Why Polkadot failed to make a mark despite high dev activity

- DOT’s metrics, including its Social Dominance and Price Volatility 1w, fell over the last few days.

- Most market indicators remained bearish on Polkadot.

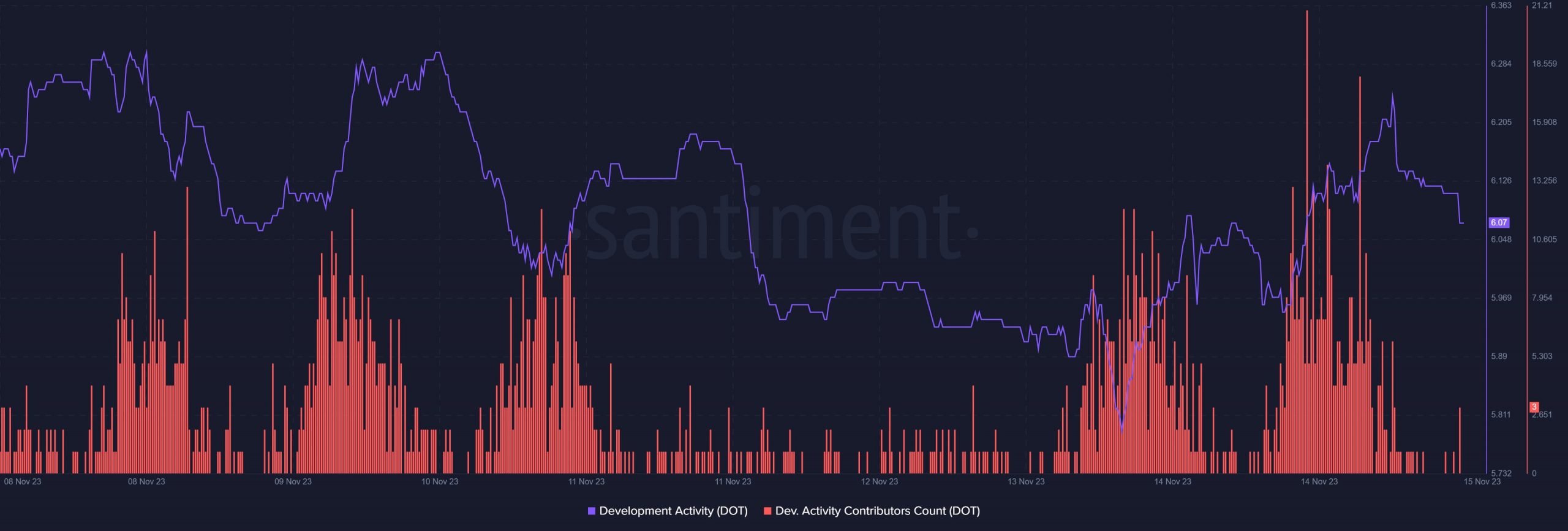

Polkadot [DOT], which is known for its high development, continued to grow in that regard over the last week. Notably, AMBCrypto found that during this time frame, Polkadot’s average core developer count reached 140.

To put it into perspective, the week before that, DOT’s average core developers stood at 136. The blockchain witnessed the maximum number of codes being committed on the 8th of November.

Polkadot boosts its development activity

AMBCrypto’s analysis of Santiment’s chart also revealed that Polkadot’s Development Activity remained relatively high at press time. In fact, its Dev. Activity Contributors Count shot up sharply in the recent past.

The blockchain also registered a spike in its Active Addresses, as it started to rise on the 9th of November. Thanks to this, its transactions remained pretty stable throughout the last week.

Polkadot investors are not happy

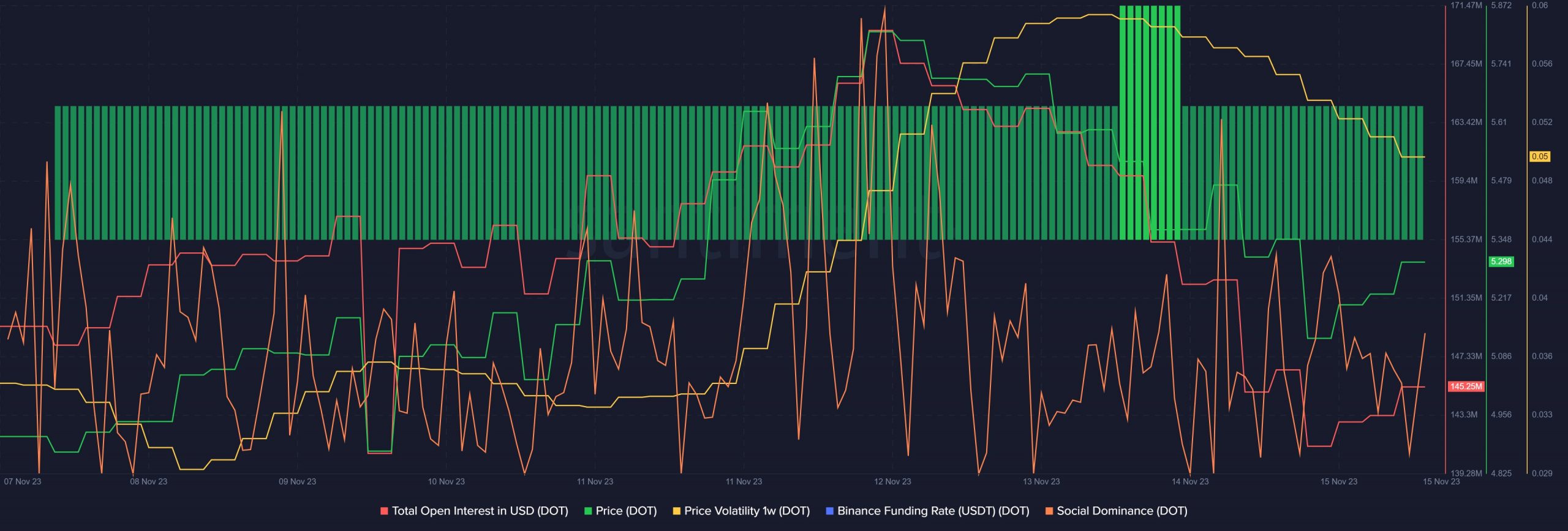

Even as Development Activity remained high, Polkadot’s price action continued to be under the influence of bulls. As per CoinMarketCap, DOT saw an increase of 8% in the last seven days. However, things turned sour in the recent past.

AMBCrypto found that DOT registered a 3% drop in its value over the last 24 hours. Its volume also fell, suggesting that investors were not actively trading the token at press time. At the time of writing, it was trading at $5.30 with a market capitalization of over $6.9 billion.

Our further analysis revealed that the token’s Social Dominance declined after a spike. Nonetheless, DOT’s Open Interest dropped along with its price, which could initiate a trend reversal.

Its Price Volatility 1w sank as well, thus minimizing the chances of an unprecedented price drop. But its Binance Funding Rate remained green. This could be concerning, as it meant that derivatives investors were buying DOT at a lower price during the time of publication.

Read Polkadot’s [DOT] Price Prediction 2023-24

DOT’s MACD displayed the possibility of a bearish crossover. Also, its price touched the upper limit of the Bollinger Bands.

To add to this, AMBCrypto found that Polkadot’s Money Flow Index (MFI) registered a downtick, increasing the chances of a continued price decline. Nonetheless, the Chaikin Money Flow (CMF) remained bullish as it moved up slightly.