Bitcoin Cash

Is Bitcoin Cash ready to break out above $300?

Despite a surge at the beginning of the year, Bitcoin Cash’s price action and trading volume have been struggling to gain momentum. It was currently being traded at $247. After weeks of consolidation and multiple pullbacks, this coin could be in for a revival.

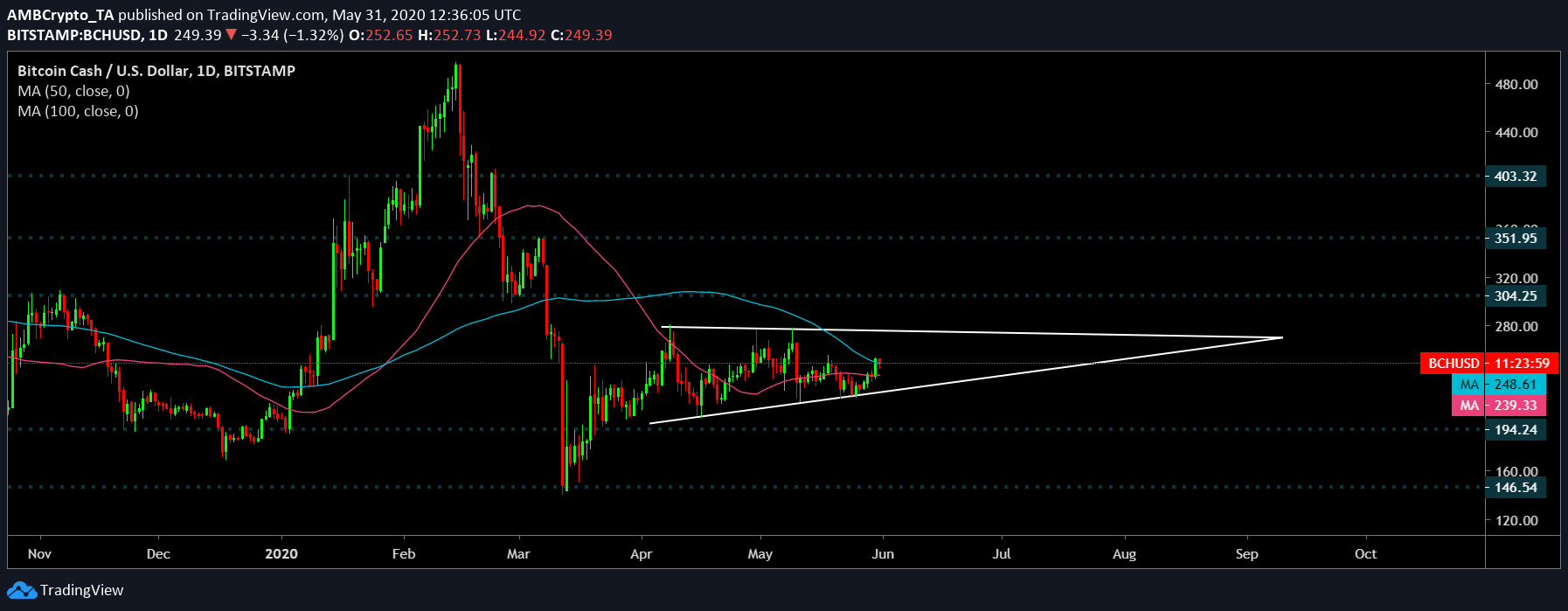

Bitcoin Cash Daily Chart [BCH]:

Source: BCH/USD on TradingView

The daily BCH chart formed an ascending triangle pattern with a horizontal line and an upward sloping trendline. This suggested a potential upward breakout after the formation of the triangle.

Additionally, the 100 daily moving average [Blue] dropped below the closing candle and even the 50 daily moving average [Pink] was hovering below the candlesticks. This depicted a bullish trend for the coin. Another positive sign was the converging DMAs. 50 DMA suffered a bearish cross over with that of 100 DMA on 29th March. The following month saw the two DMAs diverging. However, at the beginning of May, a trend reversal was observed as the gauge between the two DMAs declined consistently.

