What Aave’s rebrand means for the protocol

- Aave’s parent company has rebranded as Avara.

- AAVE maintains an upward trajectory, as alt’s price has grown by almost 45% in the last month.

Formerly known as Aave Companies, the entity behind leading decentralized lending protocol Aave [AAVE] has rebranded as Avara.

Today, we proudly introduce ourselves as Avara.https://t.co/ykEGQmXkBu

— Avara^ (@avara) November 16, 2023

According to the blog post announcing the name change, Stani Kulechov, founder and CEO of Avara, also confirmed the acquisition of Los Feliz Engineering, the software development company behind the Ethereum crypto wallet Family and developer library ConnectKit.

As noted in the press release, these actions represent concerted efforts by Avara toward achieving its mission statement of establishing “an open, decentralized internet that’s equitable, inspires participation, and fosters innovation.”

State of Aave

The last month has seen a rally in the total value locked on Aave.

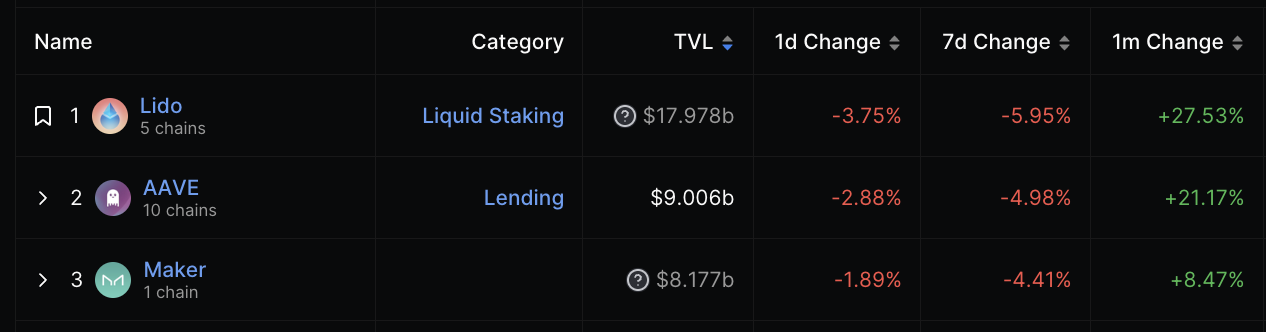

According to DefiLlama’s data, the lending protocol’s TVL has grown by 21.15% in the last month. This has caused it to displace competitor MakerDAO [MKR] as the second-largest decentralized finance protocol in terms of TVL.

At press time, Aave’s TVL was $9 billion, while MakerDAO ranked below it at $8.17 billion.

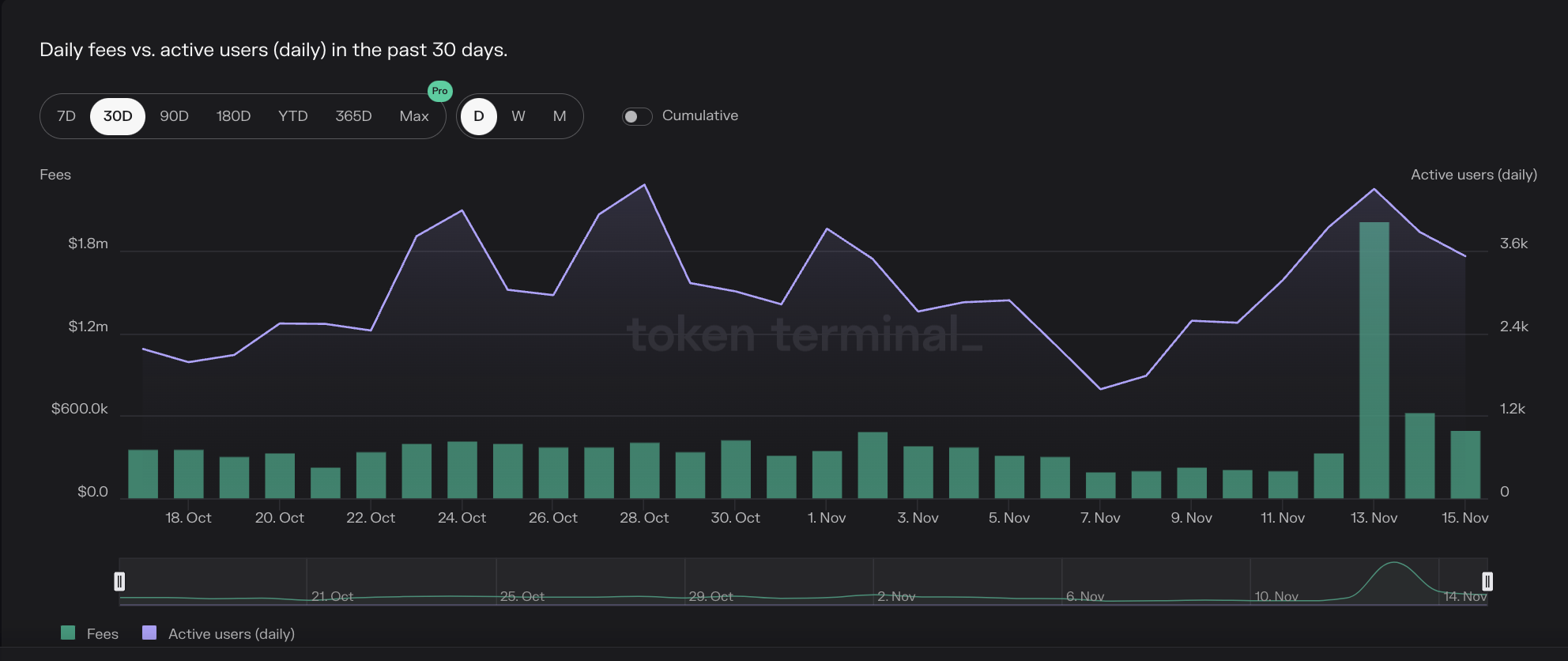

The uptick recorded in the protocol’s TVL has been due to the growth in active user count on Aave in the last 30 days.

AMBCrypto found that Aave’s daily active user count has rallied by 47% in the last month.

An assessment of the protocol’s network activity over a much wider time frame showed that in the last 180 days, the number of daily users has gone up by 118%.

With increased user activity comes a surge in network fees, which has been the case for Aave in the last month.

Data retrieved from Token Terminal showed that daily fees levied on transactions on Aave have grown by 81% in the last seven days, 32% in the last month, and 4% in the last three months.

Further, revenue obtained from these fees has also witnessed a corresponding growth. In the last month, Aave’s revenue has increased by 19%.

Realistic or not, here’s AAVE’s market cap in BTC terms

The protocol’s revenue in the last thirty days currently sits above $2 million, while its annualized revenue is $26 million.

Regarding the protocol’s AAVE token, its price has risen by 43% in the month. Exchanging hands at $99.91, the altcoin currently trades at a price level that was last seen in February.