Bitcoin’s perfect network demand score might not necessarily mean a bull market

For weeks leading up to Bitcoin’s halving, a common narrative that was advocated well by the ecosystem was the improvement in Bitcoin’s on-chain fundamentals. After the price regained its momentum following the crisis in March, the improvement in Bitcoin’s on-chain metrics was in fact, almost unavoidable.

However, over the past week, the aforementioned bullish momentum has somewhat faded. On the contrary, according to Arcane Research’s latest market update, a particular metric has continued to register growing demand across Bitcoin’s network.

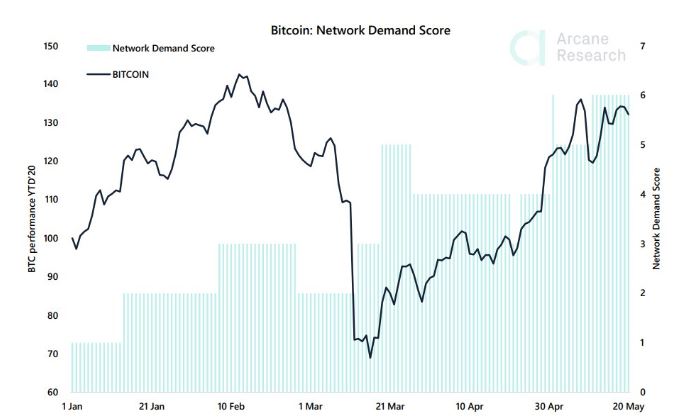

Source: Arcane Research

Now, according to the attached chart, Bitcoin’s Network Demand Score noted a perfect 6/6 score, 2 weeks after the halving event, implying that the network has grown stronger and might possibly embark on a long-term bullish run in the future.

However, there was something contrasting to be noted between certain on-chain metrics, at the time of writing. The chart below highlights that the active transaction count continued to fall since the conclusion of the halving event, implying that fewer people were using the blockchain.

Source: ByteTree

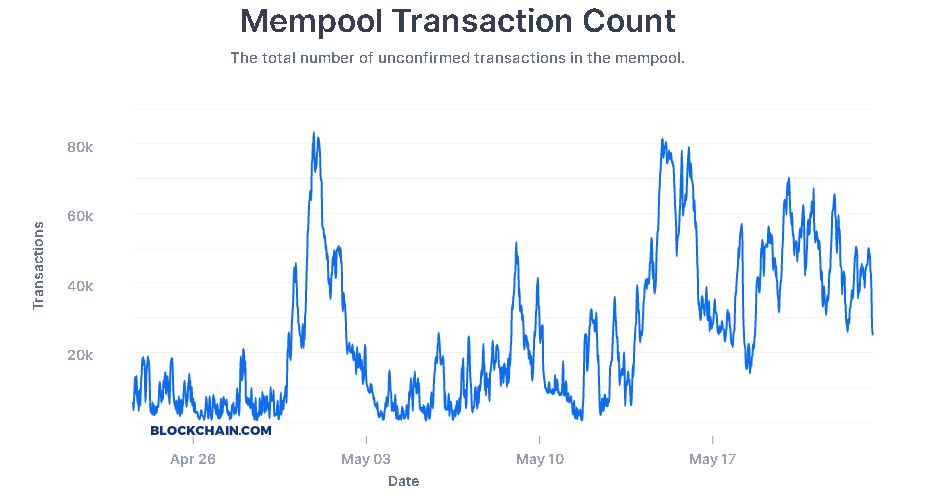

Source: blockchain.com

Similarly, a decline can also be registered in the mempool transaction count. A decrease in mempool transaction count implied that the number of unconfirmed transactions was going down. Drop-in unconfirmed transactions indicated that the network was suffering from lower congestion at the time of writing, when compared to the heightened activity that was noted during the first week of May.

A lack of clarity between price and on-chain demand?