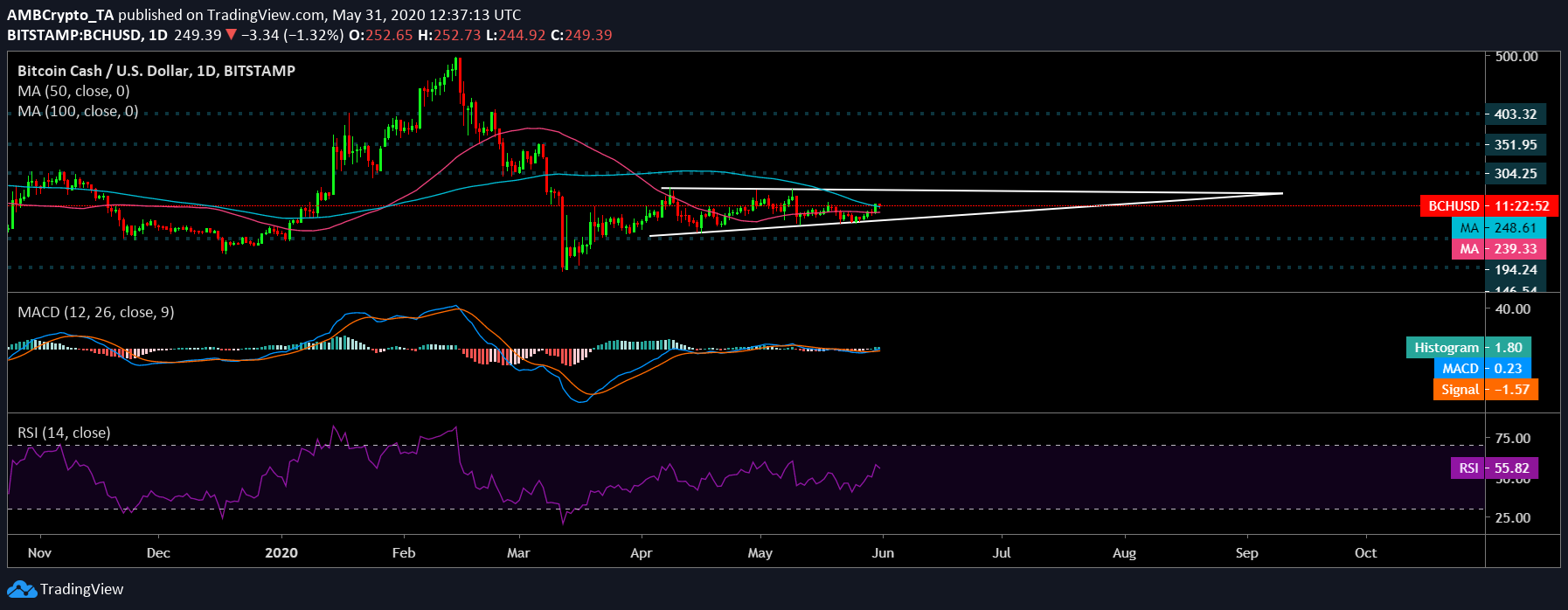

Bulls weigh in

Source: BCH/USD on TradingView

The indicators pointed towards a potential breakout to the positive side. MACD, above the signal line, depicted a positive sign for the coin. RSI was also well-above the 50-median neutral zone which indicated a buying sentiment among the investors.

Case 1:

A breakout on the upside could catapult the fork coin’s value to its immediate resistance point at $304.2. If the trend gains necessary momentum, BCH could climb all the way to its next target level of $351.9 and $403.5.

Case 2:

In case of a reversal of this positive trend, the coin could retest to its previously claimed support levels of $194.2 and $146.5. However, a breakout to the negative side appeared bleak.

Correlation:

Source: Coin Metrics

Currently, the BTC-BCH correlation coefficient according to the Coin Metrics website stood at 0.85. Bitcoin’s price has a strong correlation with the majority of altcoins and BCH is no different. If Bitcoin increases its value in the near-term, this could be highly profitable for its fork coin, Bitcoin Cash.

Conclusion:

The formation of ascending triangle pattern, bullish RSI and MACD, and the placement of the daily moving averages pointed towards a potential bullish breakout in the near-term. If this trend materializes, BCH could potentially eye target points at $304.2, $351.9, and $403.5 respectively while its support levels were found to be at $194.2 and $146.5.