Steem takes on Bitcoin Cash, Verge to come out on top

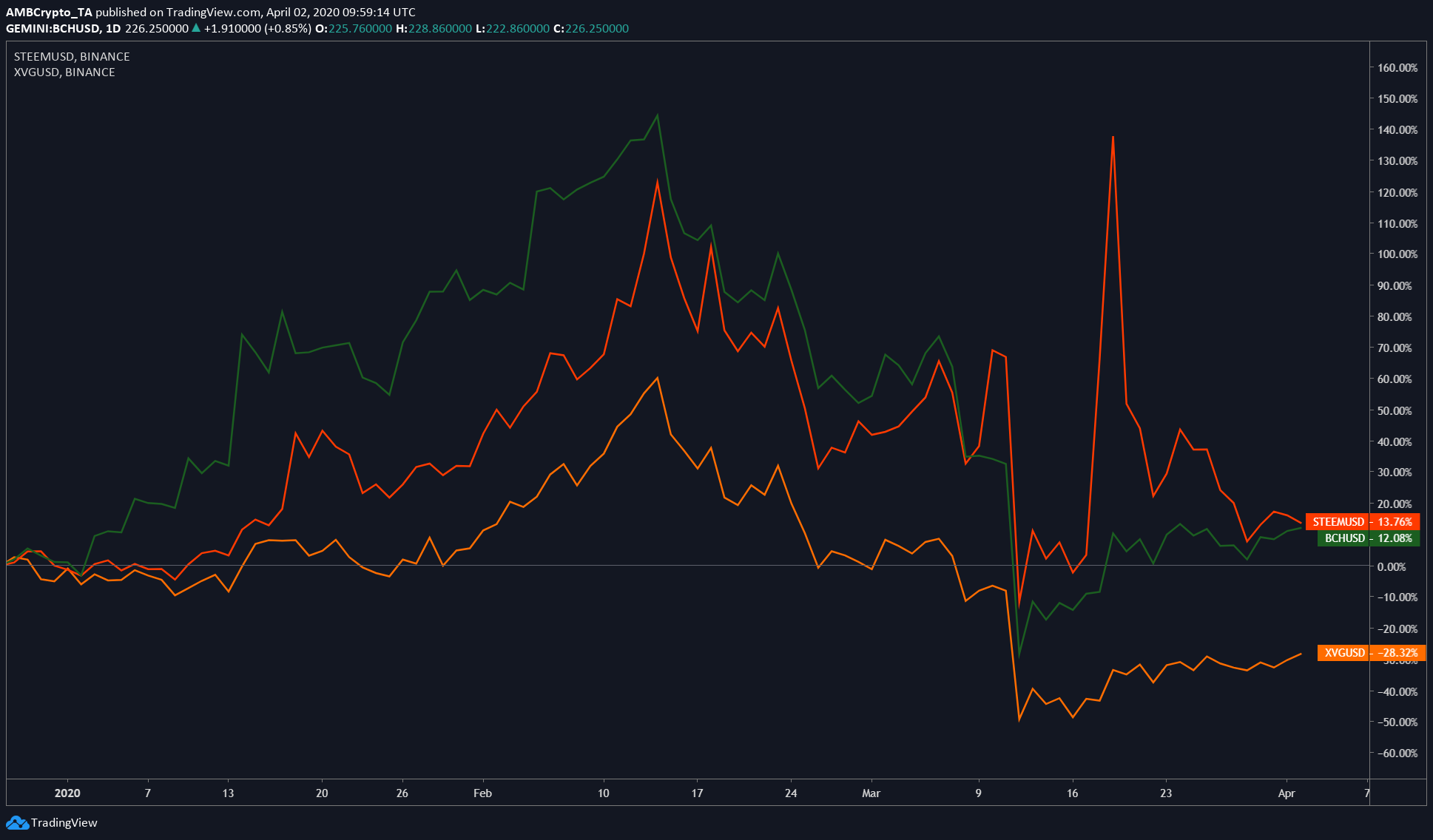

An analysis of the 90-day performance of coins gives an understanding of the bias they have, whether bearish or bullish. As for Steem, Verge, and Bitcoin Cash, Steem obviously takes the first spot. With Bitcoin Cash and XVG, the performance has been worlds apart, with BCH’s relative performance at 2.35% and XVG’s at -30.22%.

