Litecoin’s inability to ride the halving wave should not be a concern for Bitcoin

Litecoin block reward halving commenced on 5 August. However, contrary to the hype around it, the prices failed to pump or show any tremendous rise. As per data from BitInfoCharts, the hashrate on Litecoin’s network has instead decreased dramatically by 33% since the halving. Even the price of the altcoin has seen a massive dip, falling from around $95 on the day of the halving to the press time price of $63.92.

The poor state of Litecoin right after the block reward halving (which is considered extremely bullish) has made Bitcoin proponents doubt whether Bitcoin halving would meet the same fate. Amid growing concerns over the upcoming Bitcoin halving, @100trillionUSD on Twitter has come out to clear the air as to why Bitcoin’s halving may not follow the lead of Litecoin.

The user explained that although Litecoin is a forked sibling of Bitcoin, they are fundamentally quite different. He went on to explain the difference between the two coins through stock-to-flow ratios and how the graph of the two coins painted a completely contrasting picture of the two.

Some people think that because litecoin didn't jump on ltc halving, btc halving will also be irrelevant for #bitcoin. That logic is flawed. LTC price doesn't have a significant relationship with stock to flow, so halvings are indeed irrelevant. BTC price-s2f relation is strong ? https://t.co/5Wx7vHLvUd

— PlanB (@100trillionUSD) August 31, 2019

What is the stock-to-flow ratio and what does it signify?

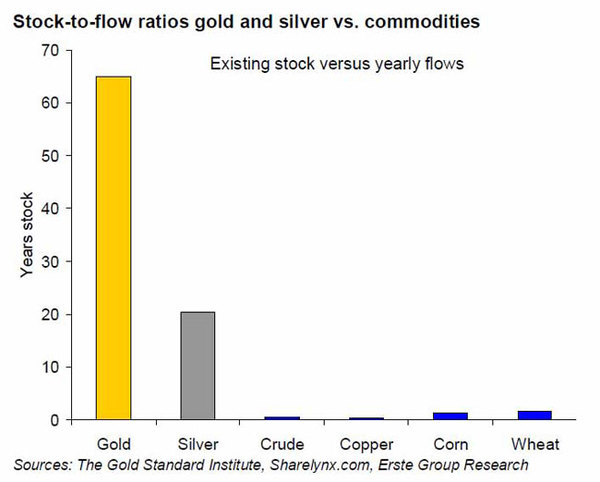

Stock-to-flow ratio measures the value of a commodity through its years of inventory, relative to annual supply. The more scarce a commodity with high demand in the market, the better its stock-to-flow ratio is. For example, gold has the highest stock-to-flow ratio currently with 65%, which is not a big surprise given how scarce the precious metal is and the huge demand for it.

Source: Revue

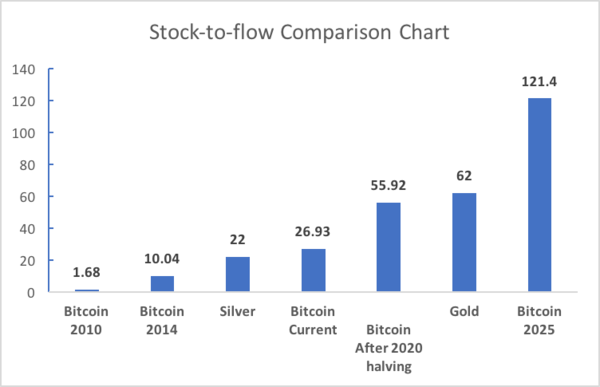

Similarly, Bitcoin has established itself as one of the scarcest modern-day commodities with a very high demand pushing its stock-to-flow ratio ahead of many priced commodities like silver. However, it is more important to note that Bitcoin has left many other prized commodities behind in just 10 years, while commodities like gold took almost 100 years to reach their current stock-to-flow ratio. Bitcoin is also expected to surpass Gold by 2025, indicating its high demand. With institutional investors showing great interest in Bitcoin this year, the world’s largest cryptocurrency has a case to make over the long run.

Source: Revue

Bitcoin’s stock-to-flow ratio is proof that its block reward halving would be quite different from Litecoin

Litecoin does not exhibit a great correlation with the stock-to-flow ratio and its woking model is also quite different. When we account in recent revelations about no development work on the Litecoin network, the block reward halving debacle must not come as a big surprise.

In contrast to Litecoin, Bitcoin’s hash rate is touching all-time high records while its market dominance is nearing 70%. The overall crypto-market is not on the bullish side currently, but Bitcoin is still well on course to break into a bull run towards the end of the year.