Some cryptocurrency exchanges only serve the darknet

Darknet transactions are so intrinsic to the Bitcoin ecosystem that to think of Bitcoin without such transactions would be to violate the core features of what makes the cryptocurrency truly decentralized. Even though it has been many years since the infamous Silk Road, Bitcoin’s first prominent e-commerce use-case, darknet transactions using the cryptocurrency have only been growing.

According to a report by Bitfury’s Crystal Blockchain, the amount in Bitcoins both sent to and received from darknet entities has increased in 2020. For instance, in Q1 2017, Bitcoin sent to darknet entities was $85 million and in Q1 2020, it stood at $411 million, a 380 percent jump. For Bitcoin received from darknet entities, there was a similar 340 percent increase within the same time period.

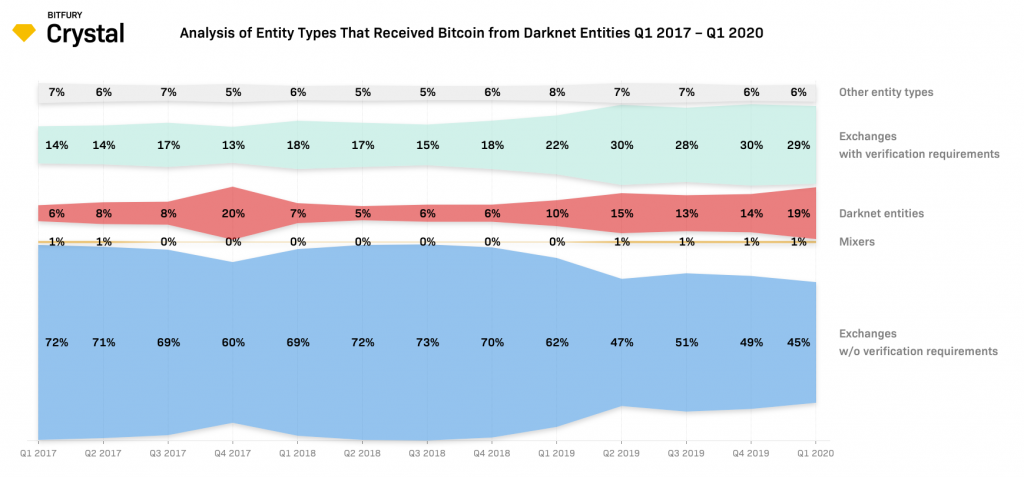

However, the middlemen-entities used in this transaction have changed significantly. The darknet transactions, going both ways, for this calendar year saw a large drop in the use of exchanges without verification requirements from 76 percent in 2017 to 46 percent in 2020. On the other hand, exchanges with verification requirements, only for Bitcoin received from darknet entities [not sent], saw an increase from 14 percent in 2017 to 29 percent in 2017.

The reason for this opposite movement, the report concluded, was due to “more new exchanges implementing verification procedures due to requirements from the FATF.”

While on the face of it there is a move from exchanges without verification requirements to market participants with verification requirements, it seems that most of the former exchanges have customers that operate within the darknet, despite the shift to the latter exchanges.

Speaking to AMBCrypto, John Jefferies, the chief financial analyst at CipherTrace stated that many exchanges with poor compliance records “tended to receive more illicit and risky funds.” Here, Jefferies wasn’t just talking about a handful of exchanges, but over a third of all exchanges.

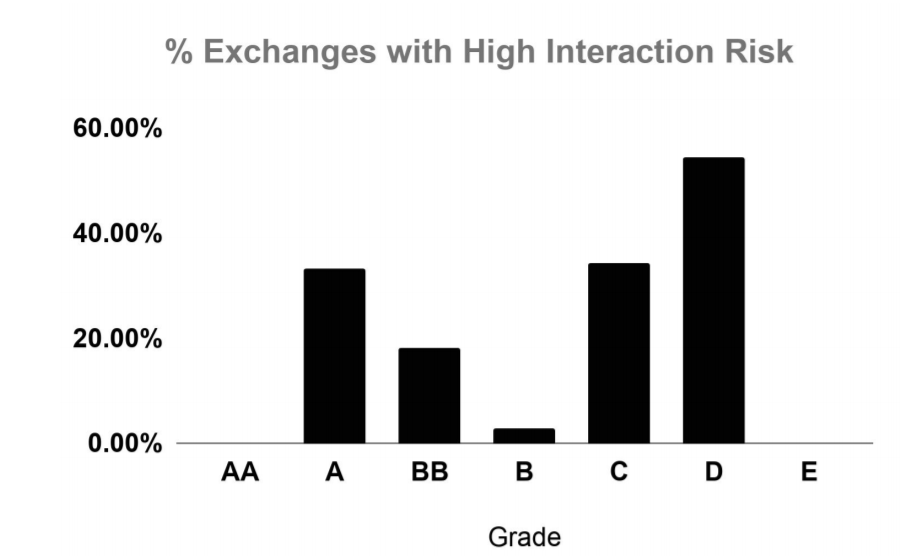

A recent report by CryptoCompare, using data from Cipher Trace, stated that 38 percent of exchanges have interacted with “high-risk entities” for over a fourth of all their transactions. The metrics used to determine compliance and transaction risk and to determine the “degree to which exchanges interact with higher-risk entities” are – KYC/AML procedures, on-chain transaction monitoring, KYC risk-score, interaction risk-score and trade surveillance.

Exchanges’ high-risk interactions | Source: CryptoCompare

The CryptoCompare report ranks exchanges on a ratings-like alphabetic system from A to E. Exchanges ranked ‘D’ saw the highest proportion of high-risk interaction at over 40 percent of all exchanges. Some of the ‘D’ ranked exchanges are DECOIN, BTC-Exchange, Coinhub, RightBTC and CoinTiger.

Darknet markets are not just in the corners of the deepweb, but are financially functioned by such high-risk, scarcely compliant exchanges which are mainly used for such transactions.