Bitcoin to turn bullish longer than Ethereum, speculate Options traders

Options, in the cryptocurrency world, have altered the markets, both in the here-and-now, and going forward.

Bitcoin, teetering at $8,600 for the third day in the row, amid pandemic fears, tearing down traditional markets looks to rise back quicker than its peers. The king cryptocurrency, closed out the month with negative returns, following a hugely prosperous January, but that is looking to change.

According to data from skew markets, the majority of options contracts traded on top derivatives platforms Deribit and OKEx, which together hold over 95 percent of the options volume, is on the bullish side. Both in the long term and the short, derivatives traders are estimating a rise in price rather than a fall.

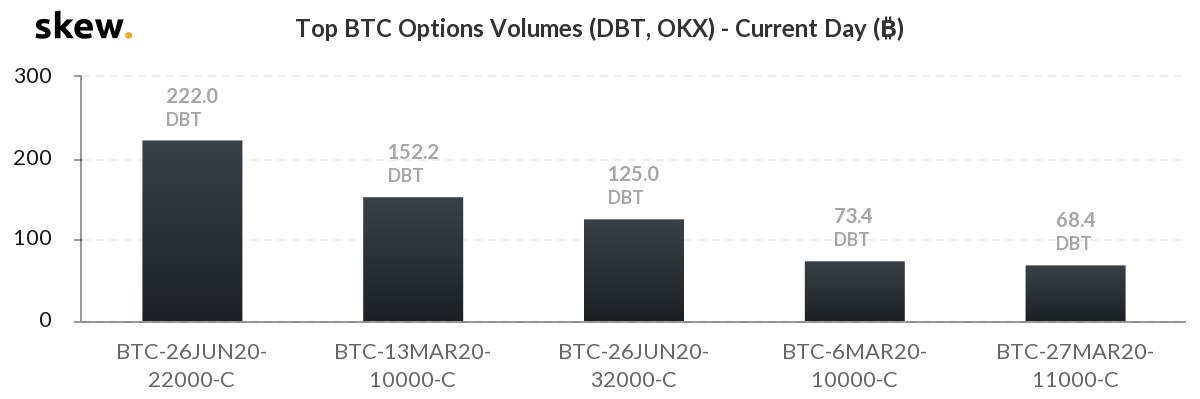

Deribit and OKEx- Top BTC Options Volume | Source: skew

Over 73 call option contracts, expiring at the end of this week, 6 March 2020, are priced at $10,000, 17 percent above the price at press time. A week following this expiry, 152 BTC call option contracts, with an expiry of 13 March 2020 are priced at the same amount. Either way, traders are betting on a bullish swing in Bitcoin price, and by no small margin either.

Expanding the time frame, the optimism only increases. The call contracts expiring at the end of March i.e. 27 March 2020, are priced at $11,000, with a volume of 68.4 BTC.

What’s interesting in that a major chunk of the contracts close to 350 is priced at a massive high post the May 2020 halving. First, 125 BTC call options expiring on 26 June 2020, are priced at $32,000, a 276 percent premium on the price at press time. Subduing the optimism, another set of 222 BTC call option contracts are trading with a strike price of $22,000.

Regardless of whether the right to buy is enforced by the holder or the premium is paid to jump-ship, optimism is certainly running high, especially after the decrease in block rewards.

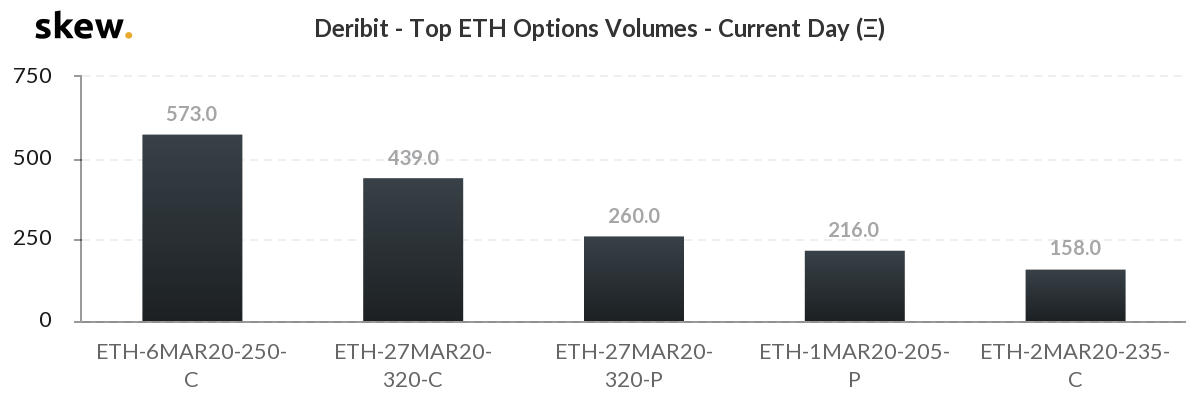

Deribit – Top ETH Options Volume | Source: skew

On the Ethereum front, similar options-optimism is absent. With the altcoin trading at $219, enjoying a massive rally, on the price and the liquidity front, the options traders are not very bullish.

While all hotly traded options contracts are marked with an expiry in the next two to three weeks, the price does not run higher than $320, while it is a 45 percent high from Ether’s press time value, it is only 11 percent above what the altcoin’s price was a few weeks ago.

On the shorter timeframe, the contracts expiring at the end of this week i.e. 6 March 2020, are traded with a strike price of $250 and volume of 573 ETH on Deribit. Further down the volume ladder, the contracts traded at the close of March are capped at a similar price.

Given that Deribit allows for daily Ether Options contracts, 158 contracts are traded at $235 expiring tomorrow on 2 March, still indicating a price rise.

However, when time and market capitalization are expanded, Bitcoin, from an options traders’ perspective, is poised to rise come the close of the month, and even more so post the halving, Ethereum, not so much.