Litecoin’s consolidation phase to continue before a potential upward breakout

Litecoin has so far failed to progress above the crucial $50-level. Despite numerous attempts upward, the coin’s price was trapped below $45 after the massive decline just a week before. Over the past week, LTC has maintained a consistent upward trend with modest gains.

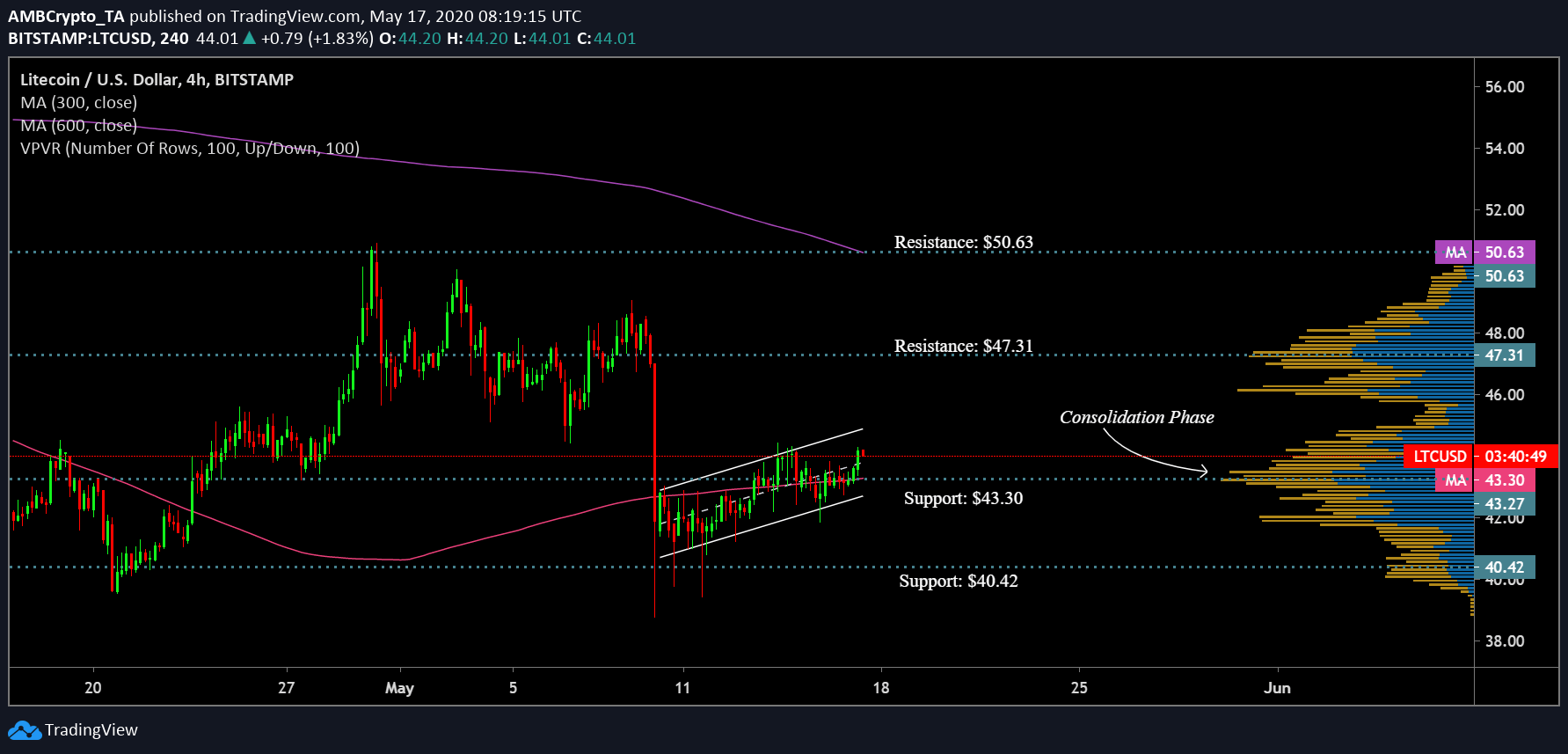

Litecoin 4-Hour Chart:

Source: LTC/USD on TradingView

Litecoin followed a steady price action leading to the formation of an ascending parallel channel. A breakout could potentially be a bearish one.

