United States’ Bitcoin adoption rates might depend on streamlined KYC processes

With respect to crypto-regulations and the adoption of popular cryptocurrencies such as Bitcoin, the U.S has traditionally been fairly cautious. For many, this approach has put the United States in a less advantageous position, in comparison to other parts of the world.

Catherine Coley, CEO of Binance U.S, on the latest edition of the Unqualified Opinions podcast, highlighted the intricacies of the U.S market when it comes to crypto, the role of Binance U.S, and issues surrounding the adoption of crypto in the country.

While Binance U.S was formed for the U.S market specifically in order to adhere to the country’s crypto-regulations, the discussion steered towards the role of Binance and whether or not its presence in the U.S is a subset of a larger organization and what the dynamics behind it are. In response to the same, Coley said,

“The real position that I’m in right now is, I want to make sure that Americans have access to how the rest of the world is trading and the sophistication that they are receiving on a global level doesn’t leave behind America.”

Highlighting the regulatory requirements in the U.S with regard to AML and KYC, Coley highlighted that the U.S team has taken the lead on streamlining this process to make it a lot faster. She said,

“We’ve streamlined KYC for our users in a way that gets them through the door much faster. That’s one of the aspects that we realized is a huge hurdle opening in the United States. We have to go through KYC and AML for all of our individuals and really understand it at a much more granular level than you’d need to at a global perspective.”

Coley went on to add that the SEC Commissioner’s safe harbor proposal is akin to extending an olive branch. With regard to the three aspects of crypto such as decentralized, secure, and scalable, Coley added that for adoption,

“You have to focus on one or two in order to get adoption and then you can focus on three. That’s really where I think we’re able to have an opportunity for people that are beginning to trade or demanding to get a US audience.”

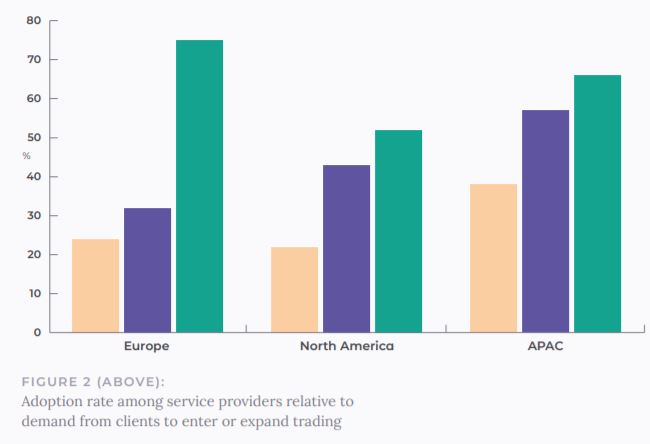

Source: Acuiti

With regard to the adoption of digital assets in the U.S, a recent report by Acuiti found that adoption lagged demand across most of North America, with only 52% of the demand being met as more and more clients are seeking to expand digital asset trading, in comparison to the APAC region and Europe.

Coley concluded the interview to expand on Binance U.S’s operations in the country,

“We’re pushing forward to increase more of our trading pairs that are demanded by our American traders, and we’re continuing to make a seamless approach, whether you’re a beginner or an advanced, whether you’re a full-time market maker, a trader.”