Was November kind to Ethereum NFTs? Here’s what the data says

- There has been a hike in NFT and DeFi activity on Ethereum.

- Despite the high demand for ETH, its supply continues to fall.

The Ethereum [ETH] network has experienced a surge in activity around non-fungible tokens (NFTs) and decentralized finance (DeFi) in recent weeks, on-chain data reveals.

This growth in network activity follows an extended period of decline when NFT sales volume and DeFi total value locked (TVL) plummeted to new lows.

Ethereum’s NFT and DeFi ecosystems

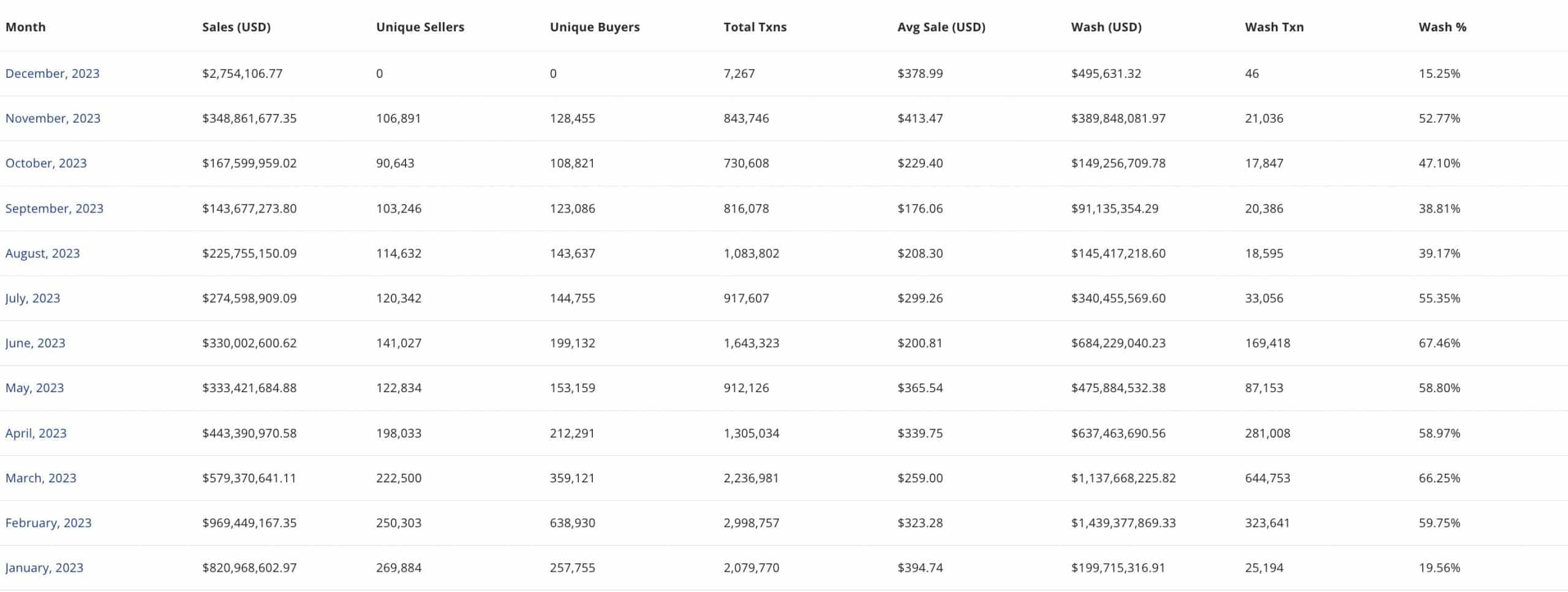

In November, Ethereum-minted NFTs recorded a sales volume of $348.61 million, according to data from CryptoSlam.

AMBCrypto found that this marked the first time since February that the chain would record a month-over-month (MoM) uptick in sales volume.

For context, Ethereum registered an NFT sales volume of $949.49 million in February. However, as bearish sentiments ravaged the entire crypto market in the first and second quarters of the year, NFT trading activity declined severely.

Data from NFTGo showed that general NFT market capitalization peaked at $10 billion on 20th February and has since trended downward.

Between February and October, NFT sales volume on Ethereum fell by 82%. However, general market sentiments improved in November, leading to a resurgence in NFT trading activity.

Last month, general NFT market capitalization grew by 39%. Mirroring the growth in the general market, Ethereum’s MoM sales volume climbed by 108%.