The placement of moving average, however, tells a different tale. Litecoin suffered a bearish crossover in which the 50 daily moving average [Pink] slid below the 100 daily moving average [Purple]. This trend was a result of the 12th March crash which continued less than a month. However, 50 DMA quickly moved upward in the first two weeks of May while the 100 DMA also appeared to drop. This was indicative of a potential bullish crossover in the near future. A bearish trend was noticed after the recent slump in LTC’s price following which the moving averages went above the price candles. At the time of writing, the candles moved above the 50 DMA, which seems to have stagnated at $43.30 level.

Intense trading activity was noted in the current price level, which was indicative of potential price consolidation in the near-term.

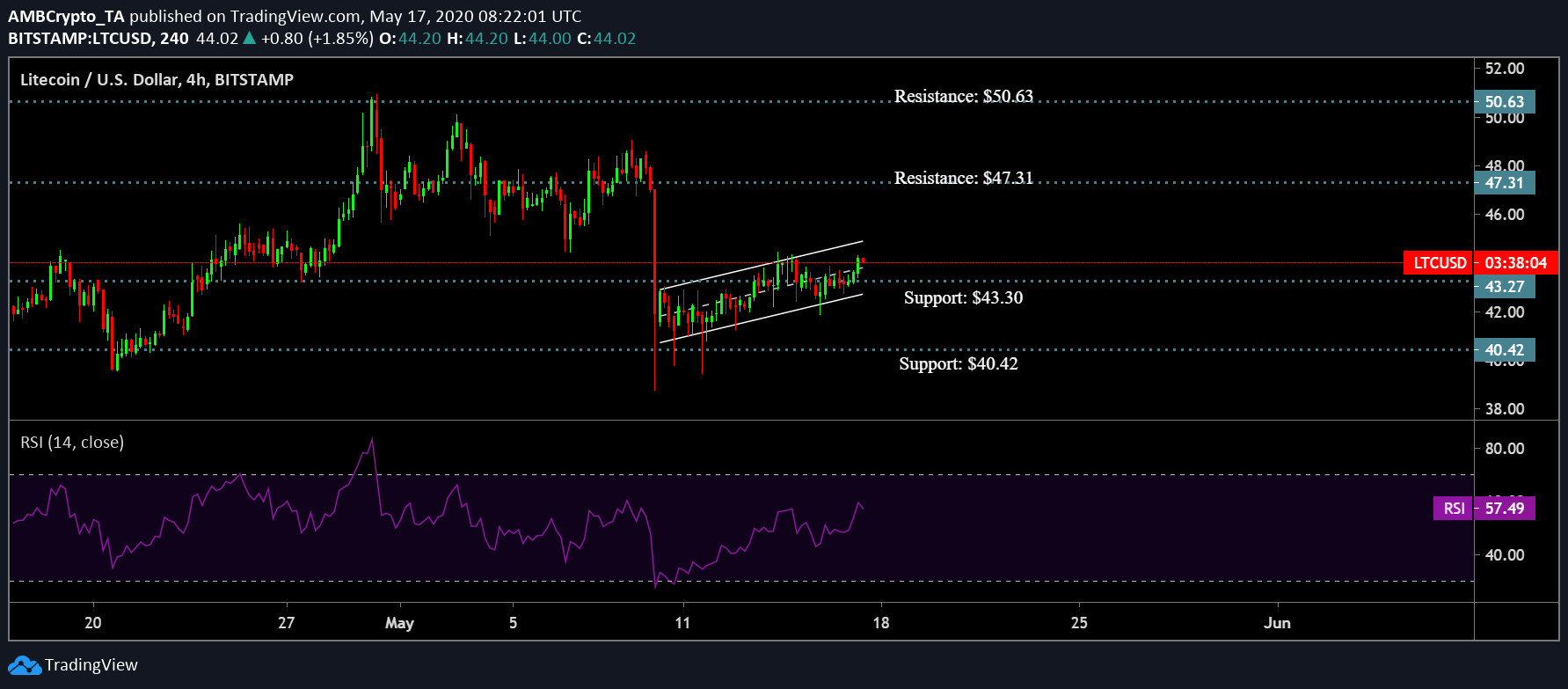

Source: LTC/USD on TradingView

The rising RSI above the 50-neutral zone suggested an increasing buying sentiment in the market. This gives rise to two scenarios.

The above charts exhibited signs of positive development in the otherwise lackluster chart of Litecoin. The increased trading activity by VPVR and the muted 50 DMA, which was treading upward for two straight weeks, suggested a potential consolidation phase in the near-term before a breakout.

