Ethereum

Should you be concerned about dropping Ethereum addresses?

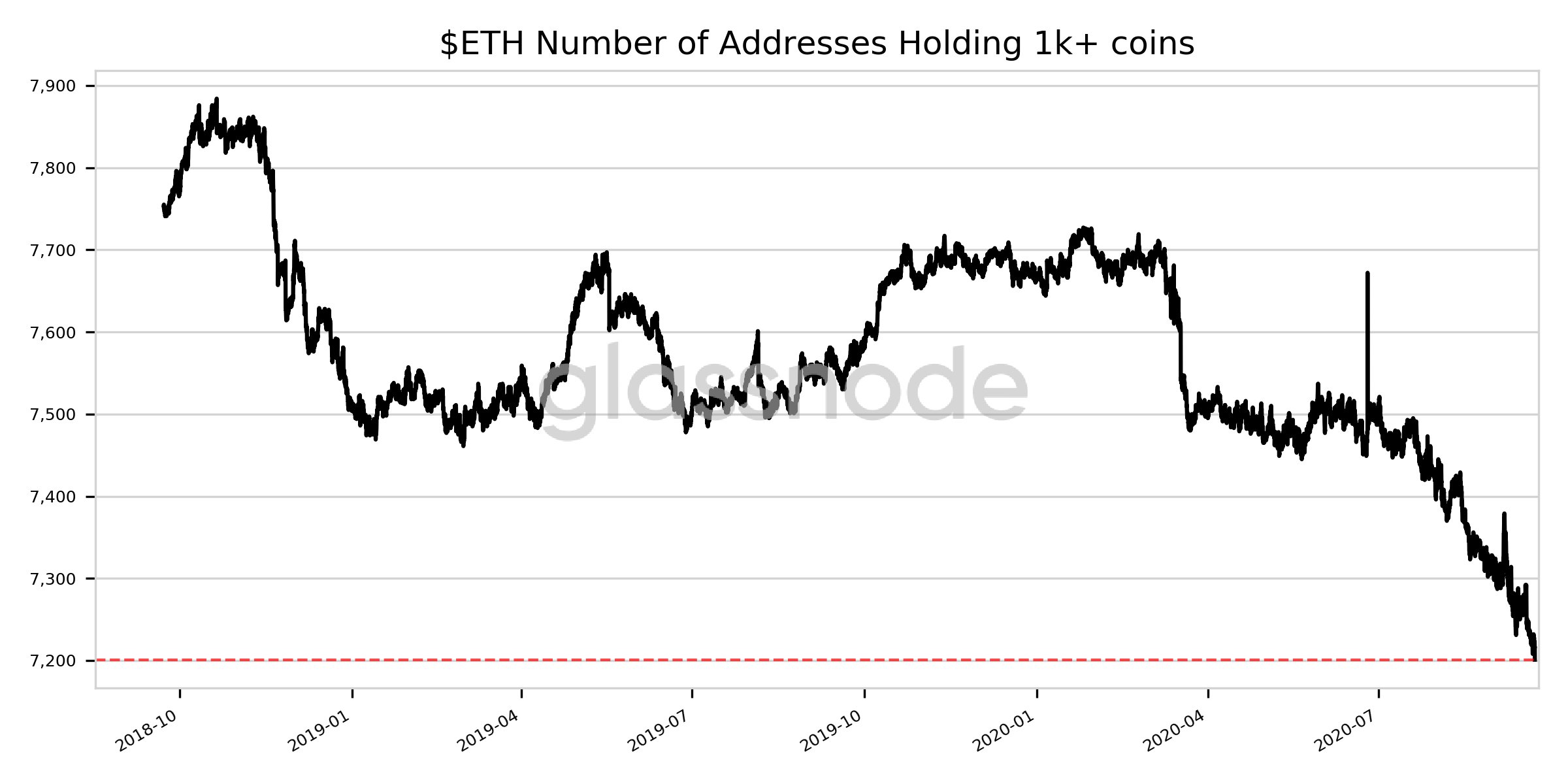

Ethereum addresses holding more 1,000 ETH have leaked out to a number last seen almost 2 years ago. In 2017, there were approximately 7,200 addresses holding more than 1,000 ETH, however, this was during thebull run and this metric was hitting new highs. Considering the current situation this might seem like a disconcerting issue on the outside, it really isn’t.

Source: Glassnode

So the next logical question would, why?

The answer is simple, Ethereum is an active ecosystem and has been even though the bear market, especially with the shift of ETH from PoW to PoS. However, in mid-2020, developer activity and the network seemed to have bustled with activity. The reason for this is defi – decentralized finance.

Defi gained prominence after the launch of Compound’s COMP token, which led to the development of yield farming or liquidity farming. This created a euphoria very similar to that of 2017’s ICO era.

Even now, users are liquidity/yield farming to earn tokens like Sushi, Kimchi, Yam, etc. This trend not only improved Ethereum’s on-chain activity but also increased utilization and even gas fees.

Source: Etherescan

The chart shows a spike in gas fees as people rushed toward yield farming. At one point, gas fees were as high as 500 gwei. The gas prices seem to spike and then return to normal, as of this writing, the gas fees have come down to 176 gwei, slightly higher than the usual levels.

Source: Glassnode

Additionally, ETH held on exchanges has suffered a similar fate of decrease. The exchange held ETH has decreased from 19k to 16k since August. This isn’t an interesting aspect but the ETH held in smart contracts has seen an increase while the exchange balance of ETH reduced.

Last but not the least, ETH locked in defi has seen a huge spike. ETH locked went from 2.482 million to 7.552 million in the last 24 hours, which is astonishing.