182 million Bitcoin longs face liquidation on BitMEX with pre-weekend volume spike

Bitcoin‘s markets are what crypto-Twitter would call “boring” right now. The price of Bitcoin is consolidating, moving sideways for more than 17 days. However, an interesting thing to observe over the last seven days is the spike in trading volume on Fridays across exchanges like Coinbase, BitMEX, Binance, and even Deribit.

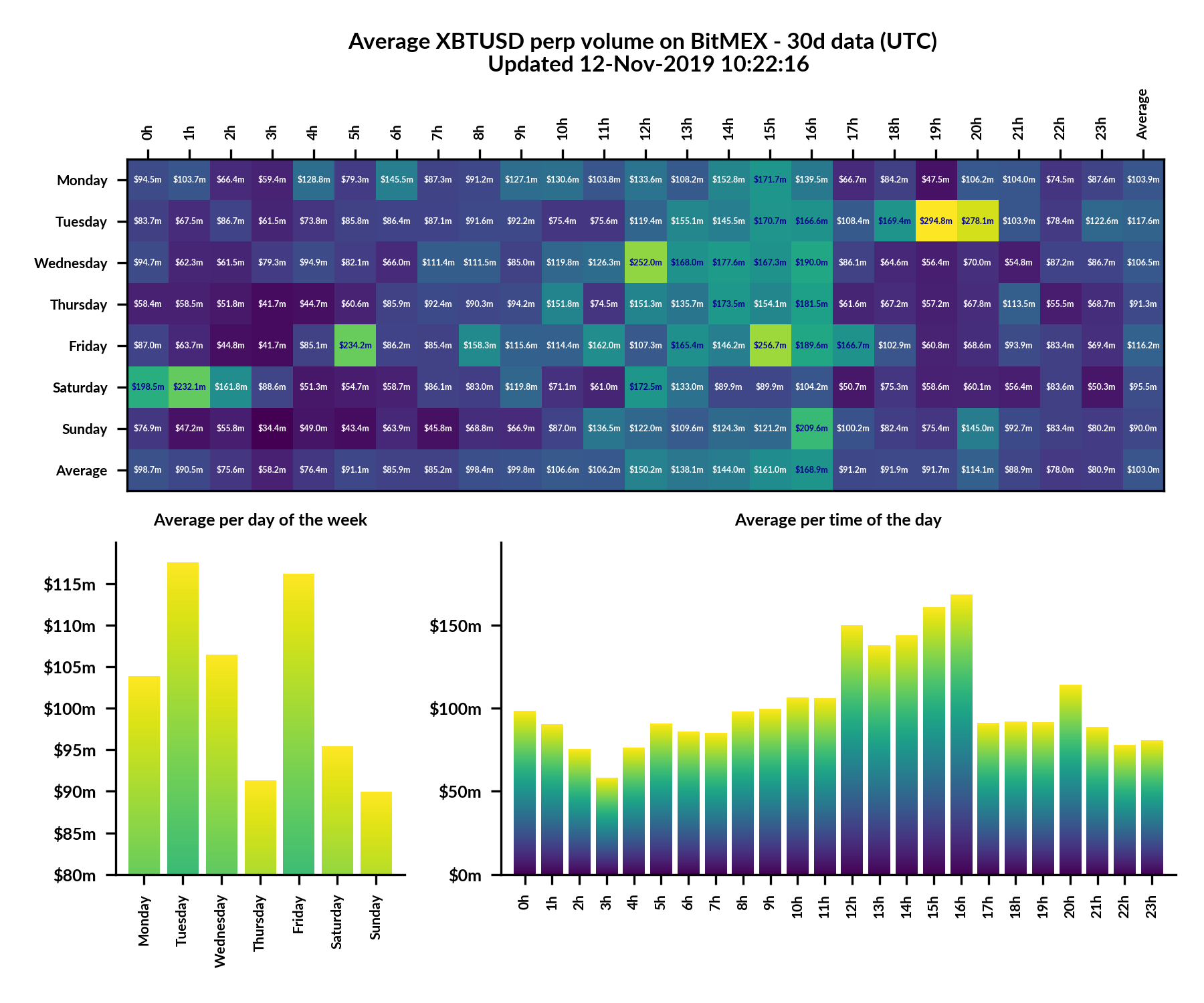

According to Skew’s heatmaps, the average trading volume for Bitcoin reaches a peak on Fridays across all the aforementioned platforms. Tuesdays are also when the volume peaks, but the same was not as consistent as the ones recorded on Friday.

Source: Skew

Moreover, the volumes on all of these exchanges tend to spike between 12:00 to 16:00 UTC. The average volume surged during these peak hours to go up to $150 million on BitMEX, $2 million on Deribit, $5.5 million on Coinbase, and $23 million on Binance.

1200 to 1600 UTC is 7 AM to 11 AM New York time, 8 PM to 12 PM Beijing time, 11 PM to 03 am Canberra time, 5:30 PM to 9:30 PM Indian time. Thus, it is safe to assume that most of the volume is coming from the East for most of these exchanges.

Comparing these statistics with BitMEX’s long v. shorts, we can infer that the longs reached a peak of 27,800 at 03:00 UTC and fell to a low of 25,800 on 12 November. This implies two things; the number of people who were long reduced, which is obvious, or that the longs were liquidated between these time frames.

Source: DataMish

Looking at the liquidation chart for BitMEX, a total of 182.6 million longs were liquidated over the last seven days, a finding which concurs with the chart of the reducing longs seen above. Moreover, the shorts that were liquidated for the same time period were only 45.8 million. Comparing this with the average total volume of BitMEX over the last 7 days shows that a total of 9.34% of longs were liquidated, while only 2.28% of shorts faced liquidations.