Analysis

Tezos, IOTA, STEEM Price Analysis: 04 October

Tezos was trending upwards for a brief period, before the market’s sellers imposed themselves yet again on the order book. In the long-term, its fundamentals were developing pace and could rekindle buyers’ interest. STEEM formed a bearish reversal pattern and sought to defend its level of support on the charts. On the contrary, IOTA noted some gains over the past few days and might be able to continue moving north.

Tezos [XTZ]

Source: XTZ/USD on TradingView

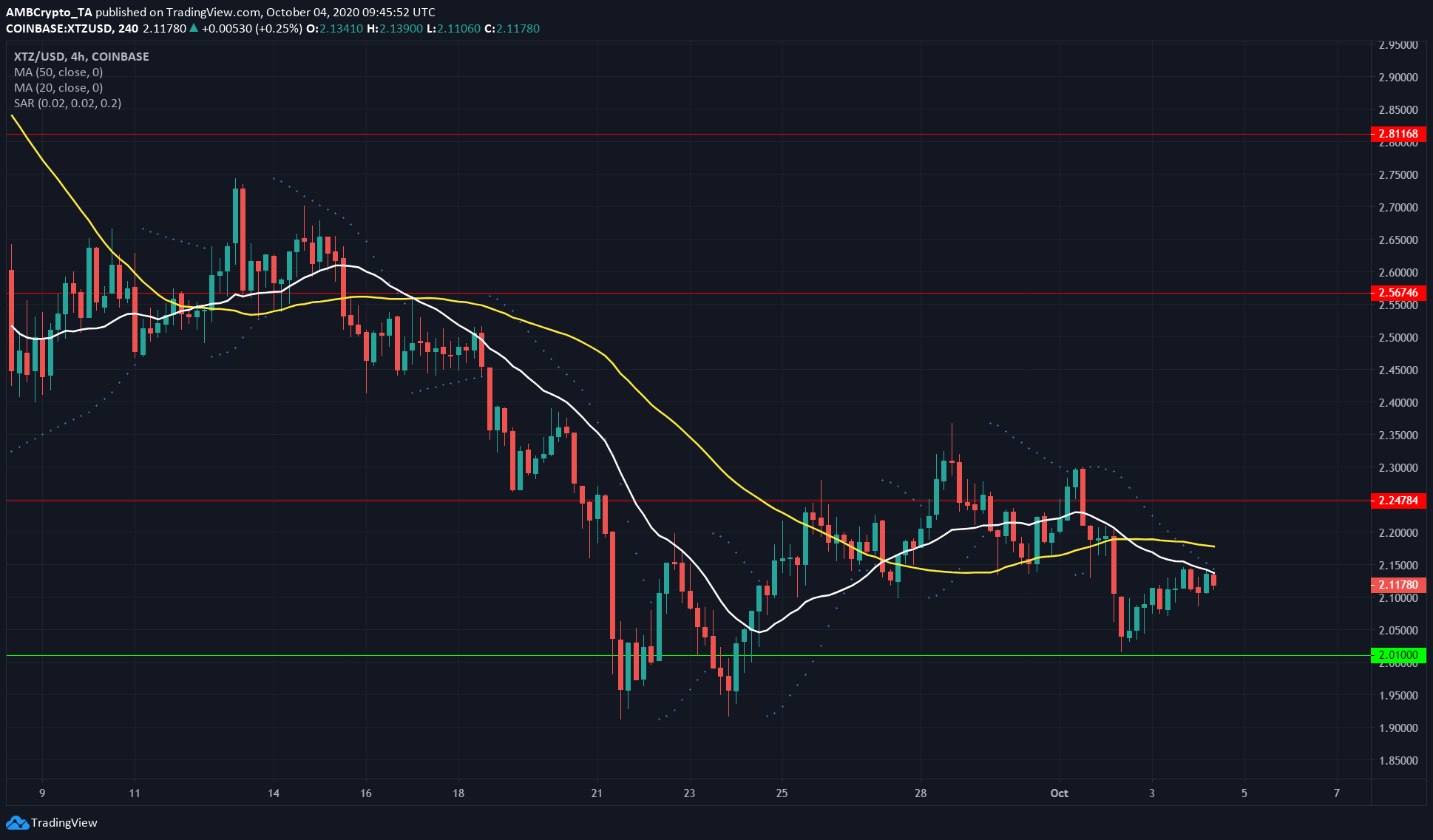

XTZ trended north for a week as it surged from $1.91 to $2.3. However, it was soon forced to drop under the $2.25-resistance. In fact, another attempt at scaling the same level was also met by rejection.

The 20 SMA (white) briefly moved above the 50 SMA (yellow) but was forced back under once more. The uptrend had no legs to stand upon and a dip beneath $2 can’t be ruled out. The Parabolic SAR also indicated a sell signal, and the moving averages can be expected to offer resistance.

Tezos has been reported to be working on advancing DeFi development, the first step towards the Tezos DeFi ecosystem competing with the Ethereum blockchain.

IOTA

Source: IOTA/USD on TradingView

IOTA hit its overhead resistance at $0.288 and was rejected harshly, but buyers were able to step in and reverse the plunge at $0.258. The crypto-asset was trading at $0.266, at press time.

The CMF showed a value of +0.15 at press time, highlighting strong capital inflows into the market. The OBV also suggested that the latest price hike was supported by buyers’ interest.

The OBV trending higher meant that buying volume outweighed selling volume. The zone of supply from $0.288 to $0.3 was not convincingly breached over the past month, so it is unlikely to be breached following this attempt.

Steem [STEEM]

Source: STEEM/USD on TradingView

STEEM formed a rising wedge, with a breakout target projected to the base of the pattern, that is, $0.15. STEEM did break beneath the lower ascending trendline and spike as low as $0.1493.

The RSI was unable to stay above 50, suggesting that STEEM was unable to muster any notable bullish momentum. It showed a value of 43, at press time. It recently dipped to note oversold conditions, but even the subsequent bounce lacked strength from the market’s buyers.

The significance of the downtrend meant that it was likely STEEM would drop beneath its imminent support, to the next level of support at $0.135.