Bitcoin

For Bitcoin, no ‘Goldman dump’ this year

Goldman Sachs is not a big fan of Bitcoin and cryptocurrencies in general. This was evidenced by its latest report in which the investment giant explicitly stated that “Bitcoin (and by extension, cryptocurrencies) is not an asset class.” This, however, did not seem to have much of an impact on the fervent followers of Bitcoin.

As revealed by the latest edition of Santiment Insights, following Goldman Sachs’ “unapologetic” report, mentions of ‘Goldman’ and ‘Sachs’ exploded on crypto-social media platforms over the next couple of days. The figures reached nearly 600 daily mentions. In fact, the multinational investment bank was the most discussed topic, according to an analysis done of more than 1000 crypto social channels that are tracked by the analytics platform.

Source: Santiment | Mentions of “Goldman” or “Sachs” on crypto social media

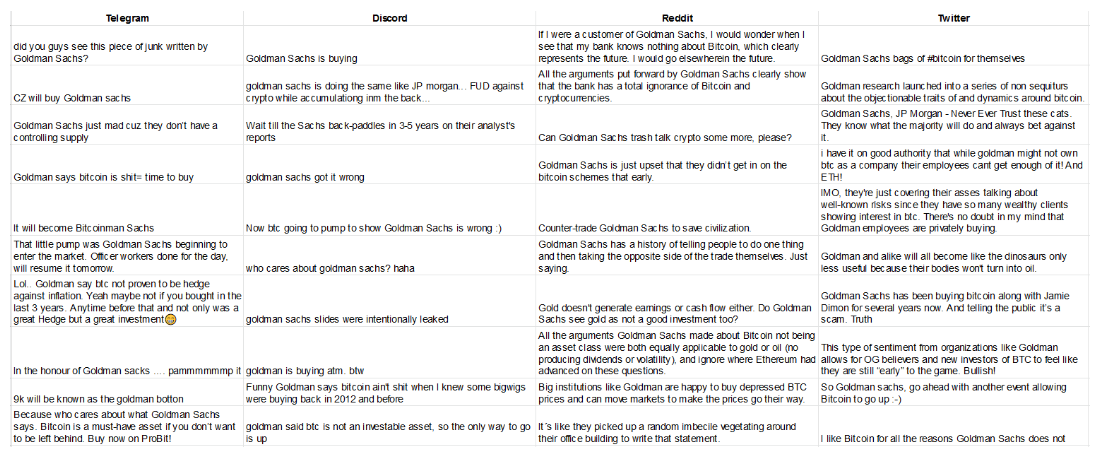

So, how did the community react? According to the post, the general consensus of the investment bank’s anti-Bitcoin narrative was a “blanket rejection.” While some called the report “ignorant and uninformed,” others accused Goldman Sachs’ employees of stacking Bitcoins on the side, but blasting about it publicly.

Source: Santiment

Santiment noted,

“The general consensus has been a juicy combination of ridicule, open condemnation and even a few conspiracy theories sprinkled in the between. And while most of the crypto crowd is denouncing the report out of the gate, there have been a few isolated voices – mostly on crypto subreddits – that see some truth in Goldman’s cryptocurrency slides”

Despite the fact that the overall reaction from crypto-social media has been “visceral” towards the latest report, there were also certain responses that were found to be reasoning with the points mentioned by Goldman Sachs. Taking into account the responses from social media, there might be no ‘Goldman dump’ this year.

The crypto-market has always been noisy and full of unexpected events. A report such as this would have contributed to major dumps a few months ago, considering the fact that the space has been historically manipulated by FOMO and FUDs, especially by giant industry players. Hence, this is perhaps a sign of market maturity, as evidenced by Bitcoin’s price action, which has been steadily rising. In fact, this stunt could actually help Bitcoin bag another rally.

To top that, Bitcoin’s Twitter Sentiment Volume Consumed was also observed to be hovering right in the neutral territory, while that of Ethereum continued to rise sky high in notably high positive territory. This is more bullish for Bitcoin than it is for Ethereum since historically, prices have risen most notably when the crowd turned negative, something that could indicate a buying opportunity, and vice-versa, when the crowd turned positive.