Scenario 1:

The probability of a bullish breakout was supported by the 50 DMA below the LTC price candles as well as the falling 100 DMA and the RSI indicator in positive territory. If this trend unravels, the coin could be resisted at points near $46. Another resistance point for the coin stood at $47.31 which has recorded a high trading activity by the VPVR, while the 100 DMA provided for another crucial level of $50.63.

Scenario 2:

In case of a bearish breakout, as supported by the formation of the ascending parallel channel, LTC could find support from the 50 DMA at the level of $43.30. Another support was found at $40.42, a level unseen since 21st April.

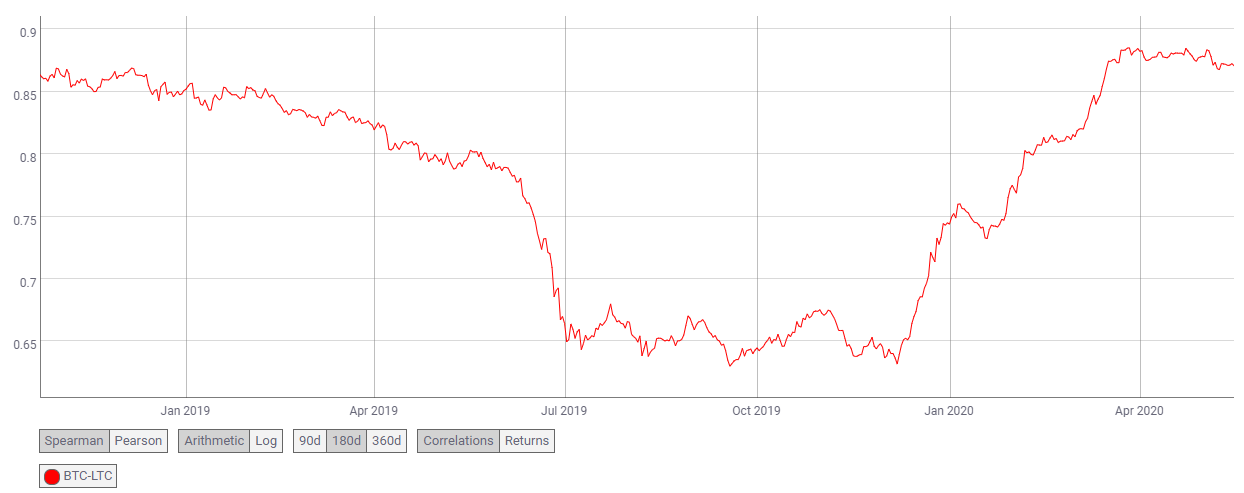

Silver to Bitcoin’s Gold

Source: Coin Metrics

BTC-LTC correlation has increased significantly since January 2020 from 0.63 to 0.87. After the halving, Bitcoin has fairly avoided drastic price fluctuations so far despite a consistent rise, and an extended price rally was anticipated by the community. If this rally materializes, Litecoin too, considering the high correlation, could potentially witness a much-needed rally following the consolidation.

Conclusion

It appears that the silver crypto is primed for a consolidation phase at the current price level before a breakout to the positive side.