IOTA put in the shade as Monacoin, Bitcoin Diamond perform well

Monacoin and Bitcoin Diamond are leading the way with respect to their relative performance against the likes of IOTA. With over 50% in gains over the last 90 days for both MONA and BCD, IOTA doesn’t even come close since its price change was recorded to be -11%.

Source TradingView

IOTA

Source: IOTAUSD TradingView

Perhaps, the aforementioned poor performance of IOTA was due to the attack on the Trinity wallet, an attack which resulted in the theft of 8.55 Ti in IOTA tokens from a total of 50 user accounts. However, since then, the coordinator has been rebooted.

IOTA, however, is higher in terms of market cap [$412 million] and ranking [24], when compared to BCD and MONA, despite the fact that the performances aren’t at par. With the formation of an ascending triangle and the MACD indicating a bullish crossover, hopefully, the token will register some profits.

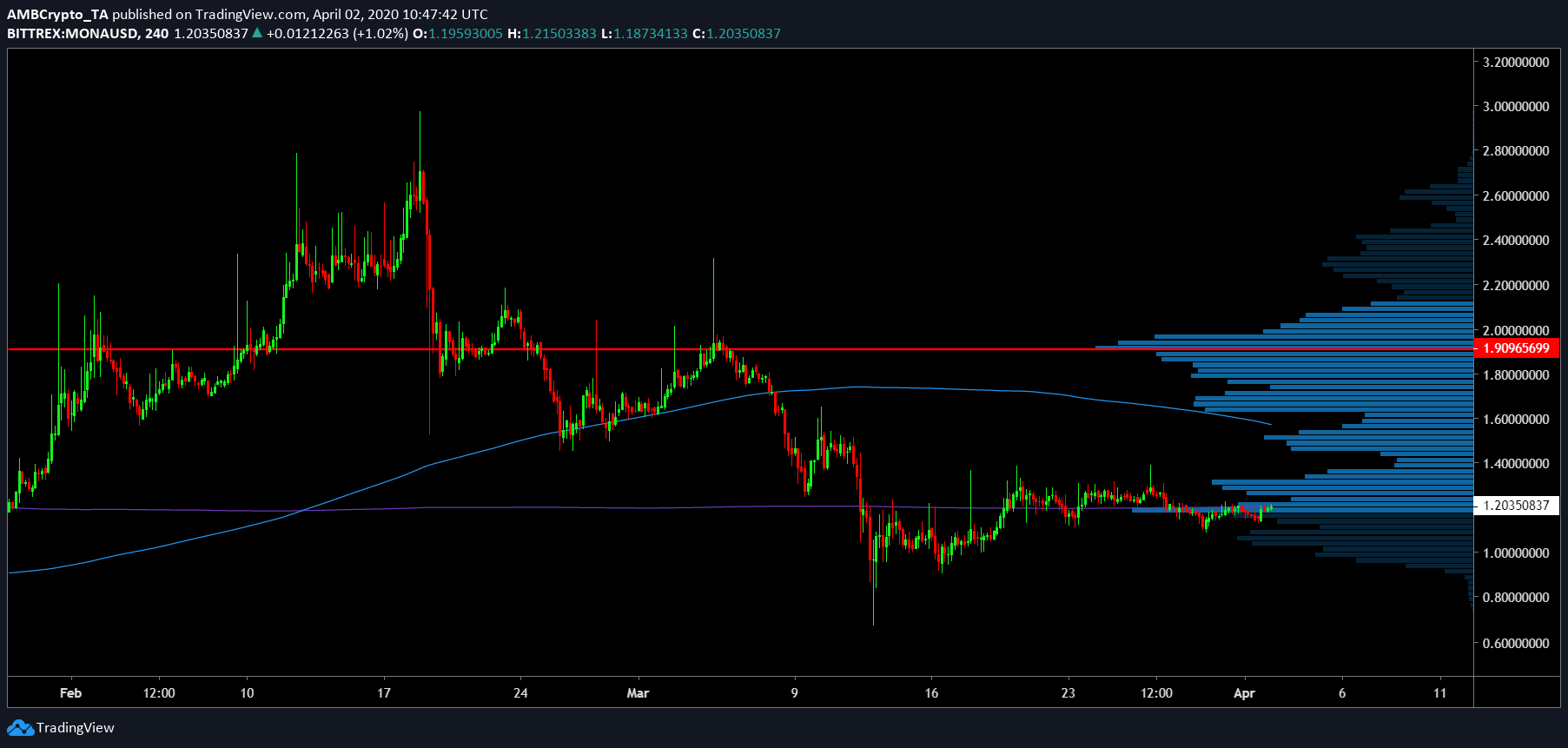

Monacoin

Source: MONAUSD TradingView

Monacoin is the 53rd largest crypto on CoinMarketCap with a market cap of $79 million and a 24-hour trading volume of $3.6 million. At press time, the price was $1.21 and the token was struggling to firmly breach the 200-DMA, a level which was acting as a resistance. The 50-DMA [light blue] was heading close, indicating further bearish pressure. The scenario, at press time, seemed bearish, with a confluence of resistance.

