Why most OKEx Bitcoin traders are looking to de-risk now?

The Bitcoin market seems to have attained a level of maturity that enables it to withstand blows in the market. A few days back when OKEx was being investigated by the Chinese Police and had to halt its withdrawals, even though a bump was witnessed in the BTC market, it bounced back pretty quickly. However, this event did give rise to changing market structures as signs of stress were becoming evident.

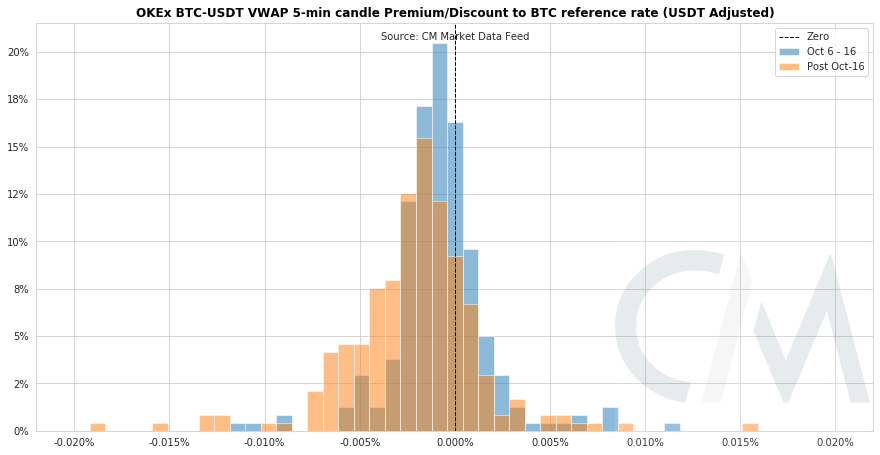

While many opted out of the OKEx market, there were plenty of traders whose funds were locked in the exchange and had continued to trade. These traders, however, were looking to reduce risk in their OKEx accounts and this was visible in the recent premium given to USDT in the BTC market relative to its associates. According to CoinMetrics’ recent data, the volume-weighted average of BTC’s price in the 10 days before and after the suspension of withdrawal highlighted this derisking behavior of the market as the median discount increased from -0.00089% to -0.00187%, an increase of ~110%.

Source: CoinMetrics

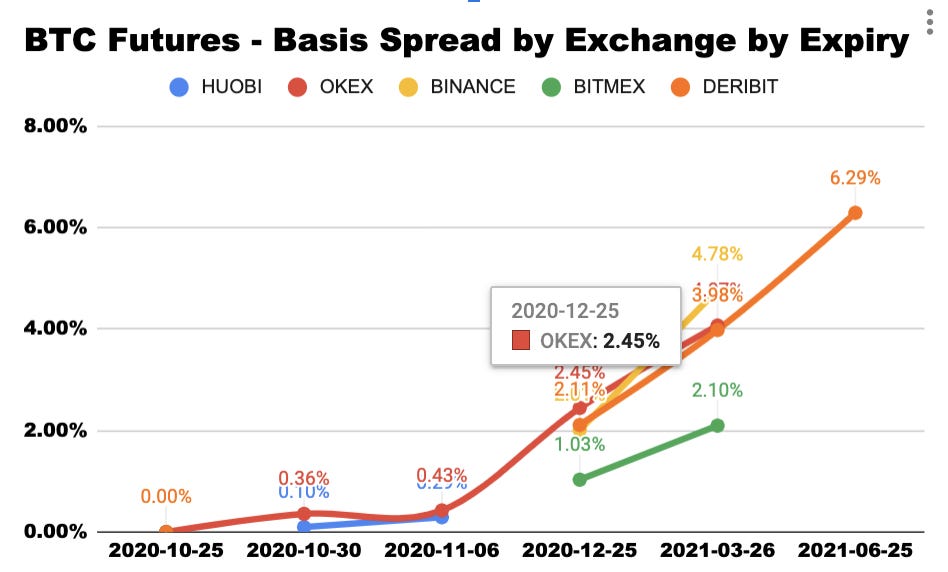

Similarly, the quarterly futures contract expiring in December also reflected the stress in the market. The news of the investigation caused the OI to drop by 20%, but as BTC price built higher in the past week, the spread between futures contract and spot increased. This caused an additional interest to be opened by traders who were waiting to take advantage of this difference.

Source: CoinMetrics

This was an important event as even though the BTC spot is trading at a discount, the quarterly contract is trading at a premium to other exchanges. As per CoinMetrics, this could have been due to the reluctance of traders about bringing additional capital on OKEx to sell the futures contracts down.

Nevertheless, the exchange was still ranking high up in terms of 24-hour trading volume and Open interest for BTC futures compares to its peers. According to Skew, OKEx still held the third position with $2.95 billion in terms of 24-hour trading volume, while its OI remained highest at $1.05 billion.