10K Ethereum calls traded in a day; is the Options market foreseeing changes?

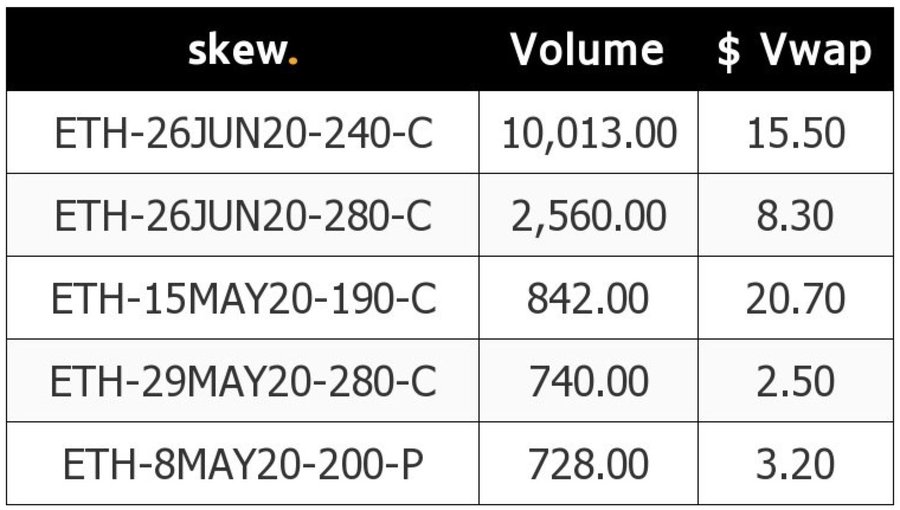

Despite there being great momentum in the spot market, the performance of Ether Options has been slow and conflicted. The Options market has limited participation from exchanges, with the lead exchange being Deribit which provides Futures and Options on Ethereum, as well as Bitcoin. As per data provided by Skew markets, on 5 May, over 10,000 Ether calls were traded on Deribit exchange with a volume-weighted average price of $15.50.

Source: Skew

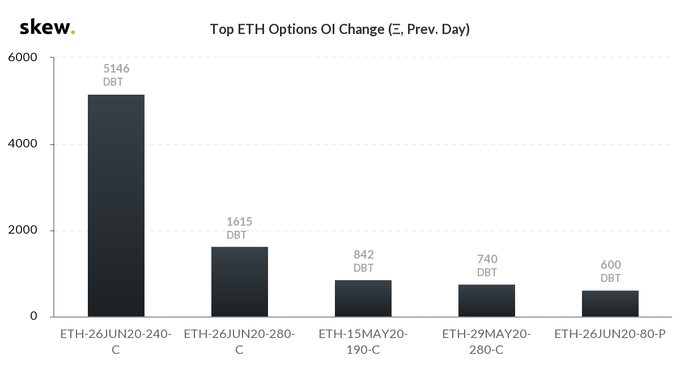

This trade of call options was followed by a surge in the Open Interest metric. The OI rose by a little over 5,000 Options on that particular contract, as indicated by the chart below.

Source: Skew

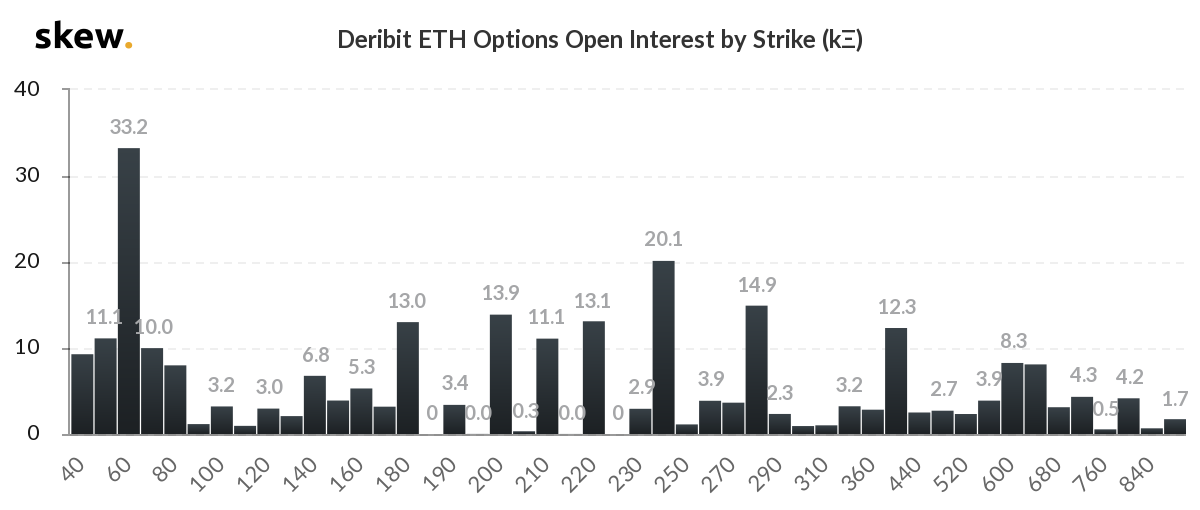

With a great number of call options traded, the strike prices did not paint a pretty picture. The prices were well under the spot price of Ethereum, and it could have a negative impact on the derivatives market.

