XLM has a bearish bias despite the recent rally to $0.136 – Why?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- XLM was trending downward and a move below the mid-range mark could see losses of more than 10%.

- A buying opportunity was not at hand, but a drop to $0.1 could be worth reassessing.

Stellar Lumens [XLM] has suffered losses of close to 12% in the past two weeks. The volatility on 13th November saw XLM briefly surge to the local highs at $0.136. Yet its lower timeframe trend was bearish.

In the next two to four weeks, it appeared likely that XLM would experience another drop in prices. This leg downward would measure close to 14%. This was partly because XLM did not witness outsized gains, unlike many other altcoins.

Was XLM a big laggard during the recent rally?

Measured from 19th October to 15th November, the altcoin market cap grew by 38%. In the same window, XLM only gained 32% at its peak, on 7th November. Since then, XLM has trended downward.

With Bitcoin [BTC] unable to break past the $38k mark, sentiment could begin to cool down. This would see XLM fall lower. In the past two months, the token traded within a range that extended from $0.135 to $0.101.

At press time, XLM was at the mid-range mark at $0.118. A move below $0.118 would likely see prices slip toward the $0.1 support zone.

The RSI was at 47 and the drop below neutral 50 on the daily chart was an early sign that the momentum was shifting bearishly.

The On-Balance Volume saw a drop in recent days as well. On the other hand, the Chaikin Money Flow (CMF) continued to signal strong capital inflows.

Social sentiment has taken a hit alongside the prices

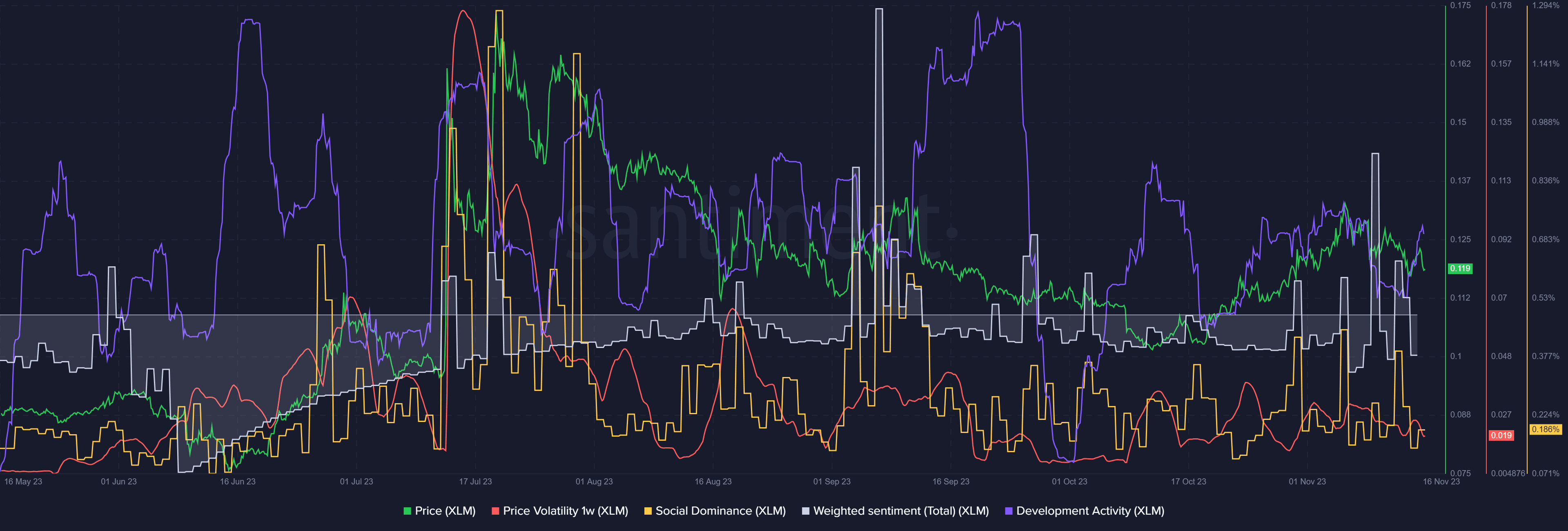

Source: Santiment

The 1-week volatility has trended downward since late October. The weighted social sentiment has been predominantly negative in recent months. However, there were brief surges in sentiment.

Is your portfolio green? Check the Stellar Lumens Profit Calculator

These fleeting shifts were not enough to justify expectations of price appreciation. Its social dominance saw a two-month peak on 1st November but has dropped lower since.

The development activity was good so investors have no worries on that front, just the price action during a mini altseason.