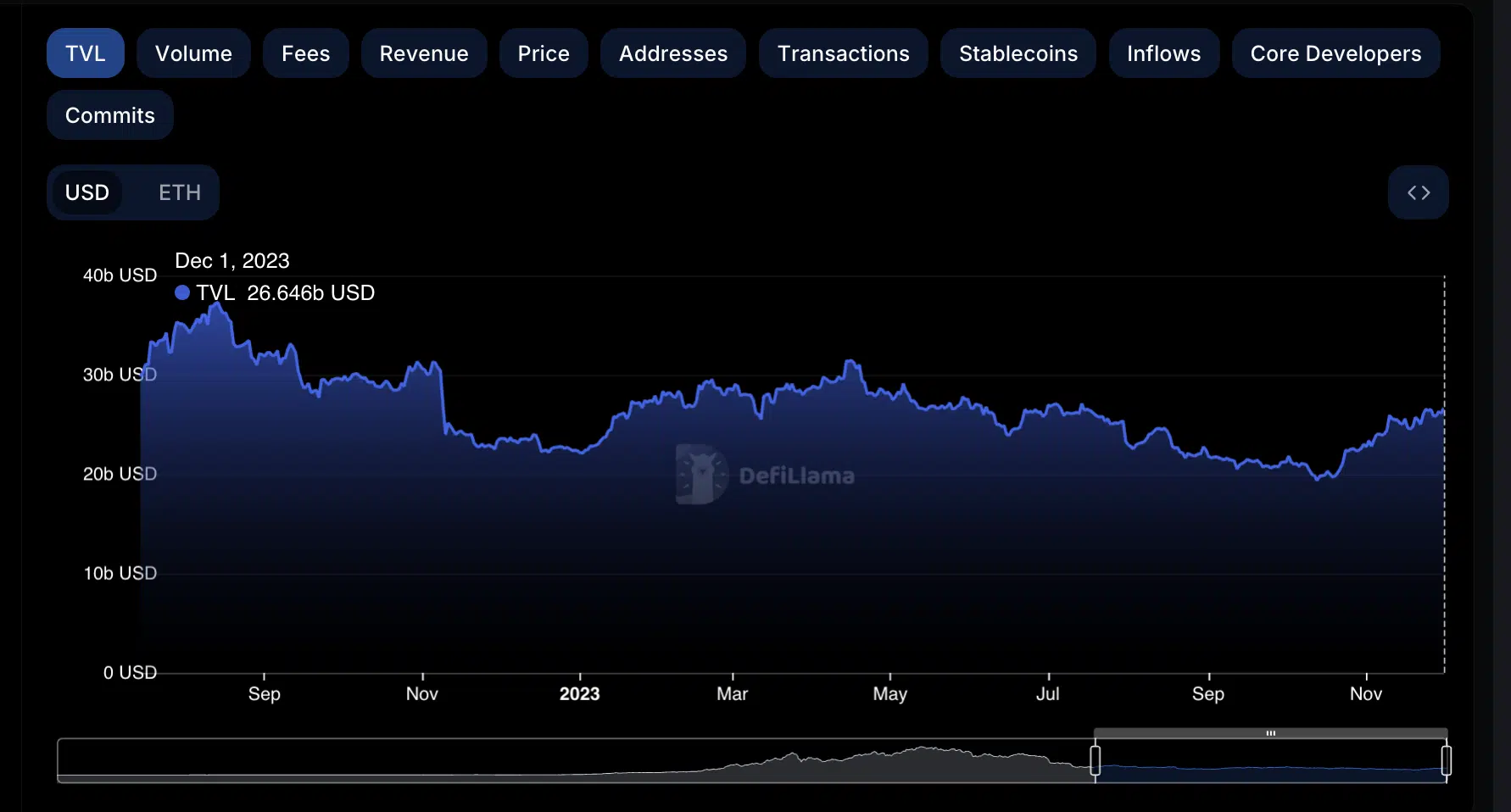

Regarding its DeFi vertical, it also experienced growth in TVL. Data from DefiLlama showed that between 1st and 30th November, the chain’s TVL rose by 15%.

The network’s TVL was $26.64 billion at press time, its highest since July.

But there is a catch…

While the growth in NFT and DeFi activity is good for the chain, it might result in a potential hike in ETH’s supply due to the current increased demand for the altcoin.

Pseudonymous CryptoQuant analyst Nino found that the resurgence in NFT and DeFi activity on the Ethereum network has led to growth in the standard deviation (SD) of ETH withdrawal transactions from exchanges.

This means that ETH’s average withdrawal transaction size is becoming more variable. In other words, there are more large and small withdrawal transactions than there used to be.

How much are 1,10,100 ETHs worth today?

Taking a cue from ETH’s historical performance, Nino said:

“Like during past bubble periods, if there’s a surge in demand for DeFi and NFTs, it would necessitate an increased supply of ETH. This could lead to higher volatility in its price.”

Interestingly, despite last month’s NFT and DeFi activity hike, its supply continues to decline. Data from Ultrasound.money showed that 32,012 ETH tokens worth around $66.95 million have been removed from circulation in the last month.