Source: TradingView

Steem

Source: STEEMUSD on TradingView

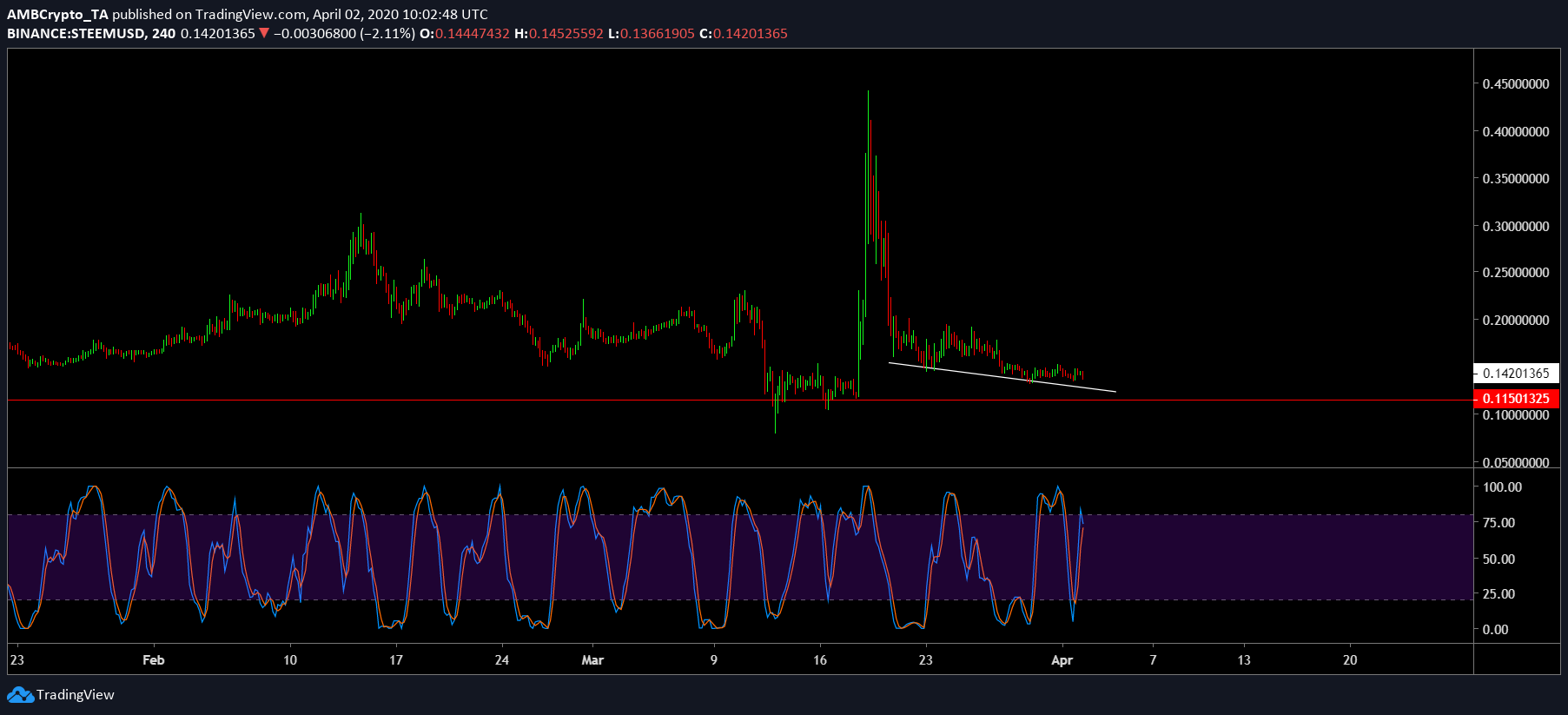

The price [$0.142] of the token, at press time, is all set to undergo a slow decline. In fact, at the time of writing, the 24-hour trading volume was at $1.9 million, with the coin trading as the 66th largest cryptocurrency on CoinMarketCap. Further, the price has continued to fall since 22 March.

The Stochastic RSI indicated a sharp decline around the overbought zone. This could point towards a further bearish trend, pushing the price to $0.1150, a level that was last seen on 21-22 March.

