Institutions are betting big on Bitcoin, should you?

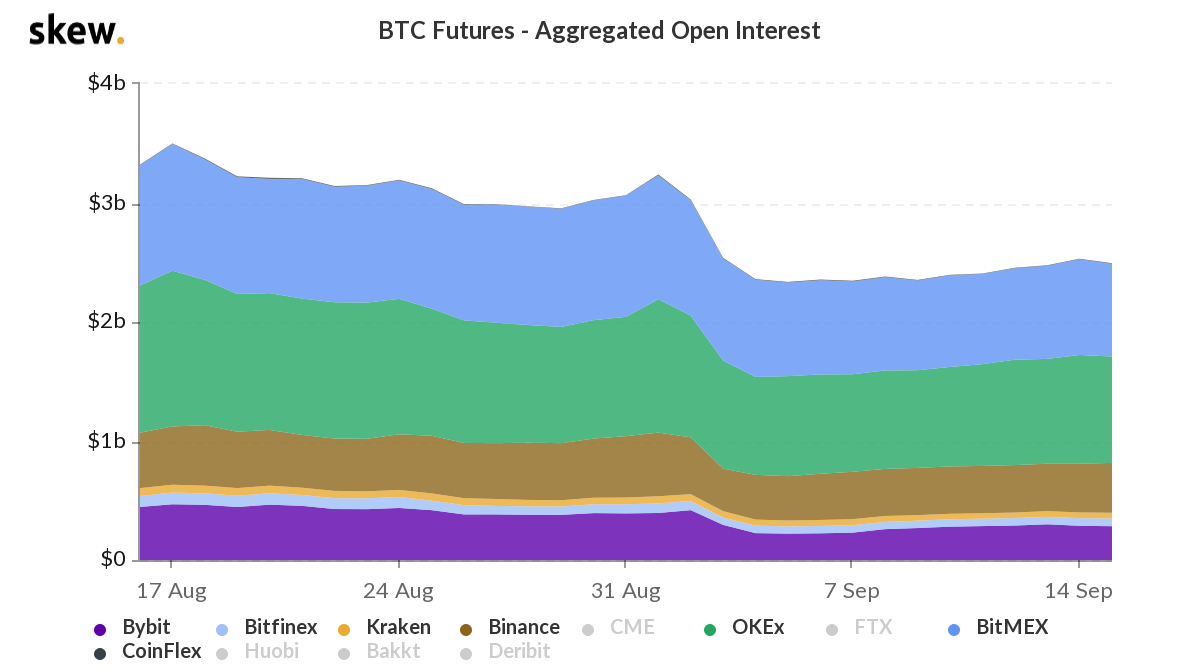

Bitcoin’s price has dropped 9% in the past month. The aggregate open interest on derivatives exchanges dropped by 24.24%, taking its cue from Bitcoin’s price on spot exchanges.

Source: Skew

This drop in price has deterred retail traders on derivatives and spot exchanges, however, the same is not true for institutional investors. The havoc wreaked in spot/ derivatives markets and the subsequent drop in prices does not entirely affect institutional investor sentiment. This is relevant to retail traders because institutional assets under management make up for a big chunk of an exchange’s trade volume or assets held in reserve. Institutions bring liquidity and generate demand that is absorbed by retail traders and other institutions.

Bitcoin’s price drop is significant only when compared to financial assets in traditional markets. For an investor comparing the recent Bitcoin price drop to others in the market cycle, a drop of 9% in 30 days is not significant at all. Price drops are not exactly the barometer for the health of an asset or its position in the market cycle. This is especially true for Bitcoin.

Institutional investors like Microstrategy, have such insights and they examine Bitcoin’s performance under a different lens. The global shake-up of assets has encouraged them to explore Bitcoin as the main asset for their treasury reserve. Microstrategy, a business intelligence firm valued at $1.5B is sitting on a pile of 38.2k BTC, bought recently on September 15, 2020.