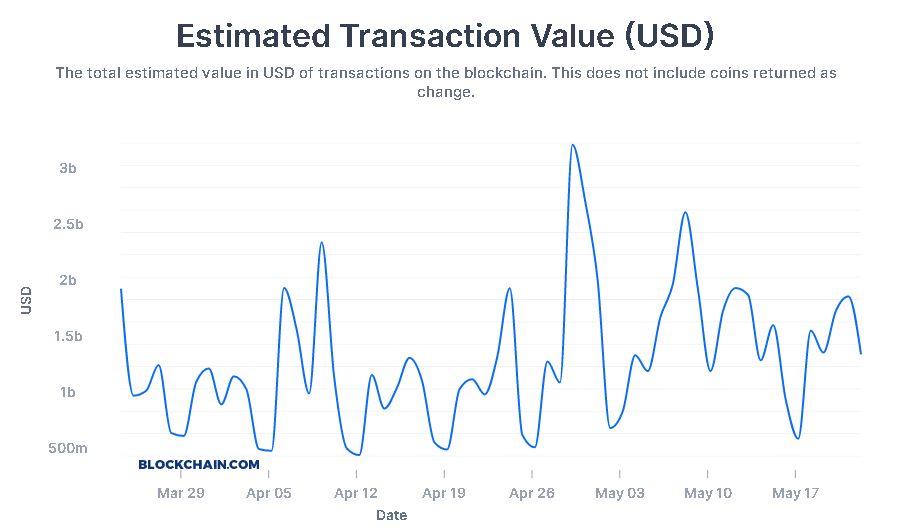

Source: blockchain.com

Now, the report suggested that on-chain demand is evaluated on the basis of metrics such as transaction value and miner’s rolling inventory. On analyzing the chart from blockchain.com, it can be seen that the transaction value from 23 April to 22 May did not change drastically.

However, the network on-demand score on 24 April was 3/6 for Bitcoin and at the moment, it is 6/6. Such contradicting data may beg the question that the translation from improving on-chain demand to bullish action in Bitcoin’s price might not be as seamless as it seems.

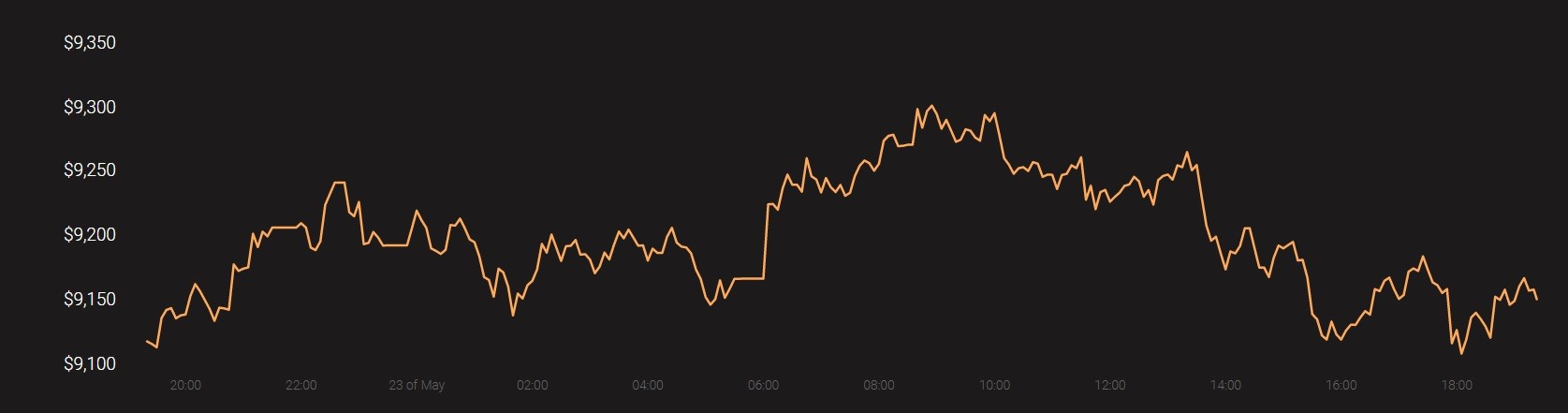

At the time of writing, Bitcoin was priced at $9,152 with a 24-hour trading volume of $13.8 billion.

Source: Coinstats