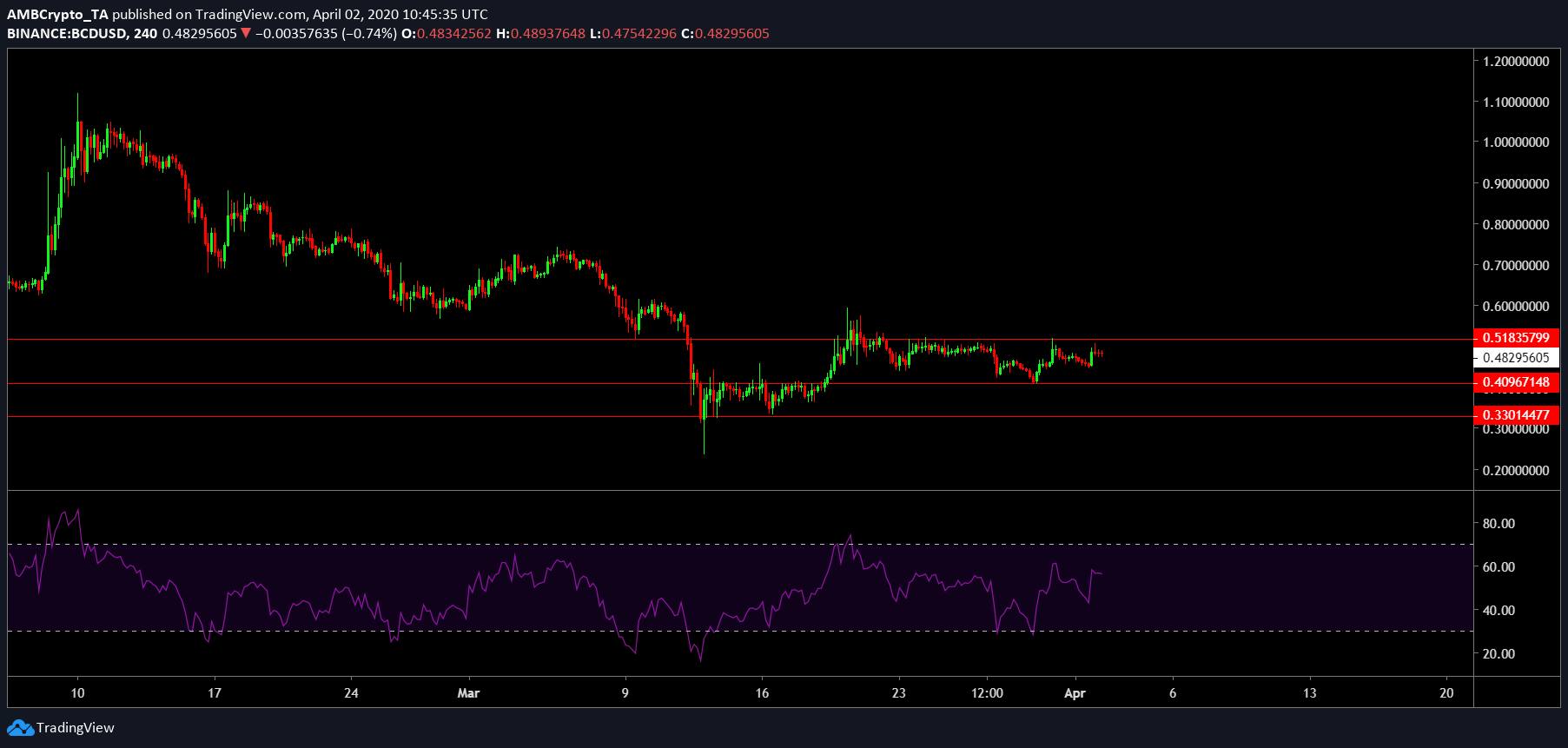

Bitcoin Diamond

Source: BCDUSD TradingView

Bitcoin Diamond, a fork of Bitcoin, has been performing considerably better, especially as it started rising after the recent collapse. At press time, BCD was trading at $0.482 with a market cap of $89 million.

Stuck between $0.518 and $0.409, the coin was trying to be bullish. The RSI indicator also showed that it was struggling to reach the overbought zone. Over the next week, the price might try to breach $0.518 and head higher.