XRP and Bitcoin correlation hits a new ATH: More headwinds for XRP soon

XRP is the third-largest cryptocurrency even with the price trading under $0.20 for quite a while. The total XRP in circulation [which is 44 billion] easily compensates for the price. At press time, XRP was trading at $0.1836, registering a -1.23% dip in the last 24 hours.

YTD performance of XRP has dipped as low as -24.43% on March 16, as of Sunday it was -2%.

XRP: Four-hour

Source: XRPUSD TradingView

As seen, the price has been on an upward trajectory since the March 13 dip, however, at press time, this trajectory is facing resistance and is being squeezed. The resistance is being offered by the 50-day moving average [50 DMA, yellow]. Beyond the 50DMA, there is an even larger resistance – 200 DMA [purple] for XRP. Hence, the short term scenario for XRP looks bearish without a doubt.

Looking at the Aroon indicator, the Aroon-down line [red] is all but exhausted, ie., the sellers have lost momentum, indicating that the downward pressure is reducing. However, at the same time, Aroon-up line [green] has already bottomed out and is looking for a surge. This set up on the Aroon indicator could indicate that there might be a chance for XRP to surge above the 50 DMA, even it might be for a brief moment.

Correlation

Source: Coinmetrics

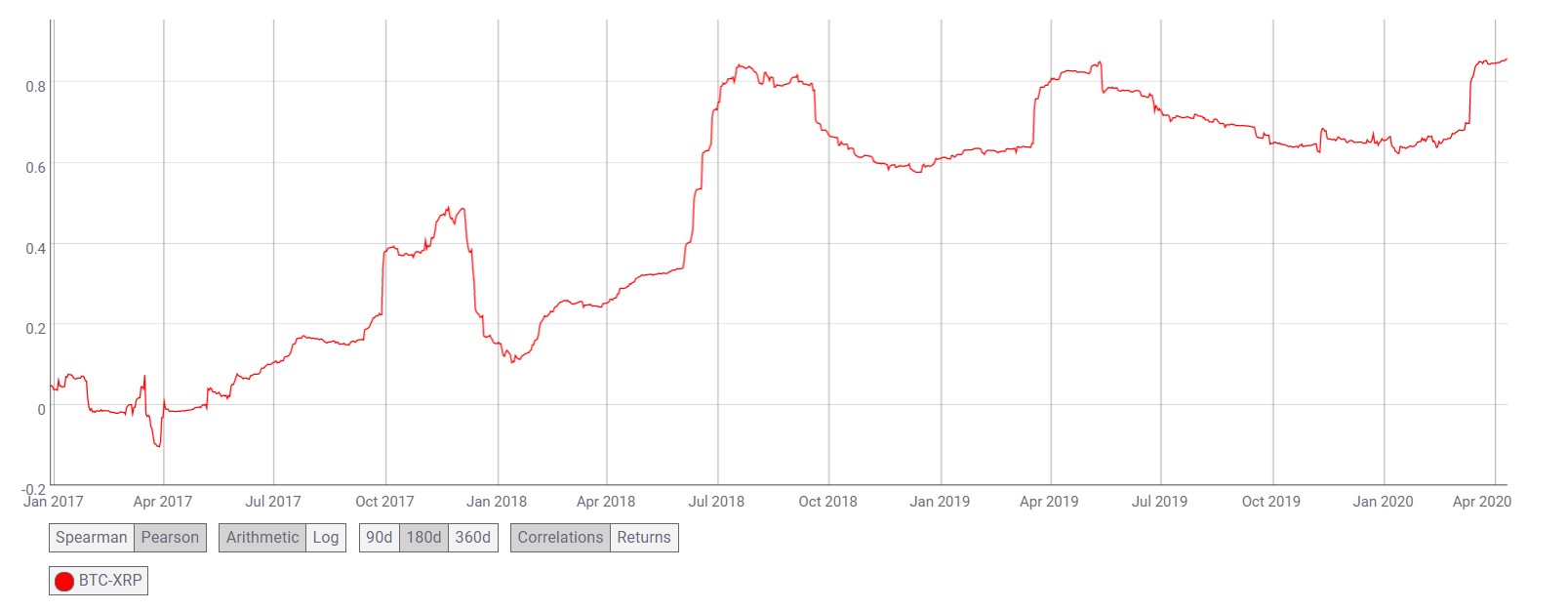

The reason for XRP’s downtrend are many, however, one that is tangible is its correlation with BTC. Since 2017, XRP has become increasingly correlated with Bitcoin. At press time, the 180-day correlation [Pearson] for XRP has surged to record levels – 0.859, the recent high was on March 12 at 0.8511, however, the recent drop and surge caused this correlation to increase.

An increased correlation is good during the bull market, however, it could be devastating during an extended bear market like now. During the 2017 bull run, XRP more than reaped the benefits of the correlation, however, it is struggling to stay afloat as Bitcoin drives altcoins to the ground.

Conclusion

The price of XRP will get squeezed in the coming days with price trying to surge above the 50 DMA to only fail and drop lower. The only respite is when the price surges towards the 50 DMA at $0.1950 aka a 4.58% surge from its current price.