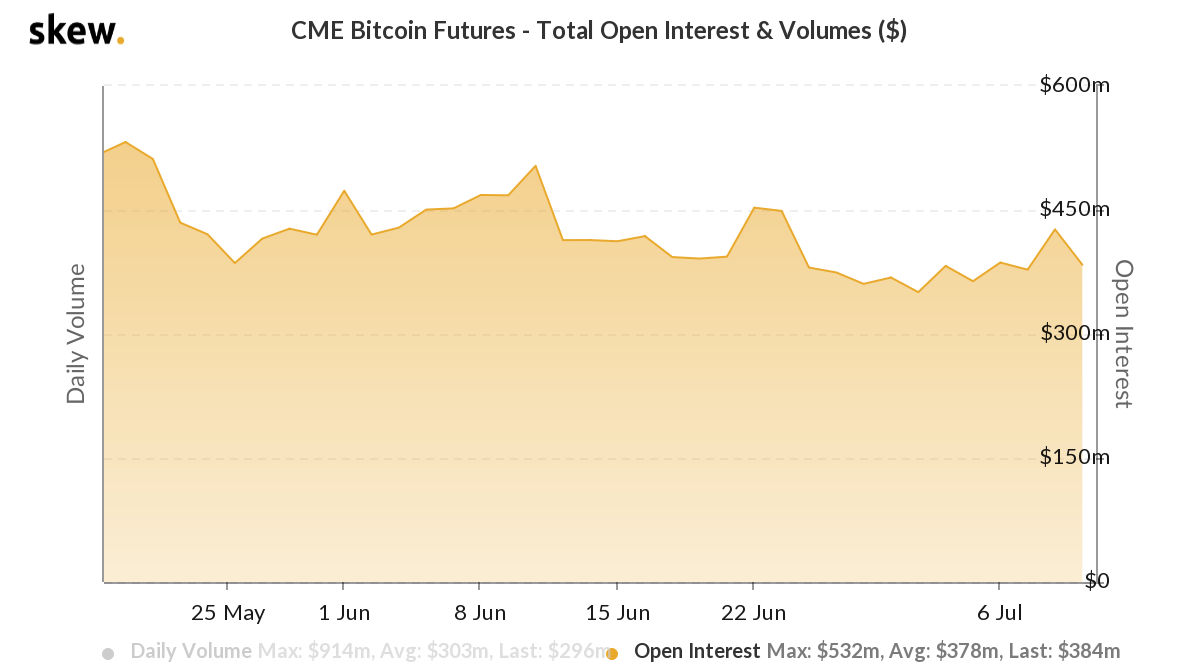

Going by these two pathways, the first would require open positions to increase, which would have to be differentiated between an “accumulation phase” i.e. positions in the aforementioned $8,700 – $9,000 range, and a “real capitulation” phase i.e. traders closing positions expecting a drop. In the past two months, since the tight-range trading began, the open interest on CME Bitcoin Futures has dropped from its ATH of $532 million to the current value of $378 million.

CME Bitcoin Futures open interest | Source: skew

The second outlook is “the sentiment straight to despair,” with Bitcoin dropping to the lows of close to $6,000 to $7,000, or even closer to the March 2020 level. If this more pessimistic future were to be realized, the report gave the following piece of advice,

“Regardless I’d see that as an opportunity to buy the dip. Trust me, you never have enough cheap sats in your wallets.”

Now that the paths are laid out, the sentiment of the traders in the market bears introspection. The report, citing the latest CME Commitment of Traders [COT] report suggested it pointed to “a path to despair.”

As laid out earlier, the OI on CME Bitcoin Futures has dropped by 28.94 percent, which looks worse compared to how the two most ardent class of investors are looking at Bitcoin. The “smart money” or the institutional investors are “very much net short” while the retail traders despite being long Bitcoin are slowly changing their tune, 50 percent of retail long positions have dropped from 2500 max net long, to 1250 at press time. The report stated,

“Less open positions together with the long positions fading away at a high rate is the path to despair.”

While this does mean the bullish sentiment is all but dead, looking at the CME Bitcoin Options data, the “story it tells isn’t bearish.” While the Bitcoin call options, or contracts to buy Bitcoin have been decreasing over the past month, there is no rush to buy put options, or contracts to sell Bitcoin.

According to the report, this means that traders don’t expect a lot of money to be made if Bitcoin drops. And on the upside, there is a decent cover i.e. 13 call options to every put. With very little concrete expectation of which way Bitcoin will move, traders aren’t jumping to bet on Bitcoin, or for that matter, better against it. In fact, traders are still maintaining their mild bullish expectations of Bitcoin rather than replacing it with bearish expectations. But some are still going short, as is evident from the falling OI.

Well, what does this mean for the market? It means that Bitcoin’s stability is not a bearish sign, but it is decreasing the bullish expectations that it accumulated during the April-May recovery period. And until a market-move does happen, traders won’t compile positions. The report concluded,

” So they are just sitting there waiting for something to happen. And isn’t it what we are all doing at the moment?”