Is Bitcoin’s digital gold narrative the catalyst for institutional investor adoption?

Institutional investors are finally welcoming change, with the past few months seeing the increasing adoption of digital assets like Bitcoin. While cryptocurrencies were once looked at as inferior and shady assets, such narratives have largely disappeared now.

On the latest episode of the On the Brink podcast, Michael Sonnenshein, Managing Director at Grayscale Investments, discussed growing institutional interest in Bitcoin and what that means for the crypto-ecosystem. He highlighted how Bitcoin leads the pack in terms of digital asset investment, adding that in the recent past, there has been increasing value for investors who diversify their portfolios to have more than one cryptocurrency.

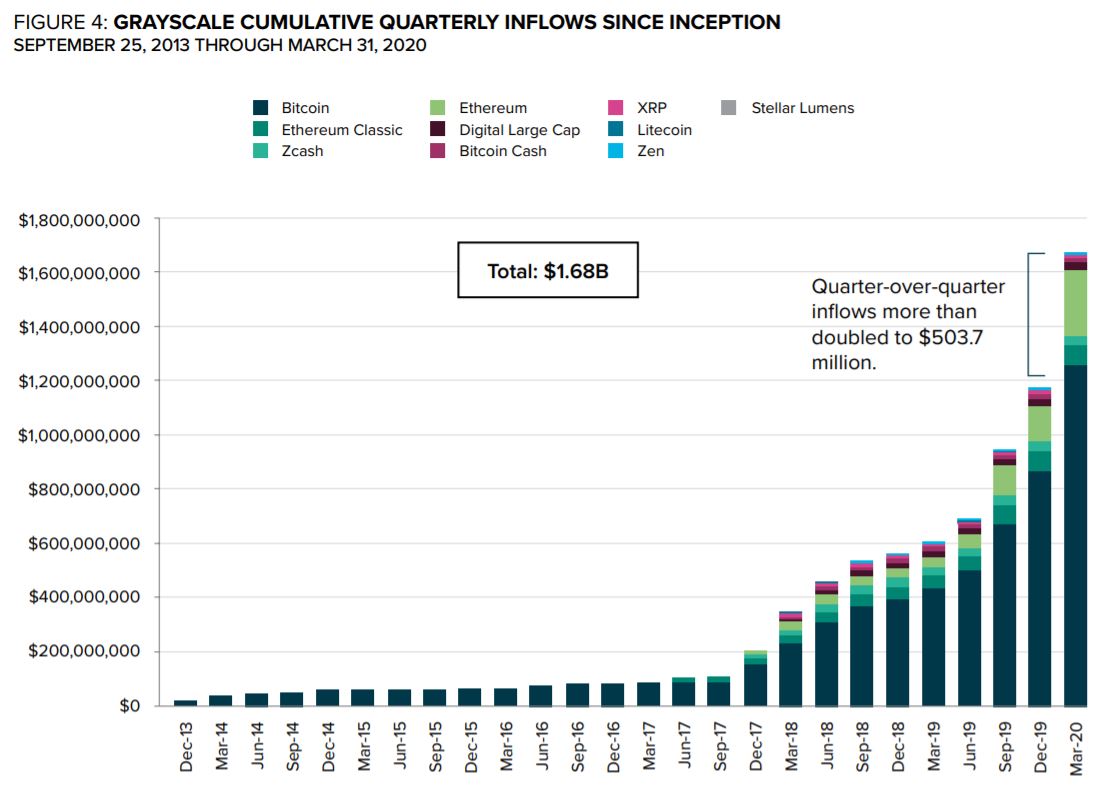

Source: Digital Asset Investment Report, Grayscale

The Q1 2020 report by Grayscale noted how there has been a significant increase in investments, despite 2020’s market conditions, with a lot of momentum going into Grayscale products.

This is an interesting observation since regulatory bodies like the SEC have rejected multiple Bitcoin ETFs in the past and according to Sonnenshein, the launch of an investment vehicle like an ETF is “a matter of when not so much a matter of if.”

In fact, a recent report by LongHash pointed out how the lack of ETFs impacts institutions who are looking to invest in crypto. It said,

“With or without ETFs, institutional investors have increasingly invested in cryptocurrencies like Bitcoin over the past 12 months. But because there are no ETFs, institutions often have to pay high premiums to purchase crypto assets.”

Sonnenshein also said that from a regulators’ point of view, before approving an ETF they intend on seeing the underlying asset mature.

“I think our regulators have made it quite clear that in order to see some exchange-traded products. They’re really looking for a little bit more of maturation in the underlying assets themselves in terms of there being, you know, domestic surveillance, market information, sharing agreements…”

However, when it comes to crypto and Bitcoin, institutional investors aren’t really holding back in 2020 and the Bitcoin versus gold narrative holds sway in such circles. Sonnenshein noted that “the easiest place for them to wrap their head around is probably around the digital gold narrative.” He concluded,

“I think many investors really are excited by, again, kind of the longterm prospects of the asset class. And even if they do, in some cases, have the opportunity to monetize their investment after six or 12 months, there’s many investors who don’t. There’s many investors who like to keep the exposure on for a longer period of time”