Analysis

Probability of Bitcoin crossing $14k by June 2020 rises to 16%

The tussle between retail and institutional investors in Bitcoin Futures was re-ignited last week after the premium rates on retail exchanges surpassed CME’s. With the overall market turning a little bearish on the price end, meaningful changes were observed over the week. However, the underlying sentiment remains the same.

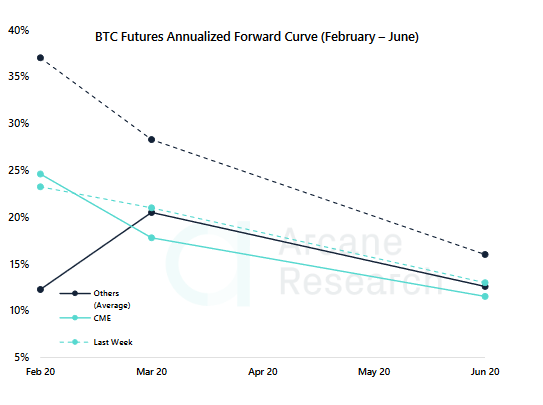

According to Arcane Research’s latest report, the premium rates for Bitcoin contracts on CME and other retail exchanges all dipped for Futures expiring in March and June 2020. CME’s premium rates for March 2020 and June 2020 depreciated down to 1.78 and 4.07 percent, respectively, whereas the collective rates on other retail institutions fell down to 2.05 percent and 4.44 percent.

In spite of falling rates, retail clearly remained more bullish than institutions.

Source: Arcane Research

On observing the BTC Futures Annualized forward curve, it can be observed that the premium rates on CME and other exchanges have leveled up as well. This is an interesting finding as this comes after CME rates dominated the others at the start of the year.

Source: Arcane Research

However, if one were to closely notice the annualized premium rates for BTC March 2020 contracts over the past 5 months, it can be seen that the rates on retail exchanges have surpassed CME since the start of 2020, indicating that the retails traders are bullish about the cryptocurrency market.

The bullish sentiment can be identified on Bitcoin’s probability index chart as well. According to the same, there was a probability of 16 percent that Bitcoin will cross $14,000 by June, surpassing its 2019 high of $13,880.

Source: Skew

With respect to the rising bullish trend on retail exchanges, a better understanding can be derived from the Bitcoin Futures chart. According to the chart below, the aggregated Open Interest on OKEx, BitMEX, Deribit, and Huobi registered an all-time high of $1.4 billion, 1.6 billion, $379 million, and $1 billion, respectively on 14 February.

Source: Skew

In spite of Bitcoin’s falling price, the aggregated OI on 21st Feb remained near its all-time high for all the exchanges, with Deribit exceeding its previous top with $469 million.

Such a situation clarifies the rising premium rates on retail exchanges for BTC futures contracts, as retail investors continue to trade strongly in the bullish rally of 2020.