Source: Skew

As per the attached chart, the strike price by Open Interest positions on the ETH Options market indicated that the most common strike price among the open contracts was marked as low as $60. This pointed to the bearish outlook of the market and accounted for nearly 33% of all active ETH Options contracts, at press time.

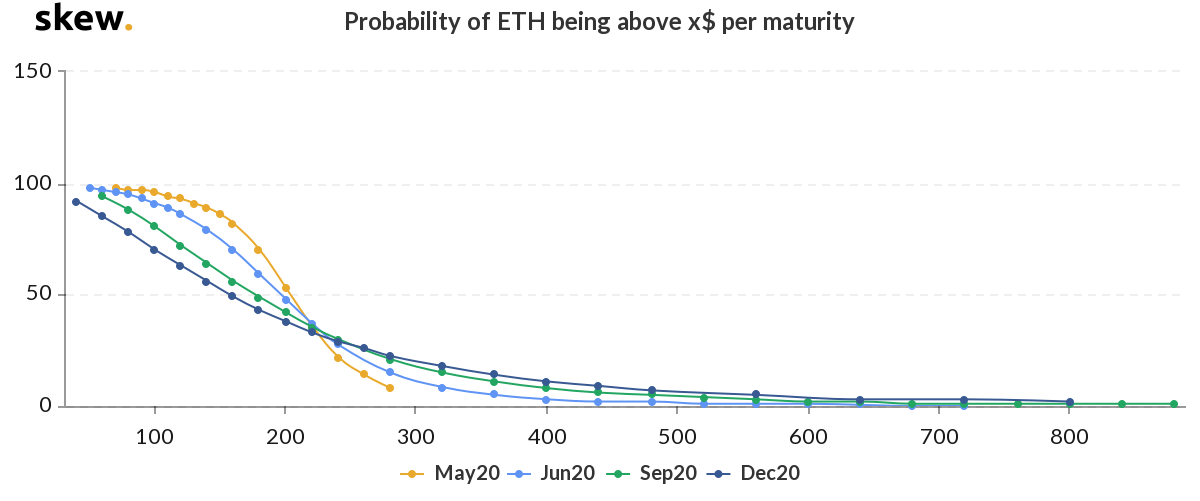

Even though ETH’s spot price was marked at $208.51, at press time, the market appeared unsure about the second-largest crypto-asset being able to hold on to this number for long. The probability of ETH moving to $280 dipped under 10% in May 2020.

Source: Skew

Despite slow market momentum in the Options market, traders on derivatives exchange like Deribit kept the interest high.

Source: Skew

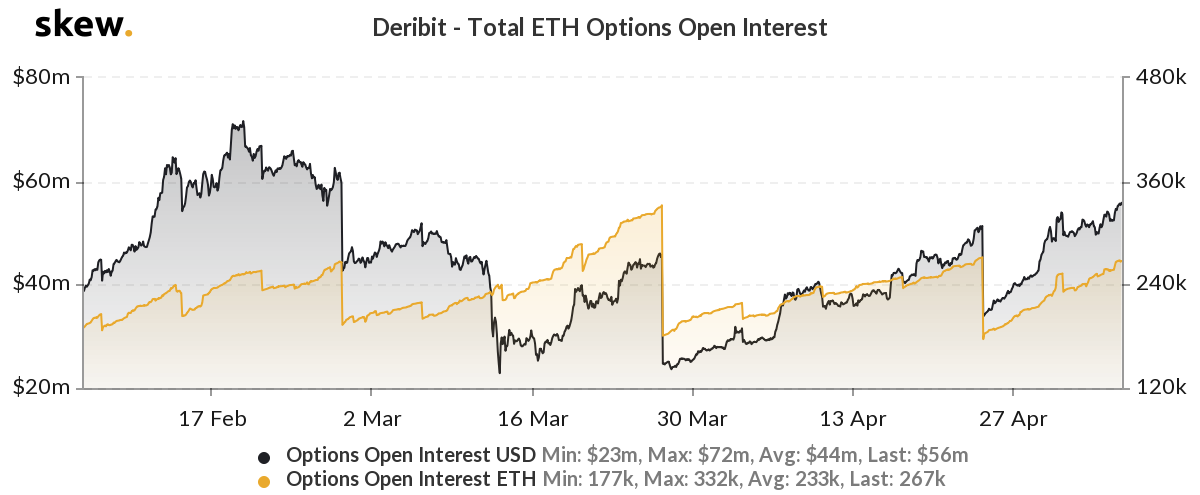

The total ETH Options Open Interest on Deribit noted a higher value for the first time since February. The OI on 28 February was as high as $60 million; however, with instability creeping into the market, the OI also dropped. However, as the market makers were building the market, trust was re-instated in the market and the OI reflected that. On 6 May, the OI climbed to $56 million as ETH’s price swung higher than in February, with the value of OI at 268k ETH.