Verge

Source: XVGUSD on TradingView

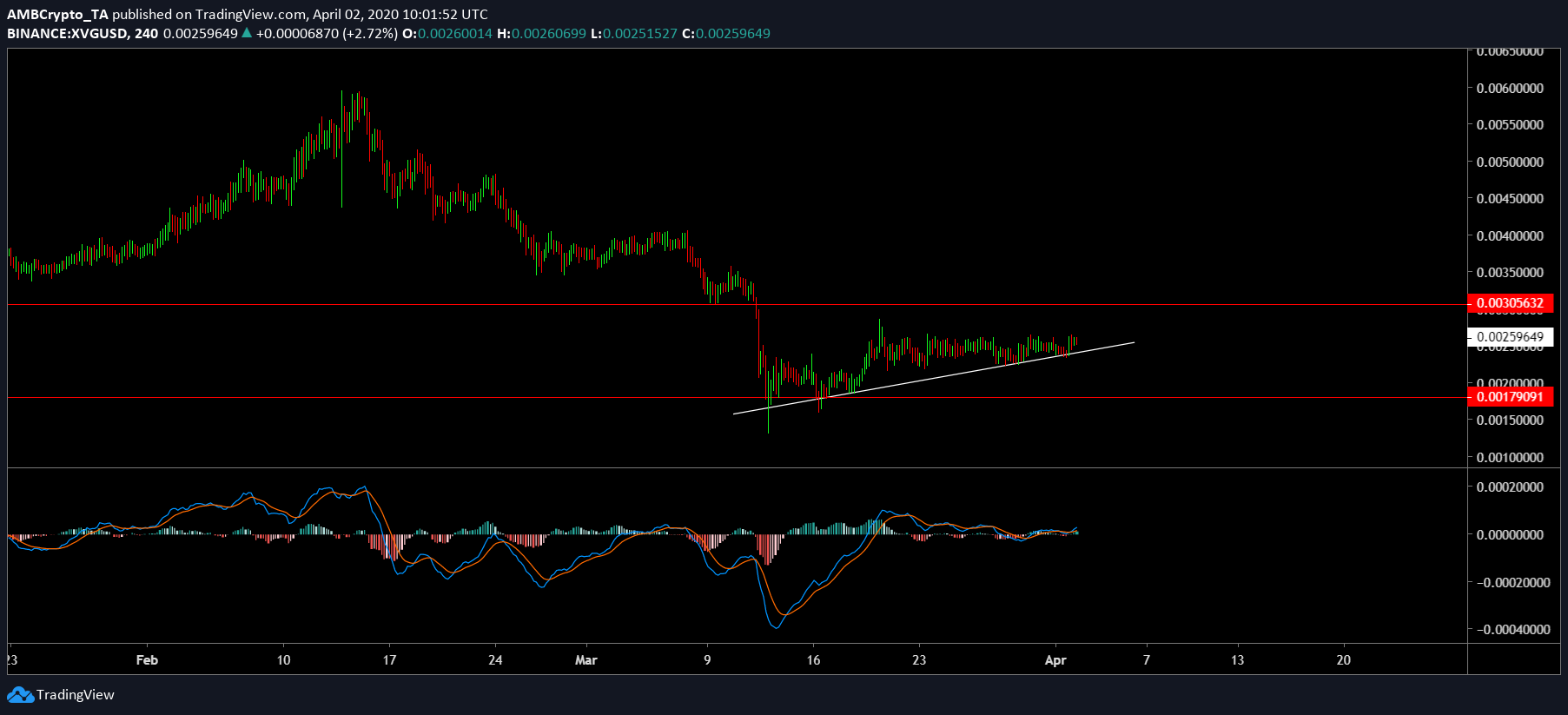

XVG was ranked 82nd on CMC, with a market cap of $41 million and a value of $0.00259, at press time. Like Steem, the coin saw a steady rise in its price, an observation that can also be seen in the MACD as it also rose considerably. However, a bearish bias can also be seen due to the formation of a potential bearish crossover.

A drop could push it to $0.00179; however, a surge could take it to $0.00305.

Bitcoin Cash

Source: BCHUSD TradingView

The fifth-largest cryptocurrency in the market had a market cap of $4.17 billion with a 24-hour trading volume at $3.34 billion, at press time. The price was forming a rising/ascending triangle with horizontal resistance at $243. The VPVR indicator also showed a steep resistance at the token’s price levels, at press time.

Targets for Bitcoin Cash on the upside includes $298, while that on the downside include $187 and $175.

BCH has flown under the radar a bit lately, especially since its halving and that of Bitcoin SV, is just a few days away. How BCH is react following the block reward halving is still up for debate.