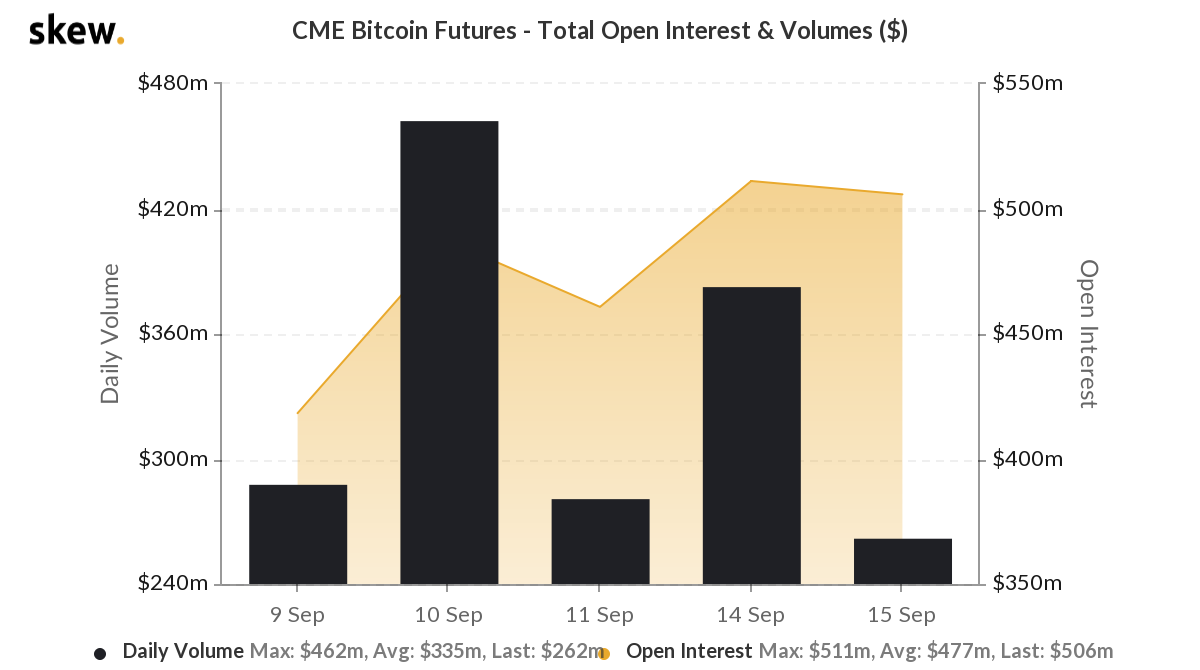

Source: Skew

Michael Saylor, CEO of MicroStrategy announced this purchase on twitter. While this is just one instance of institutional interest, there are many others buying on exchanges like CME.

On CME, open interest in Bitcoin Futures shot up by 21% in one week.

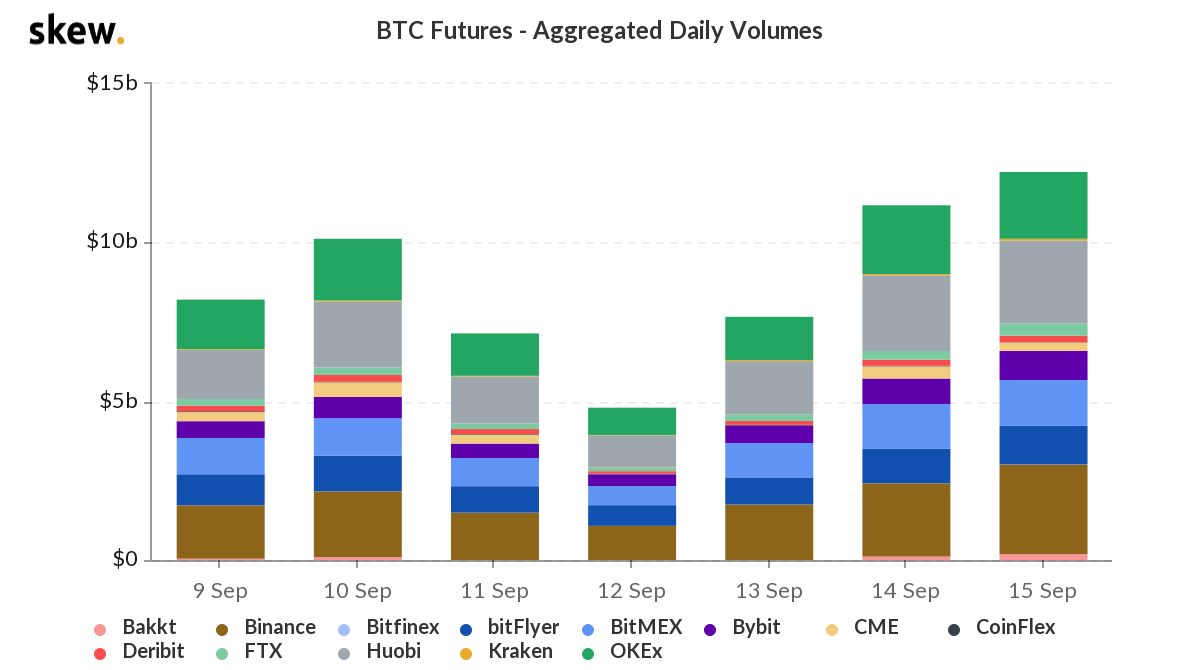

Source: Skew

CME caters to institutional investors since its launch and this increase in open interest can be attributed to top institutional investors on the exchange. The aggregate daily Bitcoin futures volume across derivatives exchanges is up 46% on Deribit, among others.

Source: Skew

Retail investors may have taken a cue from institutional investors this week. As trade volume went up on derivatives exchanges, at the time when the inflow of Bitcoin to spot exchanges was nearly at the same level. There is no significant change in the number of new buyers or demand on spot exchanges.

Institutional interest in Bitcoin may be based on the Bitcoin market cycle. Four months post halving is a crucial stage in the accumulation phase of the cycle. Bitcoin’s market cap is up 8.4% YTD and institutions may continue buying in the following months, as the market gears up for profit-taking in the next phase.